What is SwingConfidence™?

SwingConfidence™ is a scoring system that helps us decide position size in swing trading, & take sit-out-in-cash decisions in an objective way.

.png)

https://coda.io/@finallynitin/swingconfidence

How to calculate SwingConfidence™?

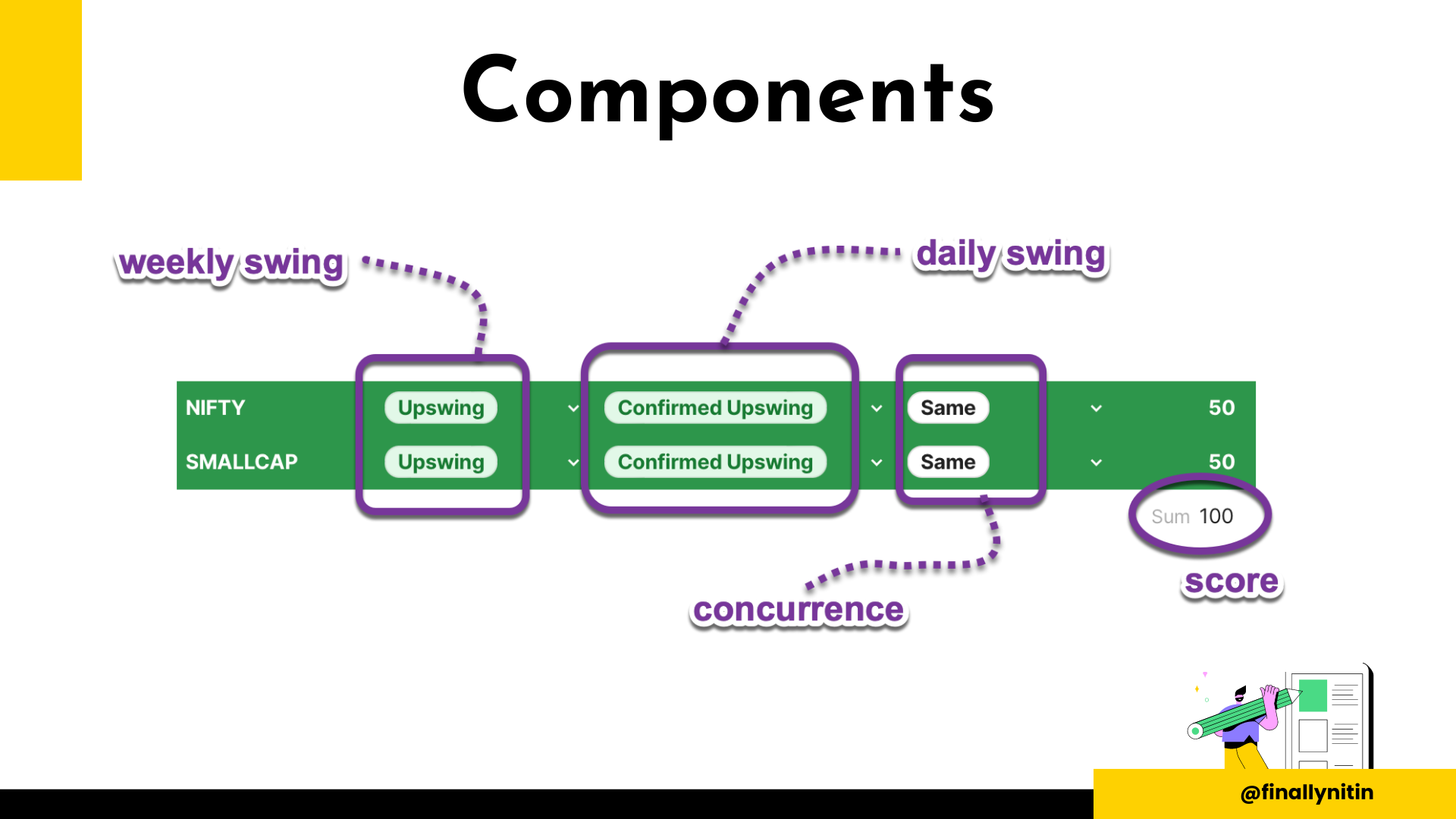

It takes into account the daily swing state of the 2 benchmark indices (NIFTY, & CNXSMALLCAP). We also need to figure out whether the index is in a weekly upswing or a weekly downswing. It has 3 components:

