These are notes from a recent webinar with Ibrahim Bashir and Sangeet Paul Choudary covering platform strategies and generative AI trends.

The Coordination Problem

This is the biggest problem in business today; work is being organized around specific problems rather than a traditional hierarchy. This is a shift from the past where the majority of problems and work were solved within a single company. Today, most pieces of work are handled by services outside of the company. For example, Uber coordinates rides for its users but does so with a network of drivers and vehicles that it does not own. The most successful companies today solve the coordination problem.

Value Creation

The landscape for value creation is shifting in a number of ways:

- Markets are becoming more connected.

- Teams of smaller size can deliver larger amounts of value.

- The number of sources of value is growing.

The biggest successes of late have been in unlocking value that was previously untapped. For example, Airbnb is not a more efficient hotel; it is an entirely new source of value.

Bill Gates famously oriented the definition of a platform around the value it creates and how that value is distributed. But there is some nuance to this. While value creation and sharing is the focus, it really boils down to a question of power. Platforms with more market power can afford to keep more of the value for themselves. For example, there are a few major record labels with the rights to the majority of music. This gives them lots of power, and they can therefore retain lots of value. A company like Spotify has to give them a large percentage of earnings in order to stream music. The distribution of value between the labels and Spotify is skewed heavily in favor of the labels.

One other counterintuitive thought here is around asset ownership. It is often thought that the best platforms are asset-light (Airbnb doesn’t own homes, Uber doesn’t own cars). But the best platforms are often asset-heavy, in the right areas. For example, Amazon and Walmart are both asset-heavy in warehouses. In the lens of e-commerce, Amazon is asset-heavy in the right orientation, since their warehouses are targeted at home delivery while Walmart’s are targeted at delivery to their stores.

Defining Platforms

Platforms can be defined along two spectrums: the function they serve and their place in the value chain.

Functions:

- Transactions: any form of exchange (social media, payments, etc.)

- Innovation in creation: facilitating new forms of value creation (Shopify allows anyone to open a store)

- Workflow solutioning: productizing business processes and workflows (most B2B software)

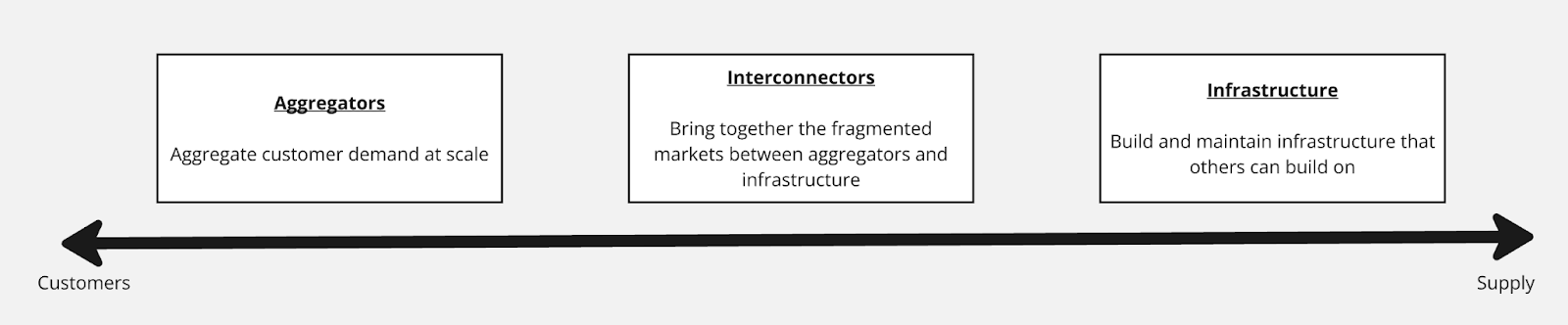

Place in the Value Chain:

Vertical vs Horizontal Platforms

Most platforms begin with a vertical orientation and become horizontal over time. Being unaware of this shift or not protecting against it can leave platforms vulnerable to disruption. Some examples:

- IBM - They had the opportunity to verticalize the personal computer market. Instead, they outsourced the development of their operating system to Microsoft. On its own, this may have been okay, but they also left the licensing open. This meant that Microsoft could sell the OS to other companies. This led to Microsoft, rather than IBM, being the platform in personal computing.

