In 2021, I got heavily into cryptocurrency. Although I only sunk a small portion of my net worth into it, it felt a little crazy, especially when sharing the news with our financial planner and accountant. So many respected financial people really were and still are against it, and for a good reason! A lot of people lose a lot of money.

I learned a lot during my first experience in a cryptocurrency bull market. I made some good decisions and also bad ones. I feel like anyone who experiences the rush of their first bull market is left with a lot of wisdom when approaching the next one.

Next one, you say? That's right. If you look back over the history of Bitcoin, it's relentlessly pushing its way up. All the previous bull runs all look like little blips on a 10-year chart because the 2021 bull run was so insane. Typically after the halving (the next one is due sometime in April 2024), there's a massive bull run, a climax, and a crash. The bear market runs its course, and then everything repeats.

I strongly believe the fundamentals of Bitcoin, the technology, the network effect, and the state of the financial system will create another bull market. Already year to date, Bitcoin has risen almost 85%. It just won't go away.

Having gone through a bull market once, I wanted to share what I learned and what I will do differently in the next one for myself and anyone who stumbles across this post.

Understand what you're getting into

I can't stress enough how important it is to educate yourself on cryptocurrency. Seek to understand Bitcoin, how it works, and what it's here to solve. Learn why it's nothing like other cryptocurrencies.

I spent hundreds of hours pouring over content educating myself, and gaining a strong conviction about Bitcoin and the future of the blockchain. In the process, I learned so much about money and how our financial system works. It was an incredible, eye-opening experience.

Cryptocurrency is a rollercoaster ride. If you can't handle volatility, you will get a huge smack in the face when the price inevitably swings.

On the flip side, there are a lot of information, opinions, ideas, and advice you really need to guard against. That's partly why I'm writing this article to help highlight what can happen to you when you get caught up and start sharing rocket ship emojis with all your friends!

If you're unwilling to do the work, you're making a bet like at the casino, not an investment.

It's not a get-rich-quick scheme

The pull of what the price of any cryptocurrency can rise to is all so alluring to the first-time bystander looking in. The facts are that cryptocurrency is not a get-rich-quick scheme. In fact, you're probably more likely to lose money.

Those who got rich quickly from cryptocurrency were lucky. Some lost their epic gains because they never took profit. The Dogecoin Millionaire is a great example of someone who got lucky with $3,000,000 in gains when he poured about a hundred grand into Dogecoin. However, he held on and didn't take profit, only for it to drop down into the low hundreds and thousands again. What a goose.

Decide your strategy in advance and consider taking profits

You only make or lose money on this type of investment when you sell it. All the losses and gains are simply on paper between buying and selling.

In my world, there are two strategies when it comes to Bitcoin.

I learned a lot during my first experience in a cryptocurrency bull market. I made some good decisions and also bad ones. I feel like anyone who experiences the rush of their first bull market is left with a lot of wisdom when approaching the next one.

Next one, you say? That's right. If you look back over the history of Bitcoin, it's relentlessly pushing its way up. All the previous bull runs all look like little blips on a 10-year chart because the 2021 bull run was so insane. Typically after the halving (the next one is due sometime in April 2024), there's a massive bull run, a climax, and a crash. The bear market runs its course, and then everything repeats.

I strongly believe the fundamentals of Bitcoin, the technology, the network effect, and the state of the financial system will create another bull market. Already year to date, Bitcoin has risen almost 85%. It just won't go away.

Having gone through a bull market once, I wanted to share what I learned and what I will do differently in the next one for myself and anyone who stumbles across this post.

Understand what you're getting into

I can't stress enough how important it is to educate yourself on cryptocurrency. Seek to understand Bitcoin, how it works, and what it's here to solve. Learn why it's nothing like other cryptocurrencies.

I spent hundreds of hours pouring over content educating myself, and gaining a strong conviction about Bitcoin and the future of the blockchain. In the process, I learned so much about money and how our financial system works. It was an incredible, eye-opening experience.

Cryptocurrency is a rollercoaster ride. If you can't handle volatility, you will get a huge smack in the face when the price inevitably swings.

