I'm going to be upfront and say that managing your finances takes work and discipline. If you're not willing to put in the time to manage your finances, you might wake up one day and realise that you don't have enough to retire on.

Inflation is a good reason to take control of your finances but honestly, finances should be managed no matter the economic condition. If you want to become wealthy, have extra cash, give generously and retire with something to live off of, you need to be a good steward of the money that comes in today.

My wife and I have had budgets for years, but we were always terrible at sticking to them. We also didn't have a clear picture of what our income and expenses truly were. And the more complex our financial structure became (investments, businesses and so on), the harder it was to keep on top of our finances.

As the years have gone on, we've tweaked our system and I wanted to share what we do.

Before I go on, Rich Dad has some great advice on financial statements as well as a template that will expand on what I share below.

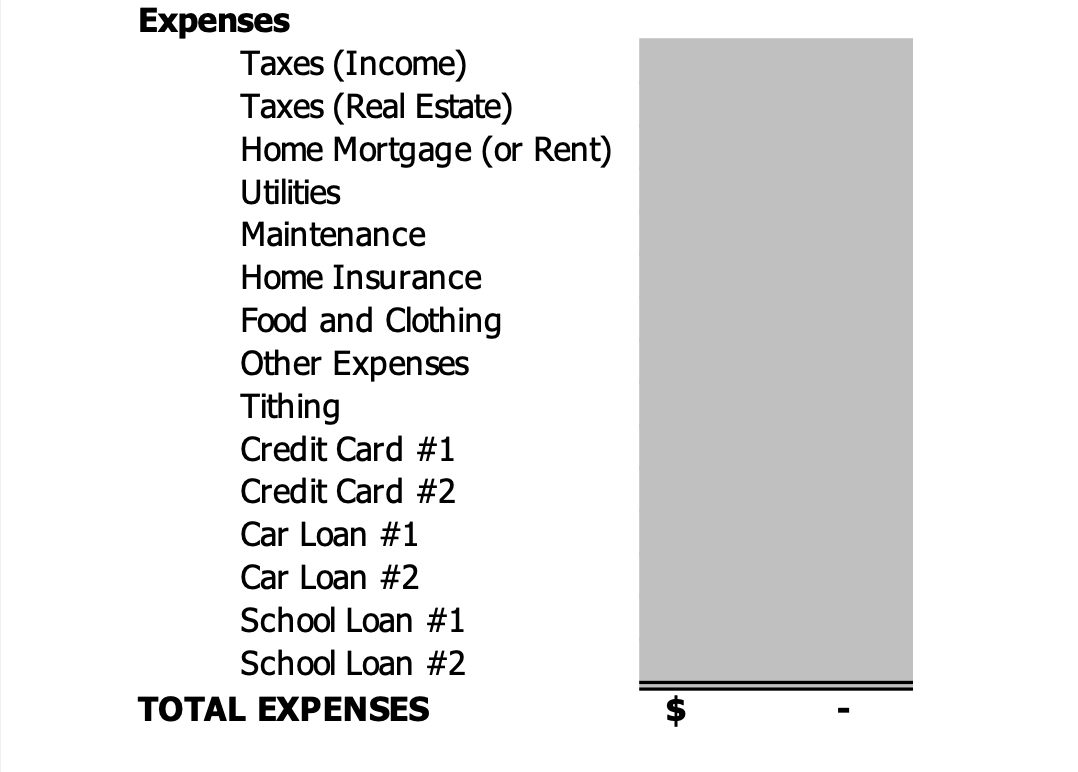

Income Statement

An income statement outlines all expected income and expenses for the year. When my wife and I started building ours, we looked back at the previous year's bank statements to get a gauge for what we were earning and spending and used that as a base.

Income minus expenses = how much leftover cash flow you have.

When you first create your income statement, you might be shocked to see you're spending all, if not more (using credit) than you earn. Welcome to the club - I've been there! It's pretty common if you're not minding your money. If this is you, definitely get discouraged for a moment - it's a good shock to have. But then quickly see this new insight as a positive step forward in taking control of your finances.

You can now review what you're spending money on and try to create a cash flow surplus. This is done by spending less than you earn or trying to make extra money to support your lifestyle.