- Weekly Swing

- Daily Swing

- Concurrence

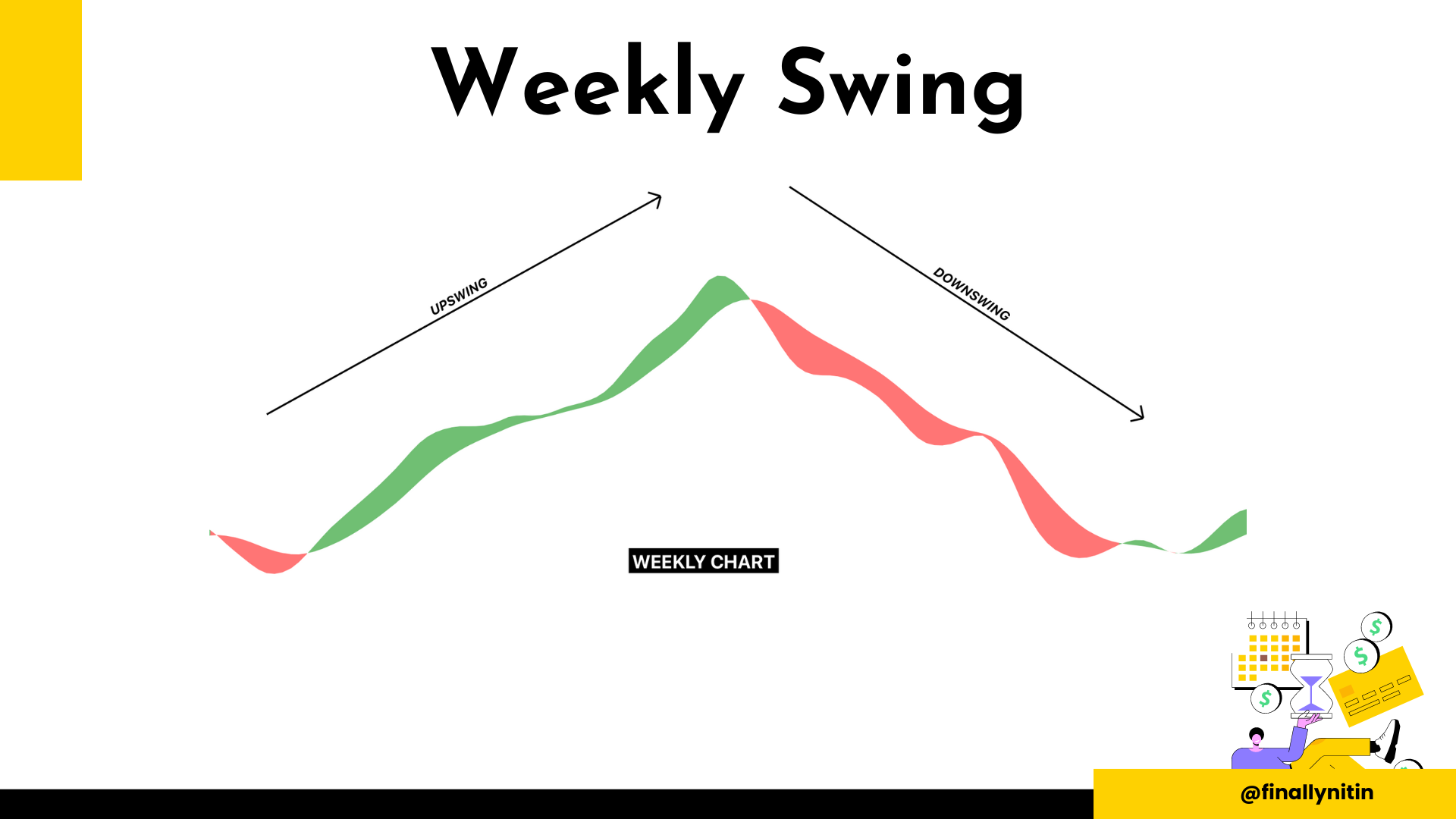

Weekly Swing

Use the Simple Swing indicator on weekly charts of NIFTY & CNXSMALLCAP indices to determine whether the index is in a weekly upswing or downswing.

- If the color of the weekly ribbon is green, we are in a weekly Upswing.