On the flip side, there are a lot of information, opinions, ideas, and advice you really need to guard against. That's partly why I'm writing this article to help highlight what can happen to you when you get caught up and start sharing rocket ship emojis with all your friends!

If you're unwilling to do the work, you're making a bet like at the casino, not an investment.

It's not a get-rich-quick scheme

The pull of what the price of any cryptocurrency can rise to is all so alluring to the first-time bystander looking in. The facts are that cryptocurrency is not a get-rich-quick scheme. In fact, you're probably more likely to lose money.

Those who got rich quickly from cryptocurrency were lucky. Some lost their epic gains because they never took profit. The Dogecoin Millionaire is a great example of someone who got lucky with $3,000,000 in gains when he poured about a hundred grand into Dogecoin. However, he held on and didn't take profit, only for it to drop down into the low hundreds and thousands again. What a goose.

Decide your strategy in advance and consider taking profits

You only make or lose money on this type of investment when you sell it. All the losses and gains are simply on paper between buying and selling.

In my world, there are two strategies when it comes to Bitcoin.

- Buy and hold. Hold on for decades because the US dollar's value will continue to decline, and Bitcoin has the potential to rise a lot in value and keep its value like a digital gold.

- Buy and sell. Take profit on some coins at planned price points to take money off the table.

In 2021, I went with option 1 and wished I had done some of option 2. The coins I had bought earlier in the year were hitting 40% returns. Due to fear of high taxes on short capital gains and listening to the hype, I held on only to see the bull market end and crash. I'm probably just as much a goose as the Dogecoin Millionaire :)

I don't typically trade investments (buy and sell) like I plan to do with Bitcoin. I really only buy and hold. Bitcoin is an exception for me right now, and my long-term goal is to buy and hold mostly. I've been buying Bitcoin monthly for a while now, which has been great with these low prices.

However, going into the next bull market, I have already planned out at what price point and how many coins I will sell. For example, I might sell a certain percentage of my coins at $40,000, a slightly bigger percentage at $50,000, and so on. That way, I'm not selling everything too cheap, but if the price goes down, at least I took some profit. I won't go into detail, but I'd like to clean things up, try to make a bit of an actual gain, and shift some of the money into other investments. I also might buy in again when the bull market ends, and there is a crash.

The old saying to sell when people are greedy and buy when they are fearful rings very true regarding Bitcoin.

Ignore price predictions and hype

The YouTubers and Twitter folks know how to hype and throw out wild price predictions. Every video I watched felt like it had someone saying where the price would get to, generally in the six-figure range. I also had fanatic family and friends sending me texts and emails with 🚀🚀🚀.

I got caught up, and it affected my decision-making. The truth is no one knows anything. Ignore it all! Stick to your strategy.

Bitcoin is a wild beast, and no one can tame it. Know that some individuals own a lot of Bitcoin that buy up cheap and then dump it when it peaks, creating crazy fluctuations in price. The financial markets also have a huge impact on people's emotions. It's like a roller coaster in fog, and you have no idea when it will turn, go up or down.

