Market Quadrant

⦿ Trend: Downtrend

⦿ Momentum: Negative & worsening

⦿ Breadth: Oversold

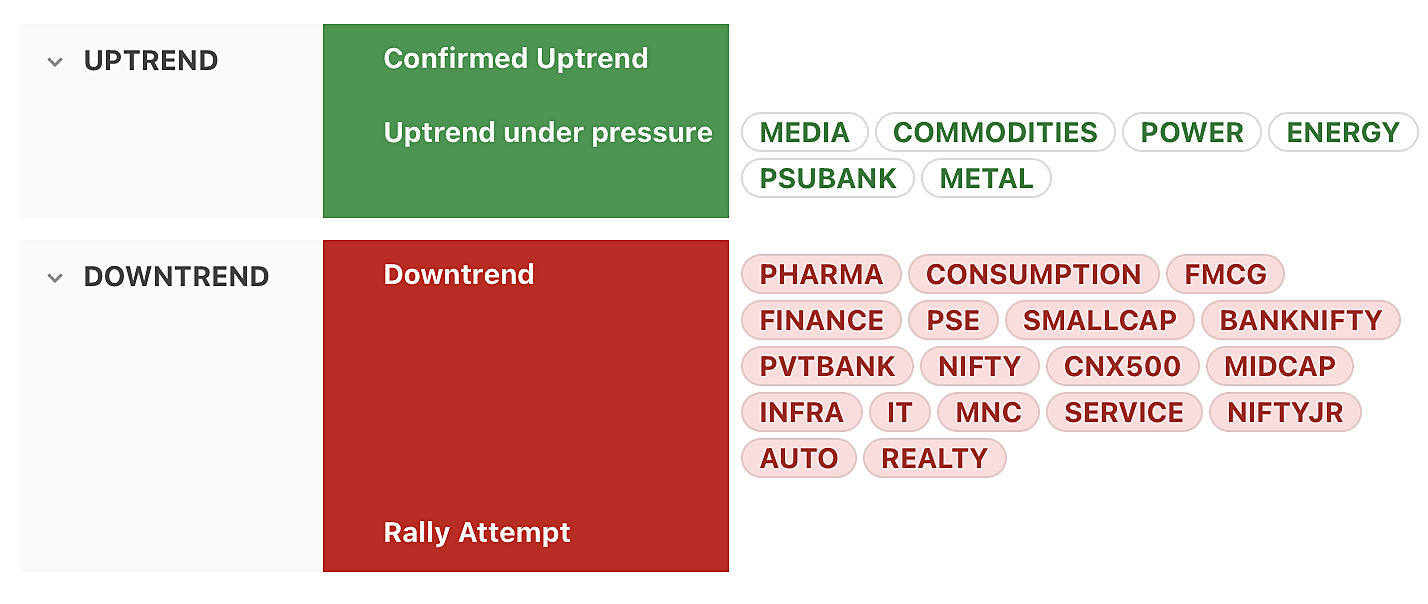

Trend

⦿ Most major indices (including Nifty, CNX500, Midcap, Smallcap) stay in downtrend.

