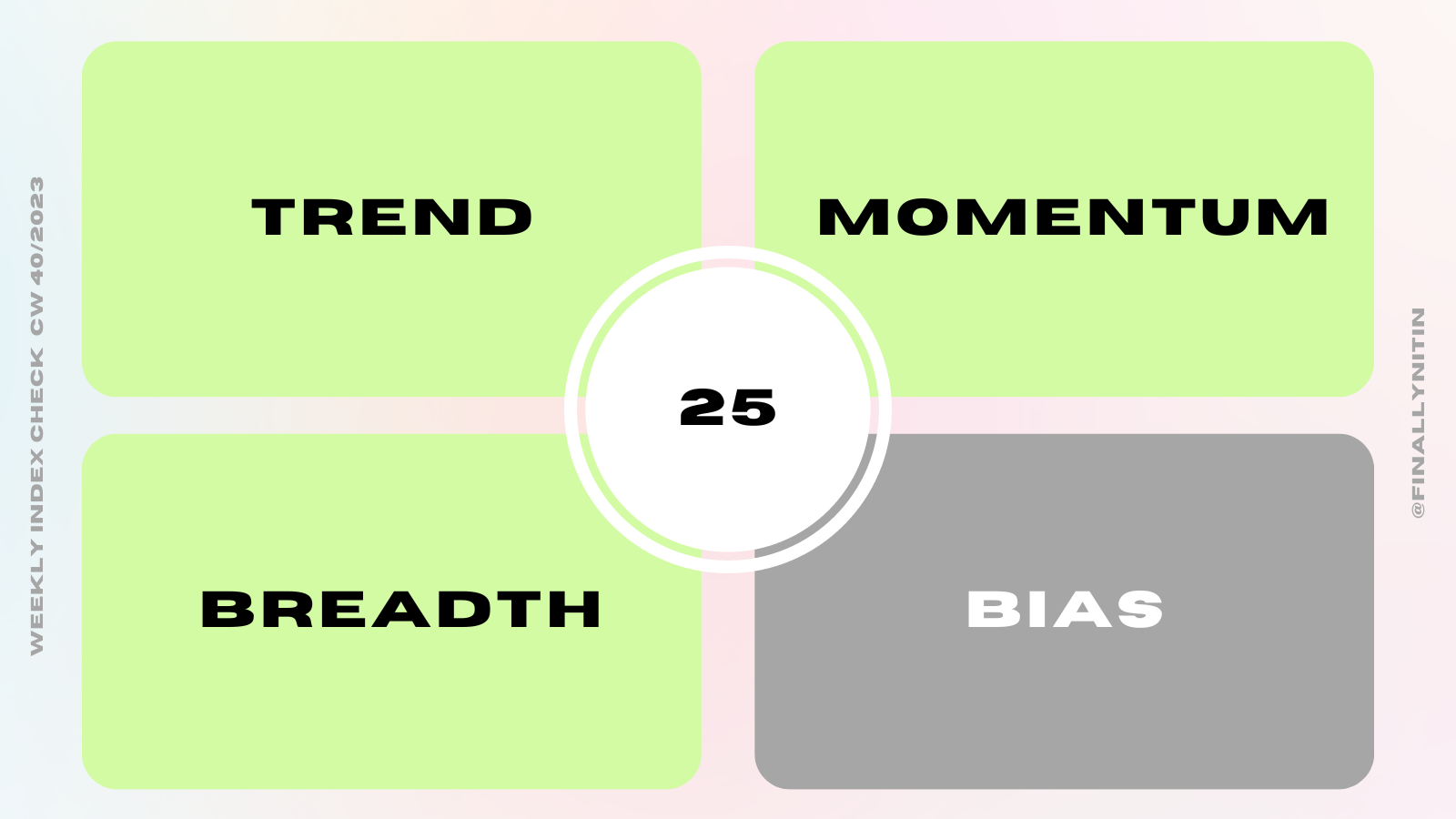

Market Quadrant

⦿ Trend: Uptrend under pressure

⦿ Momentum: Positive but worsening

⦿ Breadth: Improving

⦿ Bias: Sideways

⦿ Swing Confidence: 25

⦿ Momentum: Positive but worsening

⦿ Breadth: Improving

⦿ Bias: Sideways

⦿ Swing Confidence: 25

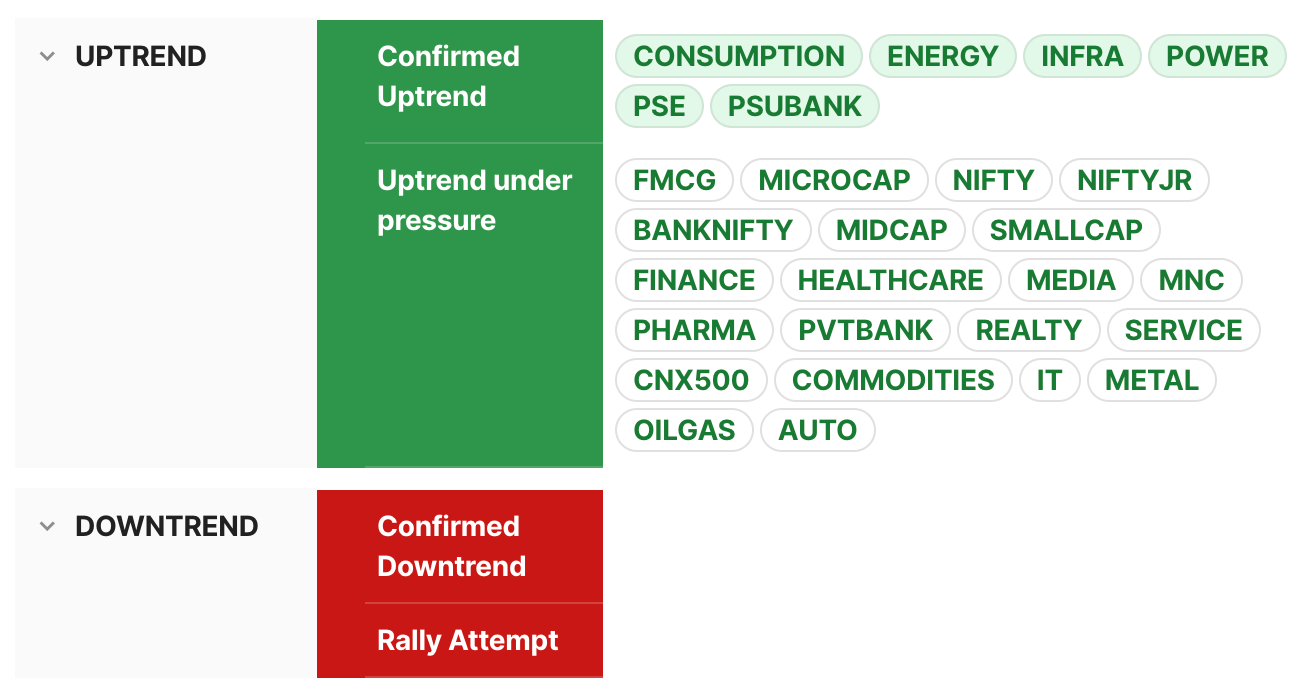

Trend → Uptrend under pressure

⦿ Majority of indices stay in an uptrend under pressure. This now also includes the Auto index, which was still in a confirmed uptrend till last week.

⦿ Consumption, Infra, Power, PSE & PSUbank are some notable indices still in a confirmed uptrend.

⦿ There is still no index in a confirmed downtrend.