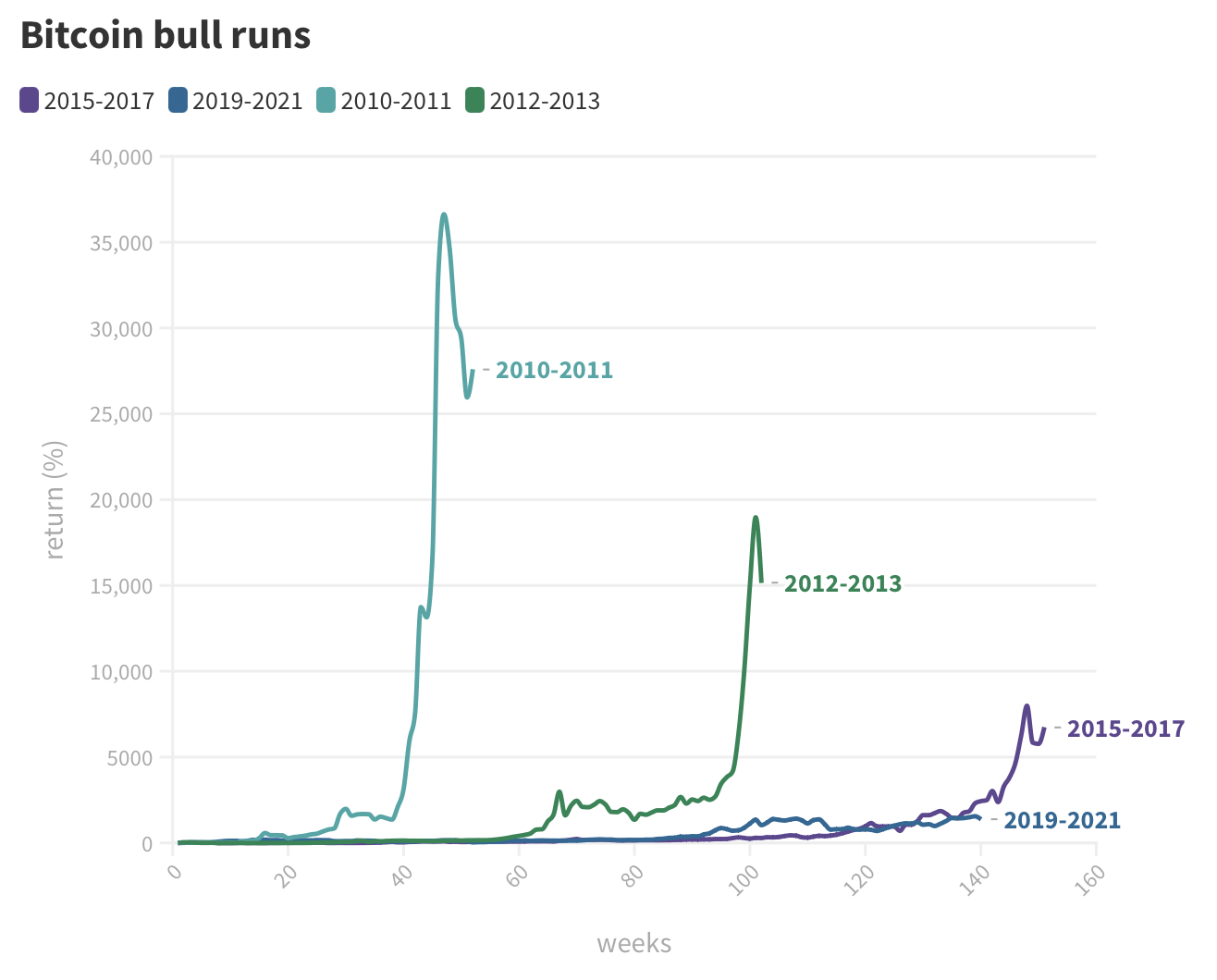

In every bull market, the returns reduce

In every bull market, the return for Bitcoin continues to reduce. This isn't bad and is likely a sign of the asset class maturing. But it's good to know so that your expectations are in check, especially around the hype.

Chart by David Canellis

There will be a crash

Cryptocurrency always crashes eventually. It's just too new and fragile. Don't listen to people who say it's different this time, and it may never go below a certain price point. I never thought Bitcoin would go below $20,000 after 2021, and guess what, it did.

One day I might be wrong once the asset truly matures, but until then, err on the side of caution and expect it to crash. Know your strategy and try to keep your emotions in check.

Don't use debt to buy Bitcoin

I remember listening to a podcast and a guy who was totally wrapped up by Bitcoin's little finger and was saying how he wished he could use some of the equity in his house to buy more because the price was shooting up. Interest rates were at an all-time low, and the "returns" of Bitcoin were way too lucrative.

I'll be honest, these examples tugged at me for a little as I looked at our interest rate and the price of Bitcoin, but thankfully, I didn't go ahead with it. It's just not something to take that sort of risk on.

Not your keys, not your crypto

I learned this the hard way, but not before doing some things right also.

I cannot stress enough the truth of the phrase "not your keys, not your crypto." Only veterans who have lost coins due to leaving their coins on exchanges or whatnot and not choosing to self-custody their Bitcoin can attest to this.