- If the color of the weekly ribbon is red, we are in a weekly Downswing.

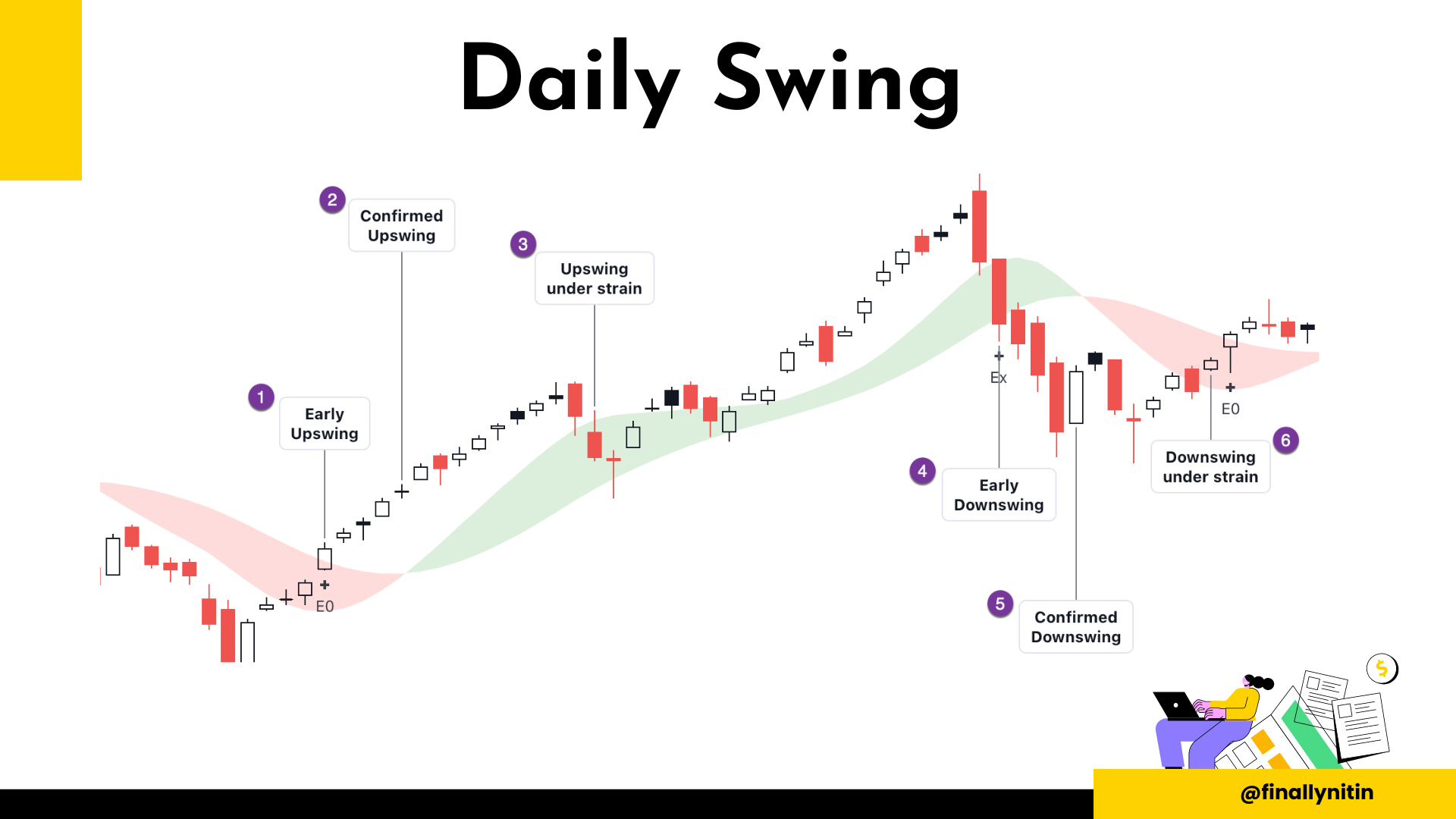

Daily Swing

Use the Simple Swing indicator on daily charts of NIFTY & CNXSMALLCAP indices to determine the daily swing state. There are 6 swing states on a daily chart:

- Early Upswing (close above red ribbon)

- Confirmed upswing (green ribbon)

- Upswing under strain (close inside green ribbon)