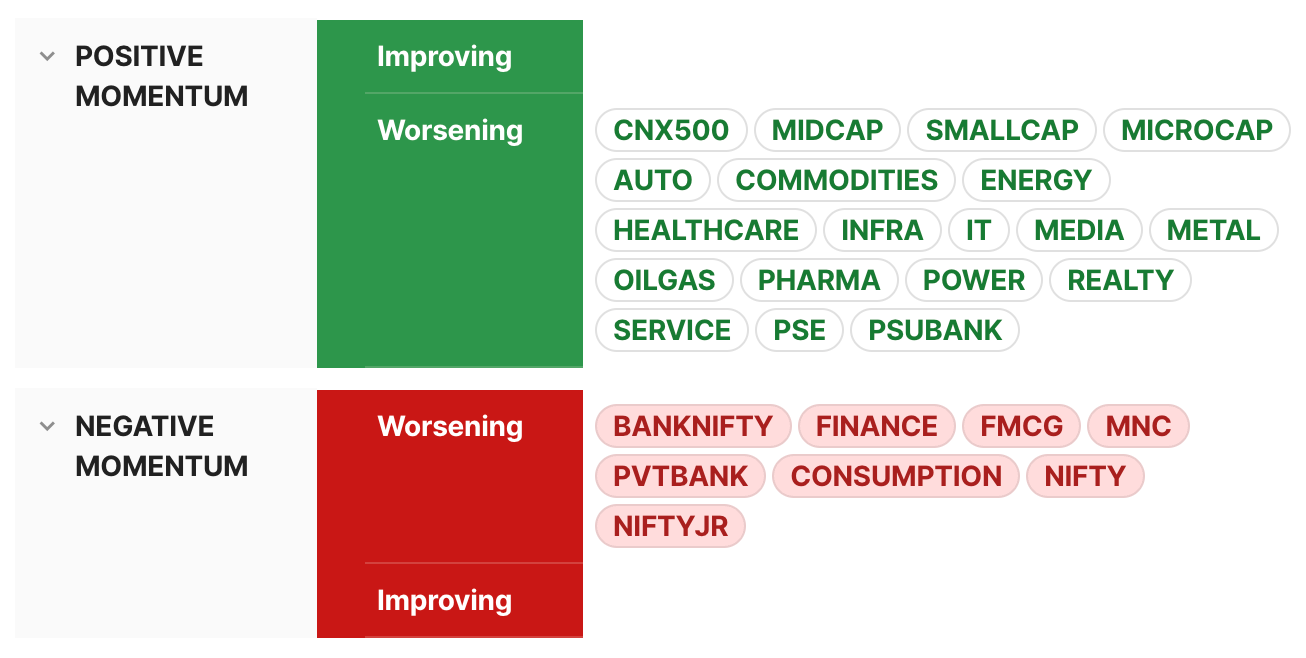

Momentum → Positive but worsening

⦿ Majority of the indices have positive but worsening momentum.

⦿ There are no indices with positive & improving momentum.

⦿ Indices with negative & worsening momentum are slowly increasing in number, with the addition of Nifty & Nifty Jr this week.

Swing Confidence → 25

⦿ Both Nifty & Smallcap are in a weekly upswing. On daily charts, while Nifty is in a downswing under strain, Smallcap is in early upswing. Swing Confidence is now 25, which means that the LOST (long-only swing traders) can trade very cautiously with minimum open risk.

⦿ Nifty bounced from just above 19300, & stays stuck in a 1000 point range between 19200 to 20200. Any decisive resolution is beyond a breach of any of thes 2 levels.

⦿ Majority of indices are in a confirmed downswing.

