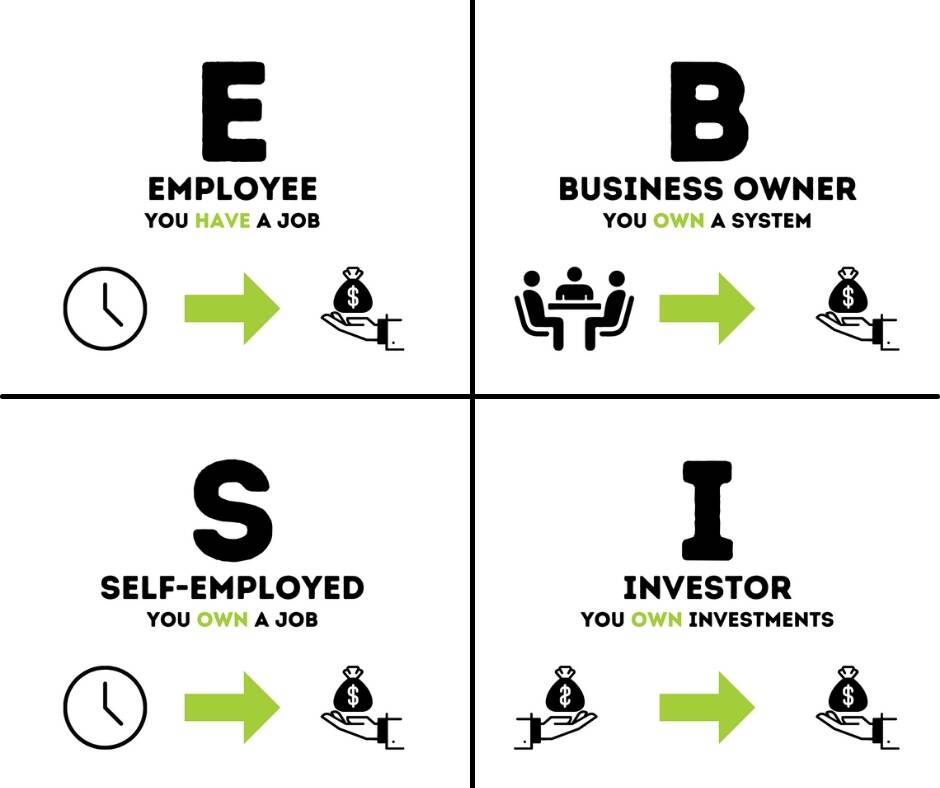

Everyone can be categorized according to how they get their money:

- Employee

- Self-employed

- Business owner

- Investor

The Cashflow Quadrant from Robert Kiyosaki is divided into four types of people, each representing the four different ways to make money.

Every person who generates income resides in at least one of the four sections (quadrants), and where you are is determined by where your cash comes from.

You can…

- Be paid directly as an employee

- Be self-employed or and get paid for your services

- Own a business system and be paid from its profits

- Invest and be paid for the use of your money

CHARACTERISTICS OF EACH:

- Employee, or the E-quadrant, values security above all else and seeks the safety of a long-term contractual agreement. This person works within someone else’s system to earn money.

- The Self-employed person, or the S-quadrant, does not want their income to be dependent on other people. They essentially own their job and is likely a hardcore perfectionist who values independence and expertise.

- The Business owner, or the B-quadrant, has a system where other people do the work— like Henry Ford, who surrounded himself with smart people who knew all the answers so that he could concentrate on new ideas.

- The Investor, or the I-quadrant, uses money to make money. The opportunity for real wealth lies in the I-quadrant.

SECURITY OR FREEDOM?

The difference between individuals who face financial difficulties and those who financially flourish economically can often be traced back to their positions on the two halves of the Cashflow Quadrant.

LEFT SIDE: This side is usually populated by those who prioritize security above all else. They are individuals who prefer the comfort of a steady paycheck and the predictability of a regular income. They often aim for stable employment, seeking out positions that offer regular hours, job security, and a consistent wage or salary.

RIGHT SIDE: On the other side of the quadrant, we have those who value freedom. These individuals are not necessarily opposed to security, but they place a higher value on the ability to control their own time and income. They are typically entrepreneurs, investors, and business owners who thrive on the unpredictability and potential high rewards of the financial marketplace.

MOVING FROM THE LEFT QUADRANT TO THE RIGHT

Moving from the left side of the quadrant (employee or self-employed) to the right side (business owner or investor) involves a shift in mindset and strategy.

Instead of relying solely on a paycheck, focus on acquiring assets that generate passive income. This could involve investing in stocks, purchasing real estate, or starting a business that other people can run for you.

The goal is to let your money work for you, instead of you working for your money. This transition may take time and requires planning, education, and possibly taking on some risk. It is important to start small, learn from your experiences, and gradually increase your investments. With time and perseverance, you can build a diversified portfolio of income-generating assets.

WHY IT MATTERS: Understanding Robert Kiyosaki's cashflow quadrant can really open your eyes to the different types of income out there and what makes each of them unique. It's a great way to see where you're at right now in terms of where your money's coming from, and it can also guide you on how to mix things up and bring in income from different sources. Plus, it's super useful for planning your finances, building your wealth, and managing risks. Once you've got your head around these ideas, you'll be all set to make smart choices for your financial future.

more tomorrow,

Hunter