A few notes before we get in: I’ve always loved how Bill Gates reviews books on his personal site. One of the richest guys in the world, Bill still does book reports like he’s been given homework assignments from a teacher he wants to impress. I greatly admire people like Bill who learn because learning interests them, and Bill is undoubtedly one of the best learners out there. Interspersed with my regular blog posts, I’m going to start adding book reports to the site, which you can find under their own label as well as on the main feed. Aside from helping me synthesize my thoughts on the material, I hope writing these reports will give you a peek into the vast world of finance and help you decide where you want to learn more. Any Amazon links you see to buy these books are affiliate links.

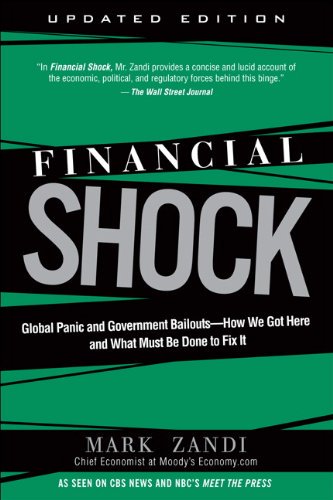

Mark Zandi and Moody’s

Zandi works for the same parent company I do, but he’s not on the bond rating side. In the early 2000s, his firm was acquired by Moody’s for its economic research and analysis prowess, and he’s been with the firm ever since. Aside from his frequent CNBC spots, I was lucky enough to see Zandi speak in person one one occasion. He is as captivating and impressive a speaker as Steve Jobs.

Zandi works for the same parent company I do, but he’s not on the bond rating side. In the early 2000s, his firm was acquired by Moody’s for its economic research and analysis prowess, and he’s been with the firm ever since. Aside from his frequent CNBC spots, I was lucky enough to see Zandi speak in person one one occasion. He is as captivating and impressive a speaker as Steve Jobs.

In front of a room of about 100 different Wall Street analysts, Zandi walked to the podium and asked, “What do you to hear about today?” People asked about every part of the economy — about Amazon, about the Fed, about China, about why was Moody’s stock price so high — about anything in which anyone who followed financial markets might be interested.

He didn’t write down any notes. He didn’t have a powerpoint deck to refer to. He just kept nodding, saying, “Ok … yep … sure, we’ll cover that … ok.” And over the next hour, he told his version of what was happening in the world. It was so rich and interesting, and he answered every single question that he was asked about. Just the definition of calm, cool, and collected.

I finally got around to reading one of his books. It’s important to remember that Financial Shock was published in 2009 so this is a ‘during the moment’ recap from Zandi, which is good. You don’t necessarily want someone to write about a financial crisis being several years removed; you want an account that is real and slightly messy and shows the confusion that we all had when the world economy was grinding to a halt. That said, some of the information is slightly dated – we had a comprehensive tax bill in 2017, for example – but the book holds up well. Let’s dive in.

Recapping the 2008 financial crisis

The 2008 financial crisis had its roots in greed. Unlike any other country in the world, Zandi writes, Americans define success by the size and quality of their homes. For almost all Americans, the home is the largest asset and the mortgage the largest liability on one’s personal balance sheet. Because of the preferential tax treatment homeowners receive, all Americans are incentivized not just to become homeowners, but to buy as large of homes as they can possibly afford given their incomes. We are greedy when it comes to our homes.

The 2008 financial crisis had its roots in greed. Unlike any other country in the world, Zandi writes, Americans define success by the size and quality of their homes. For almost all Americans, the home is the largest asset and the mortgage the largest liability on one’s personal balance sheet. Because of the preferential tax treatment homeowners receive, all Americans are incentivized not just to become homeowners, but to buy as large of homes as they can possibly afford given their incomes. We are greedy when it comes to our homes.

In the ordinary course of things, mortgage lenders have implemented risk layering in order to weed out unqualified homebuyers and temper this greed. Instead of offering mortgages to anyone who wants one, lenders typically required:

- a 20% down payment

- private mortgage insurance if the down payment wasn’t large enough

- income verification – are you making enough and is your job stable?

- credit check – do you typically pay off your debts on time and in full?

You can compare this risk layering to the Swiss cheese model of protecting yourself from COVID-19.

While any one activity won’t give you 100% protection from COVID, layering multiple safe habits on top of each other significantly reduces one’s chance of infection. So…

- wear a mask AND

- socially distance AND

- get the vaccine AND

- don’t be inside with other people AND …

This model – for protecting from both financial and viral risk – works well. But making mortgages to only highly qualified borrowers isn’t great if you make commissions on the number of mortgages you can originate, or your bank makes fat fees securitizing mortgages into mortgage backed securities (MBS). The natural cap on how many new homes Americans can afford each year — not everyone can drop $60,000 every year to buy a new $300,000 home — was a limit for many on Wall Street to earning higher compensation, so the normal risk vetting process began to change, and the slippery descent into all out financial chaos began.