Self-custody is super scary when you first start out. I didn't trust myself, and the idea of going through the complexity and risk of hardware wallets and seed phrases scared me. In early 2022 I finally found a solution I was comfortable with. It was called Casa, and I'd highly recommend checking them out.

Let's get back to the hard lesson I had to learn. I dabbled with a yield platform called Celsius where you transferred coins to their platform, and they paid interest. They were cool, transparent, and helping people, or so we all thought. In 2022 they filed for Chapter 11 bankruptcy, and it turns out they lied about a lot of stuff and ran a terrible, risky operation. Who knows if I'll get the coins I put on their platform back. To me, the coins are gone. If I get anything back, it's a bonus.

Only spend what you're prepared to lose

Bitcoin and cryptocurrency have a bright future. I strongly believe that. It's important to remember that it's like 1999 when the dot com bubble popped. There was potential, but everyone was still trying to figure it out.

Only put money into cryptocurrency that you are willing to lose. If you buy Bitcoin or maybe even Ethereum, the chance of loss is much less if you keep your money invested for long enough. I'm not sure about Ethereum but I've heard that anyone who has held Bitcoin for more than 4 years has never lost money is something to give you some peace about. Everything else, in my eyes, is so risky, and the chances of losing everything are very, very high. Go in with eyes wide open.

Another way to think about it is only to invest whatever figure will allow you to sleep at night, even if the value of your investment drops 99% overnight. If you can sleep just fine, then you haven't invested too much.

Cryptocurrency always crashes eventually. It's just too new and fragile. Don't listen to people who say it's different this time, and it may never go below a certain price point. I never thought Bitcoin would go below $20,000 after 2021, and guess what, it did.

One day I might be wrong once the asset truly matures, but until then, err on the side of caution and expect it to crash. Know your strategy and try to keep your emotions in check.

Don't use debt to buy Bitcoin

I remember listening to a podcast and a guy who was totally wrapped up by Bitcoin's little finger and was saying how he wished he could use some of the equity in his house to buy more because the price was shooting up. Interest rates were at an all-time low, and the "returns" of Bitcoin were way too lucrative.

I'll be honest, these examples tugged at me for a little as I looked at our interest rate and the price of Bitcoin, but thankfully, I didn't go ahead with it. It's just not something to take that sort of risk on.

Not your keys, not your crypto

I learned this the hard way, but not before doing some things right also.

I cannot stress enough the truth of the phrase "not your keys, not your crypto." Only veterans who have lost coins due to leaving their coins on exchanges or whatnot and not choosing to self-custody their Bitcoin can attest to this.

Self-custody is super scary when you first start out. I didn't trust myself, and the idea of going through the complexity and risk of hardware wallets and seed phrases scared me. In early 2022 I finally found a solution I was comfortable with. It was called Casa, and I'd highly recommend checking them out.

Let's get back to the hard lesson I had to learn. I dabbled with a yield platform called Celsius where you transferred coins to their platform, and they paid interest. They were cool, transparent, and helping people, or so we all thought. In 2022 they filed for Chapter 11 bankruptcy, and it turns out they lied about a lot of stuff and ran a terrible, risky operation. Who knows if I'll get the coins I put on their platform back. To me, the coins are gone. If I get anything back, it's a bonus.

Only spend what you're prepared to lose

Bitcoin and cryptocurrency have a bright future. I strongly believe that. It's important to remember that it's like 1999 when the dot com bubble popped. There was potential, but everyone was still trying to figure it out.

Only put money into cryptocurrency that you are willing to lose. If you buy Bitcoin or maybe even Ethereum, the chance of loss is much less if you keep your money invested for long enough. I'm not sure about Ethereum but I've heard that anyone who has held Bitcoin for more than 4 years has never lost money is something to give you some peace about. Everything else, in my eyes, is so risky, and the chances of losing everything are very, very high. Go in with eyes wide open.

Another way to think about it is only to invest whatever figure will allow you to sleep at night, even if the value of your investment drops 99% overnight. If you can sleep just fine, then you haven't invested too much.

-Ben