- Early Downswing (close below green ribbon)

- Confirmed downswing (red ribbon)

- Downswing under strain (close inside red ribbon)

SwingConfidence™ Scoring

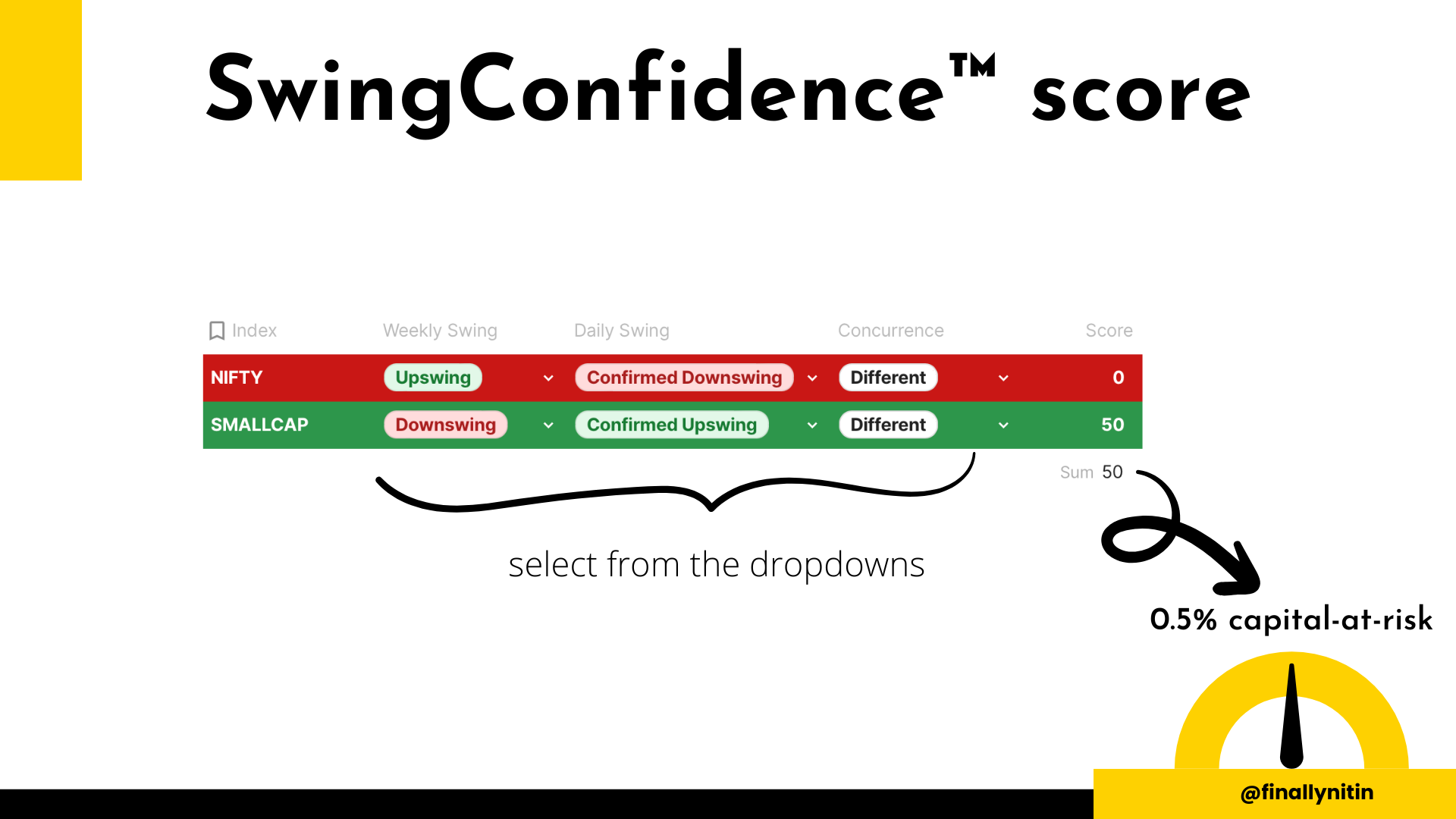

You just need to select the Weekly & Daily Swing states from the dropdowns. If the daily swing states of both the indices are the same, then select the Concurrence dropdowns as *same* (in both indices), else select *different*. The sum of the scores is the final SwingConfidence™ score.