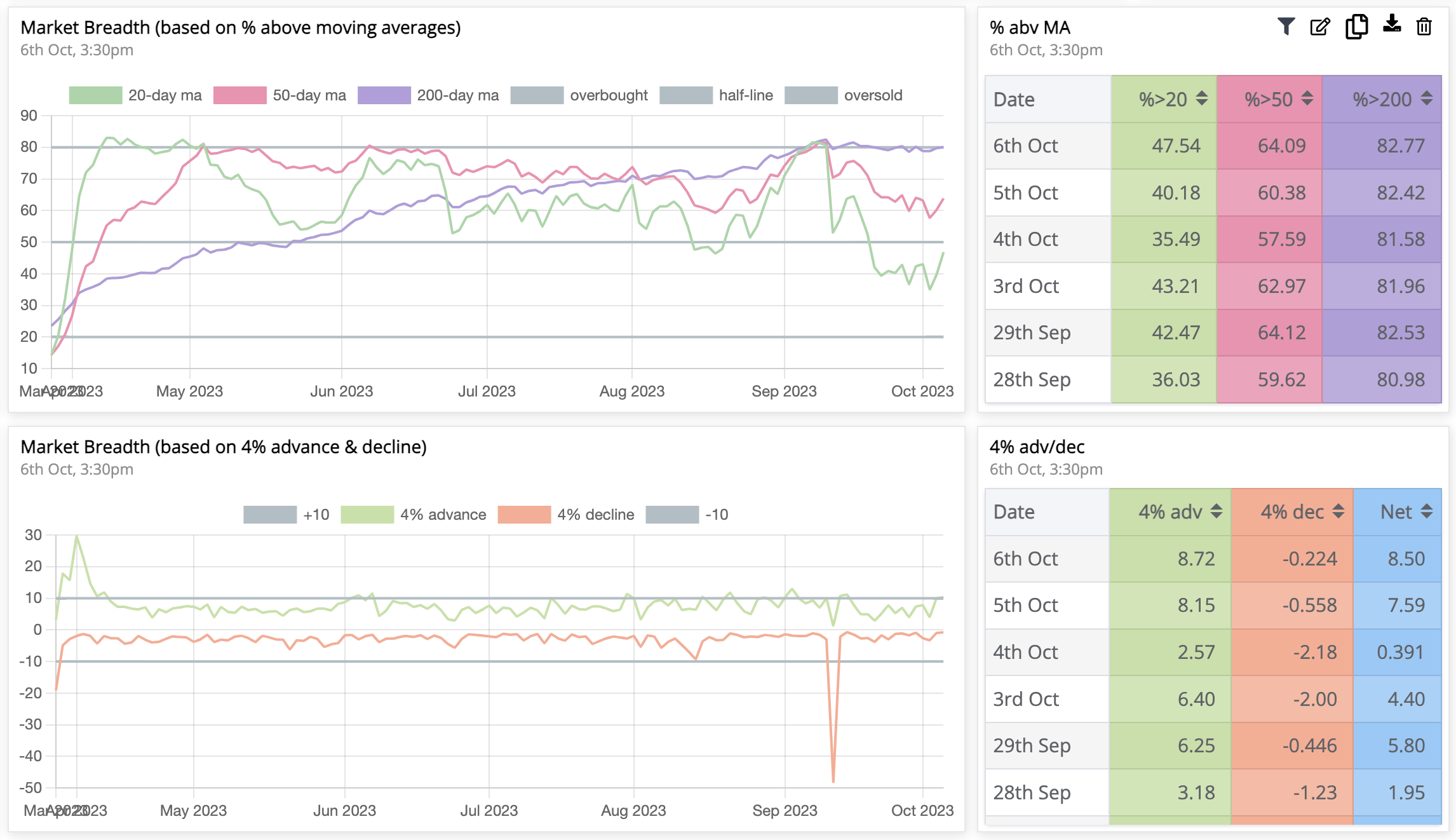

Breadth → Improving

⦿ % of stocks above 20-day MA stays below 50, but better than last week’s levels.

⦿ As long as % of stocks above 50-day MA are >50%, we are are above the bullish threshold.

⦿ % of stocks above 200-day MA stay comfortably bullish & sustainability 80+ for 5 consecutive weeks now.

⦿ Net breadth stays positive.