- Apple - They have expanded the iPhone and iOS to be a platform that others can build on, but they did something critical before opening the platform. They standardized the design of the phone and locked in vertical integration. This ensures that they recoup the majority of the value of their platform.

- Tesla - Another good example of locking in vertical integration. They owned their own charging networks. Other EV manufacturers outsourced charging to third parties, where priorities and value creation were not aligned. This led to Tesla having an advantage in their charging experience, which led to customer satisfaction and retention. This also allowed Tesla to become the charging standard for the industry, rather than Tesla needing to adapt to an industry standard.

Performance Vector

The Performance Vector is the key dimension or attribute that a product or platform must optimize to differentiate itself and achieve market success. This can vary widely depending on the market. For example, in PCs, the hardware and software can be decoupled, and you still get a good outcome. In automobiles, you need the entire car to perform at a high level, so vehicles stay vertically integrated. Some other examples:

- iPhone - the performance vectors in phones are speed and scope. Apple solved for speed by allowing multi-threading. You can run more than one app at the same time. They solved for scope by defining what a phone looks like. The design of the iPhone has stayed the same (and most other phone manufacturers have followed suit).

- Tesla - battery life was the first performance vector here. Tesla became the market leader by providing better battery life. The second vector was charging infrastructure, ensuring that customers could always charge before they ran out of battery. Again, Tesla owned and operated their own charging network to ensure they could deliver on this vector.

Incumbents vs New Entrants

As with other types of markets, there is a tension in platforms between incumbents and new entrants. Each brings its own advantages and disadvantages and is often focused on different things. The biggest mistake incumbents make is focusing too much on the customer; they think the customer relationship is the end-all, be-all. They constantly chase customer engagement. While this is important, they also need a high-level of focus on building supply-side strength. They need to be innovating and shoring up their supply side so they are ready for dramatic demand-side shifts. Some examples:

- Chegg - they can be thought of as the first public company that was disrupted by ChatGPT. They were heavily focused on their homework answer service, which had high demand during COVID. But then ChatGPT was released, and demand shifted instantly because customers could get answers for free rather than paying for them through Chegg. To prepare for this shift, Chegg should have been thinking through how to build supply-side strength and expand their offerings before it was too late.

- Texas Instruments - they have long been the default in scientific calculators for students. They charge $100+ for their TI series calculators. When the iPhone released a free scientific calculator, Texas Instruments should have been disrupted. But they are still the standard in calculators today. This is due to them creating a supply-side advantage long before the iPhone. All the way back in the 80s, they worked to become the standard for academic testing. So even though the iPhone has a free calculator, they are unable to disrupt the testing market, and students must still buy a Texas Instruments calculator.

Generative AI

All of the above factors in platform success apply to generative AI as much as they apply to any other technology. By looking at who is already executing against these factors, you can likely determine who will be winners in the AI boom. Platforms with supply-side advantages have the ability to tweak their demand-side offering. In other words, they can credibly offer demand-side generative AI solutions because of their supply-side strengths. Some examples:

- Microsoft - they have supply-side advantages in cloud computing (predictability of performance and cost of cloud computing). They also have a supply-side advantage in content aggregation through things like Office (enterprises put all their content into Microsoft services). This strength has given Microsoft the ability to launch CoPilot as a new demand-side offering.

- Salesforce - their entire value proposition was built on disrupting the pains of on-premise software. However, on-premise software companies do hold an advantage in the fact that it is hard to move away from them. This gives them lots of power to land and expand. The land and expanding motion in the cloud is much harder because switching costs are low, and customers can mix and match vendors. Salesforce has tried to replicate the land and expand motion in the cloud (as has done well, but doesn’t have the same power as an on-premise vendor). They have long focused on building a bundle of offerings of CRM that makes them attractive as a vendor for many things, think of the Slack acquisition. They are now trying to wrap that bundle in GenAI to meet new demand.

- Snowflake/Databricks - both have moved quickly to message themselves as AI data platforms. They do have strong supply-side advantages in the form of ingesting large amounts of customer data and being a backbone for data and engineering work. It remains to be seen if these supply-side strengths give them enough credibility to flex their demand-side offering.