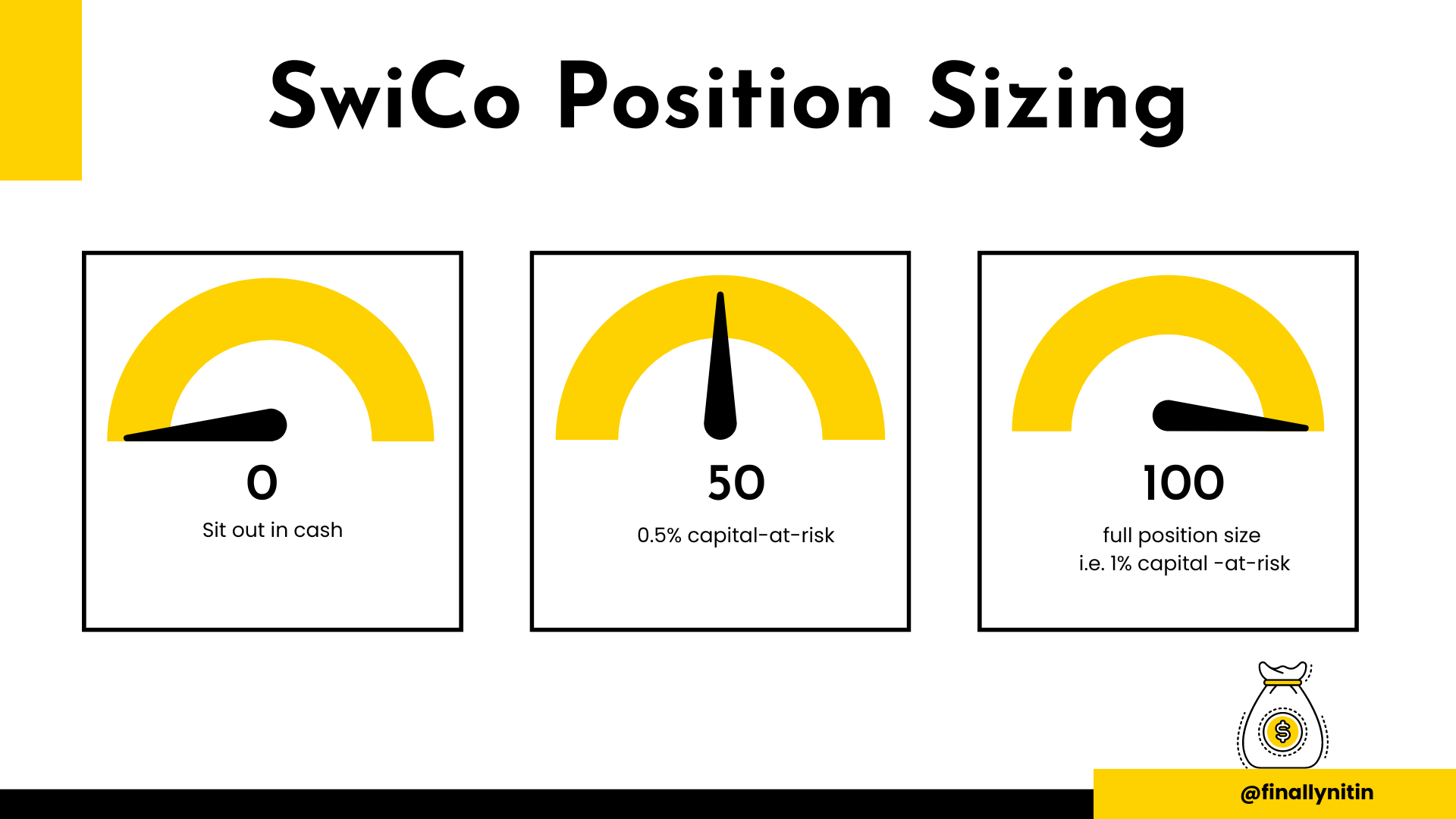

How to use SwingConfidence™ to decide position sizing?

If the SwingConfidence value is 100%, then we go with full position size (1% capital-at-risk).

If the value is 0%, we sit out in cash.

Between these 2 extremes, we reduce/increase our position size accordingly (either 0.25% CAR, or 0.75%CAR).

Hope you find this useful. If you'd wish to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you. 🙂