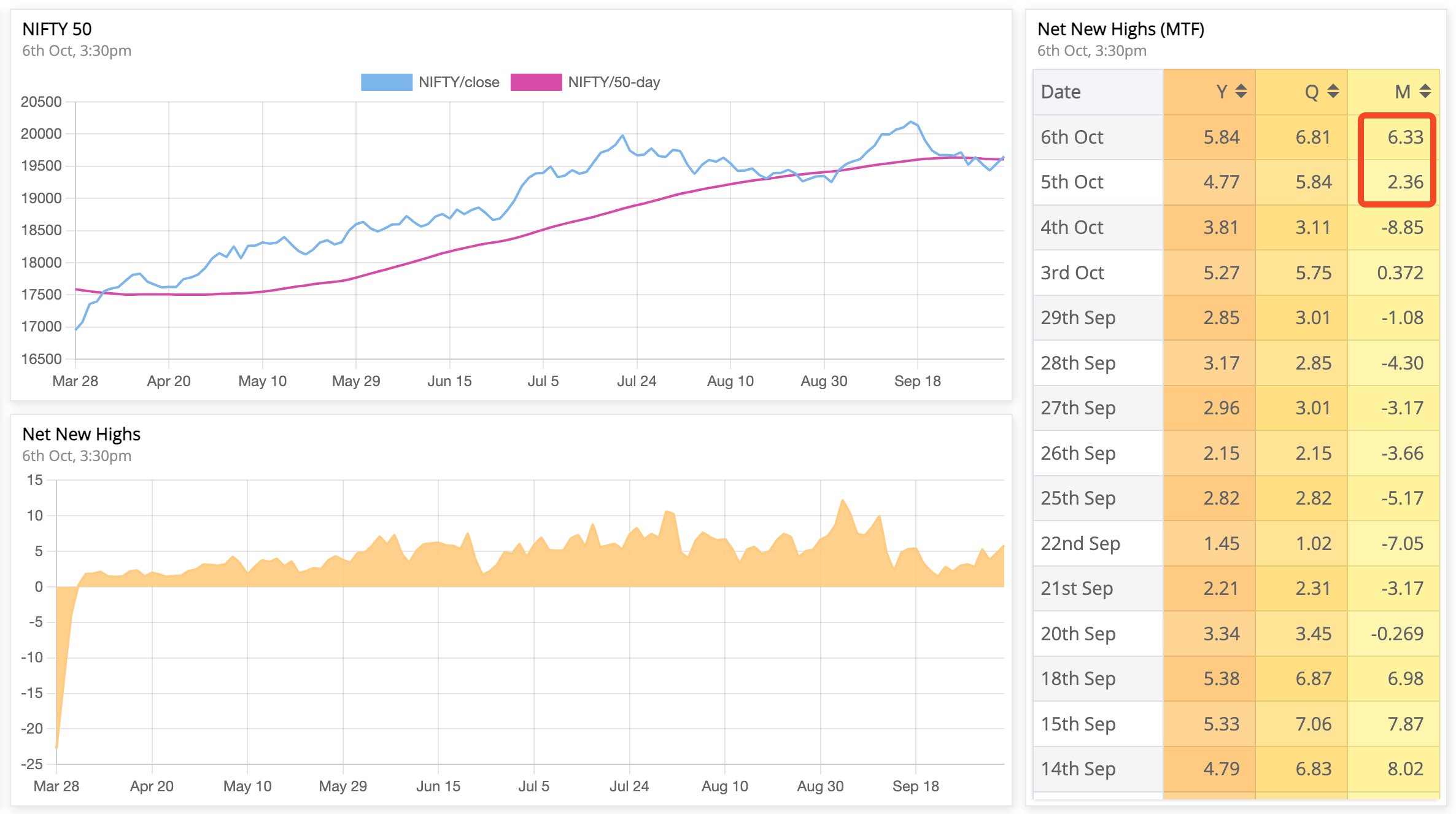

Bias → Sideways

Currently, the bias is sideways.

⦿ Nifty has closed above the 50-day MA, but as Nifty is neither above nor below the 50-day MA for 3-consecutive days, the bias is sideways.

⦿ Net New Highs stay positive for 3-consecutive days.

⦿ On a lower timeframe, the 20-day NNH has now turned positive again. With the 52-week NNH already positive, if now the 20-day NNH also stays positive for 3 consecutive days, it can signify a completion of the pullback & resumption of the bullish move.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.

.png)