What followed is obvious in hindsight but was more subtle at the time. Slowly but steadily, banks unlayered their risk layering methods. Income verification could be stated – you didn’t need to prove you made $100,000 per year, just tell us that you do *wink wink*. You could avoid having to buy PMI by buying two mortgages, the first at 80% of the value of the home, and the second for the remaining 20% (called piggyback loans). Eventually, you didn’t need to prove anything as NINJA loans – no income, no job, no assets – proved that we were definitely in a bubble.

Although Alan Greenspan, the federal reserve chairman at the time, didn’t believe we could accurately identify bubbles in real time. He thought it was the Fed’s job to come in after bubbles broke and repair the damage to the economy – like Captain Marvel smashing Thanos’s ship in the final scenes of End Game. (Spoiler alert?)

Zandi disagrees with Greenspan and says there are ways to tell when bubbles are forming if you’re looking for the right identifiers. If you see multiple of the following trends, he argues, you can likely assume you’re in some sort of asset bubble

- Prices are going up

- New, less sophisticated borrowers are entering the market

- Leverage is up

- Trading volumes are soaring

- Something fundamental has changed (i.e. the Internet is changing how business is conducted, China is buying more than ever before, interest rates are at 30 year lows)

I agree with Zandi, it’s possible to identify not only bubbles but general financial market instability with precision. As an example, I take great pride in knowing I correctly called the 2020 stock market decline ahead of time and was able to move my assets out of the stock market. Of course, my actions were less impressive when six weeks later the Fed decided to pump nearly endless amounts of money — to the tune of $3 trillion — into the financial system to make sure COVID-19 didn’t necessitate another financial crisis. But, that is exactly what the Federal Reserve should have done. You want central banks to respond aggressively to crises to limit the damage to everyday people. But of course, Fed action can make searching for bubbles seem unnecessary if you assume the Fed – Captain Marvel – will always bail you out at the last second.

So who was responsible for the crisis?

No one. And that was the whole problem. When you don’t have pain receptors going off anywhere, you’re numb to what’s happening, and you don’t realize that you might be causing real harm. Investors, homeowners, banks, ratings agencies, and regulators had no skin in the game, so no one really cared whether or not the mortgages that were being created would be something homeowners could actually pay or not. Without US homeowners paying their mortgages, investors all around the world that held MBS were suddenly not receiving the money they were expecting. Soon, you had asset sales leading to fire sales, contagion spreading to all sorts of products that weren’t even linked to the residetnial mortgage market, and before long we were in the recession.

No one. And that was the whole problem. When you don’t have pain receptors going off anywhere, you’re numb to what’s happening, and you don’t realize that you might be causing real harm. Investors, homeowners, banks, ratings agencies, and regulators had no skin in the game, so no one really cared whether or not the mortgages that were being created would be something homeowners could actually pay or not. Without US homeowners paying their mortgages, investors all around the world that held MBS were suddenly not receiving the money they were expecting. Soon, you had asset sales leading to fire sales, contagion spreading to all sorts of products that weren’t even linked to the residetnial mortgage market, and before long we were in the recession.

Take the concept of skin in the game to its full conclusion and you can see it makes a lot of sense. Imagine you have $200,000 of equity in your home, and the roof starts leaking. What do you do? You call a roofer and you fix it. You’re not going to ignore a leaky roof and wait for it to cause more damage to your house.

Now imagine you had -$75,000 of equity and the same situation happened. Would you care at all? You’d probably abandon your home, which, by the way, is now literally and figuratively underwater, and start from scratch somewhere else, leaving the bank with a house that is nearly impossible to sell in a market where 1 in 10 homes in each neighborhood is already for sale.

Wall Street’s classic formula

Wall Street always takes a good idea and abuses it until it becomes a terrible idea.

Wall Street always takes a good idea and abuses it until it becomes a terrible idea.

Zandi goes through a plethora of areas where Wall Street products and processes incentivized the wrong behaviors. I’ll cover just two of them below.

Adjustable rate mortgages (ARM) were one example where something that started out pretty positively become something completely distorted and abused and ending up hurting homeowners and in turn the global economy. In a typical US mortgage, a homeowner borrows money at a fixed rate of interest, say 4%, for 30 years. With ARMs, that rate of interest isn’t fixed – it is reset periodically. The benefit of this is that short term variable rate are usually lower than long term fixed rates (maybe your ARM only requires 2% interest payments to start, so you’re saving 1/2 the amount you’d be paying on interest vs a regular mortgage).