Tip: When you have control of your finances, ensure your budget isn't so strict that you and your partner feel guilty spending. Sometimes my wife and I have had to tighten our belts but most of the time, I want to ensure my wife has a budget for clothes, makeup and personal things she wants or needs. We agree on a budget and it's added to the expenses column.

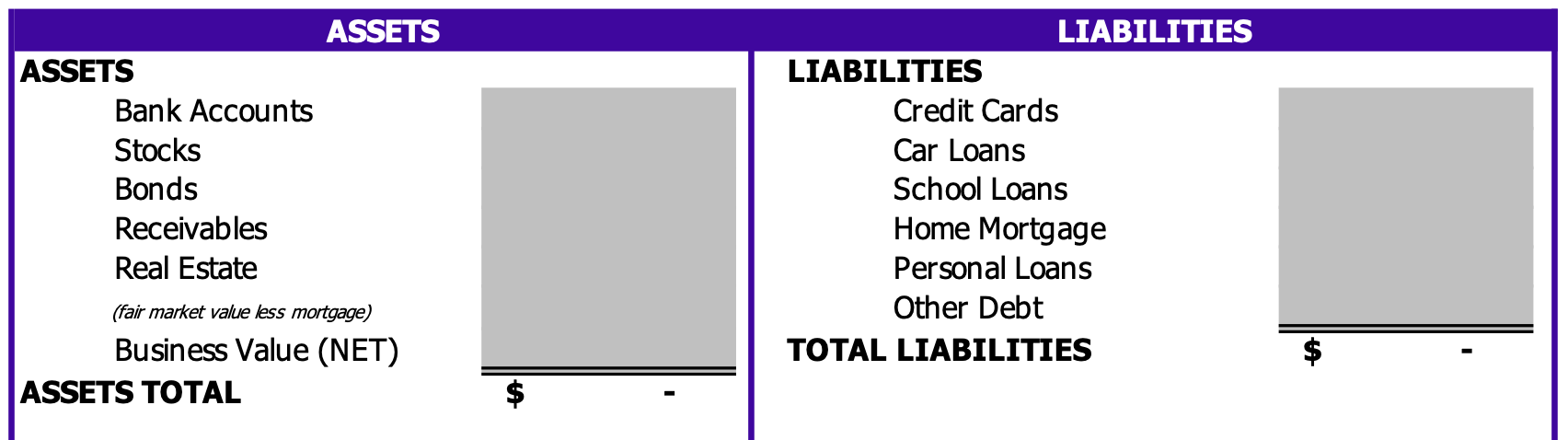

A balance sheet has a list of all assets and liabilities in your possession.

Assets minus liabilities = your net worth.

It's important to know what is the difference between an asset and a liability. I like how Rich Dad puts it, an asset is something that puts money in your pocket, and a liability is something that takes money out.

Monthly Income and Expenditure Tracking

We export our bank statements each month and reconcile everything we earn and spend. Yes, I know, that sounds like a lot of work and a huge pain. I spend roughly an hour a month on this and it gives me a really clear understanding of where we are spending our money and how we are going against our budget. To me, the time is totally worth it!

Here are some examples of things we categorize:

- Children

- Clothing

- Eating Out

- Giving

- Groceries

- Health

- Holidays

- Housing

- Housing

- Insurance

- Interest

- Investing

- Pets

- Presents

- Subscriptions

- Tax

- Utilities

- Vehicle

Another option might be to follow Barefoot Investor's advice and divvy your income into different bank accounts. That way when a bank account runs out of money, you know you've spent that budget and there's no excess credit or allotted money to use. I haven't personally used this approach but I could see it working really well!

Bringing it Altogether

With the three items above, we now have everything we need to manage our money effectively.

- The income statement helps us understand what money is coming in, where it's going and how much we have left over.

- The balance sheet gives us a good idea of our net worth and helps us identify liabilities we want to reduce or eliminate.

- The monthly income and expenditure tracking allow us to track how our spending is compared to what we've budgeted. This way we can pull back if we're overspending in a certain area or go wild and spend up big (within the budget of course!) on categories that have budget remaining.

-Ben