Regulators liked ARMs because they allowed homeowners to save money and by the time the rates reset, sometimes not for 7 years, most Americans could have either refinanced their loans or they were selling their home to buy new ones.

But what happens when Wall Street pours Everclear in the punch bowl? Plain vanilla ARMs gave way to interest only ARMs (where you don’t pay any principal) and then to option ARMs (where you could choose to pay amounts that are so low you’re not even covering the principal payments on your mortgage). Option ARMs introduced the concept of negative amortization — next month, you owe more against your house than you owed last month! Combined with banks’ lax policies of screening homeowners, a greater number of people than ever before were taking out mortgages on homes they could barely (and often just not at all) afford.

Securitization is another example: Combining many mortgages into one tradable asset – the mortgage backed security – is on its own a good thing. When investment banks create MBS, investors can more easily match their preferred risk/reward profile with what is being offered to them. Like any product that is a better fit for its customer, that is a good thing. But when you securitize $1 trillion residential MBS in one year and then another $1.5 trillion the next year, where will you keep finding people to take out new mortgages to help you generate $2 trillion, and then $3 trillion, and then $4 trillion… Eventually the music has to stop.

So, how can we prevent the next crisis?

First, let’s recognize that allowing creative destruction is one of America’s best open source secrets. Our bankruptcy laws have historically been the reason people are able to take big risks and start big companies here. If they fail, they don’t go to a debtor’s prison. They just lose the money associated with the business and have a chance to restart their economic lives. I don’t think we should spend too much time on worrying about economic cycles. Business will be born and will die and that’s healthy. Replace the old with the new. However, preventing crises like 2008 from happening again is definitely important, and there are a variety of things that have been done and have yet to be done to make sure we don’t get so caught up in the hype next time around.

First, let’s recognize that allowing creative destruction is one of America’s best open source secrets. Our bankruptcy laws have historically been the reason people are able to take big risks and start big companies here. If they fail, they don’t go to a debtor’s prison. They just lose the money associated with the business and have a chance to restart their economic lives. I don’t think we should spend too much time on worrying about economic cycles. Business will be born and will die and that’s healthy. Replace the old with the new. However, preventing crises like 2008 from happening again is definitely important, and there are a variety of things that have been done and have yet to be done to make sure we don’t get so caught up in the hype next time around.

Zandi ends his book with ten examples, some of which have already made their way into our new and improved financial systems. His most common sense suggestion is to start teaching financial education in school.

Before we can prevent the next crisis, we need to think about what matters to us and how we’re going to address things like equality and justice when the inevitable blow up occurs. Many homeowners – who bought only as much home as they could afford – were rightfully angry when the federal government started talking about ways to bail out homeowners who were defaulting en masse. Why should my taxes cover their greed? The unsatisfying answer, is that without helping those greedy taxpayers, the hurt to the entire economy — financially savvy homeowners included — would be much worse.

We have the same argument brewing today over student loans. Why should we provide relief to students who took out $120,000 in debt to get an English degree from a private university? Doesn’t everyone learn English from K-12? Is it my fault you chose a degree that may not be useful in the market place? Again, this debate goes back to making sure the incentives are correctly lined up in the first place. If colleges and universities were financially on the hook for graduating students who were unable to secure employment, you can imagine a good amount of non-STEM degrees would die overnight, so then there would be no students paying ridiculous sums of money for a useless piece of paper. So, why are colleges allowed to offer you a shoddy product with no refunds allowed? These sort of debates are essential to have now before the next crisis happens, so we know what we value and where we might be exacerbating problems today that we don’t want to be forced to solve (or pay for) tomorrow.

Further resources

Zandi’s book is great for a lot of reasons. It’s an all encompassing account from someone who has been studying and applying economic theory for years. He explains the basic feedback loops that led to the crisis, while keeping his writing approachable enough for anyone with an interest in the subject to learn more about the mess we were in over thirteen years ago.

Zandi’s book is great for a lot of reasons. It’s an all encompassing account from someone who has been studying and applying economic theory for years. He explains the basic feedback loops that led to the crisis, while keeping his writing approachable enough for anyone with an interest in the subject to learn more about the mess we were in over thirteen years ago.

If you’re looking for more reading on the financial crisis, Tim Geithner’s Stress Test is another excellent book that gives a more up front and personal account of the crisis given Tim’s role as Treasury Secretary. And the movie Margin Call starring Kevin Spacey and that guy from Wimbledon and A Knight’s Tale is a fictional but highly entertaining account of what was happening at one of the major banks in lead up to the financial crisis.