⦿ Auto & Realty join the red list this week

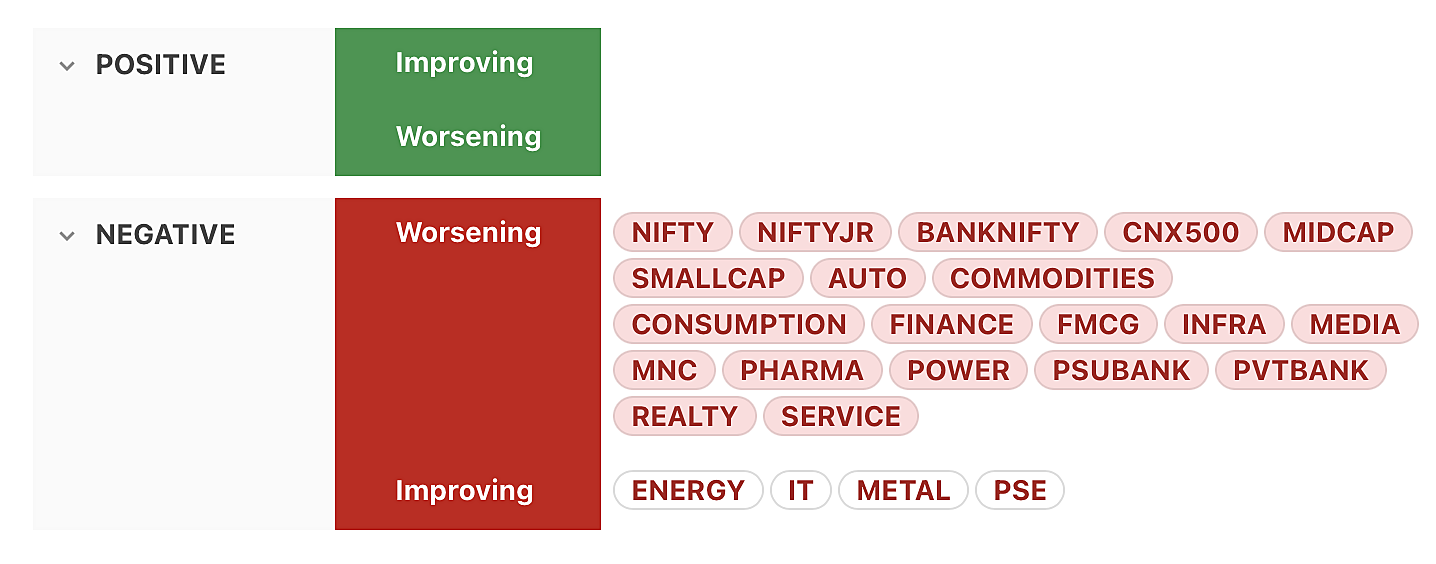

Momentum

⦿ No index is having positive momentum

⦿ Most indices (including Nifty, CNX500, Midcap, Smallcap) are showing negative & worsening momentum

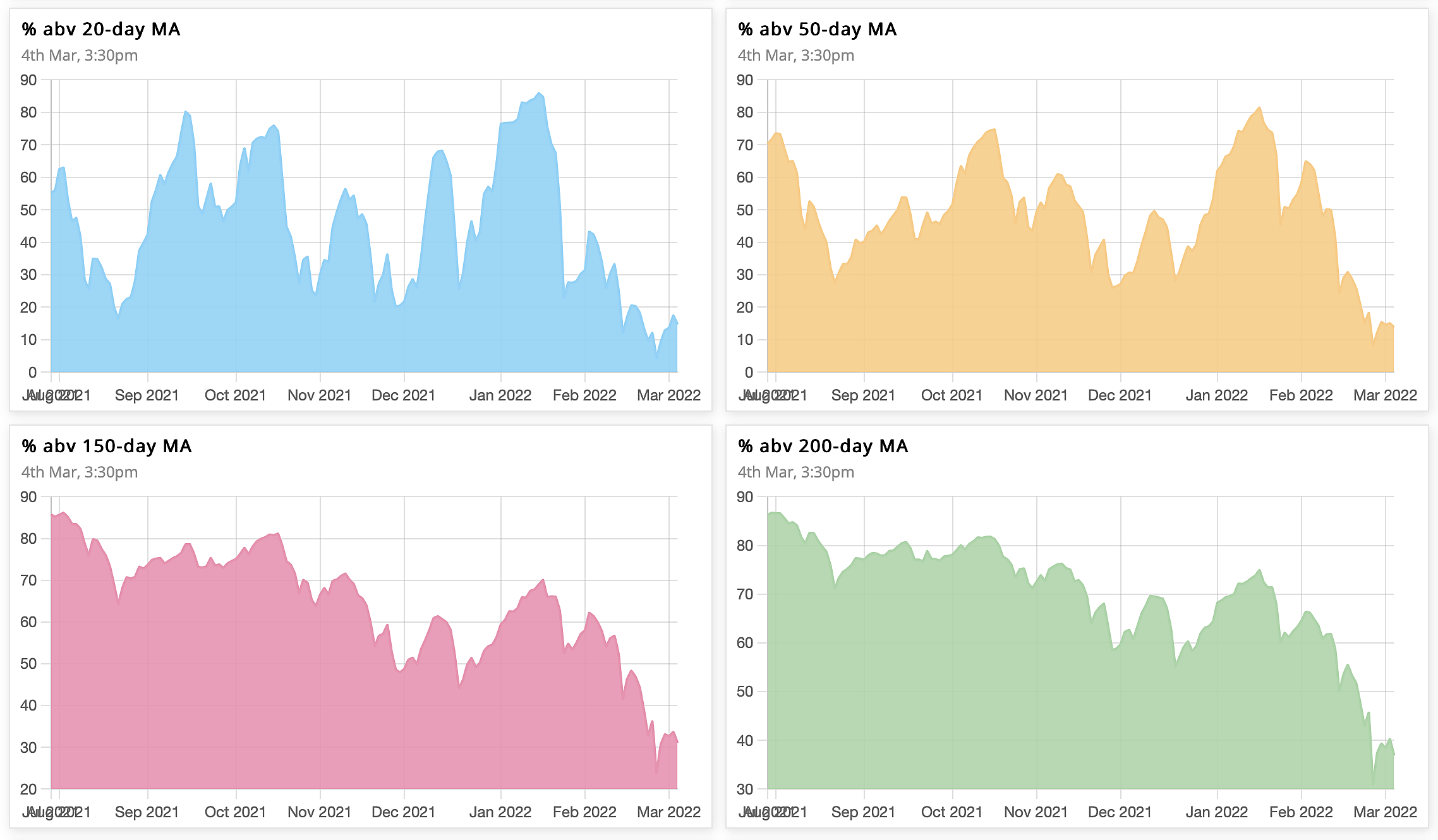

Market Breadth

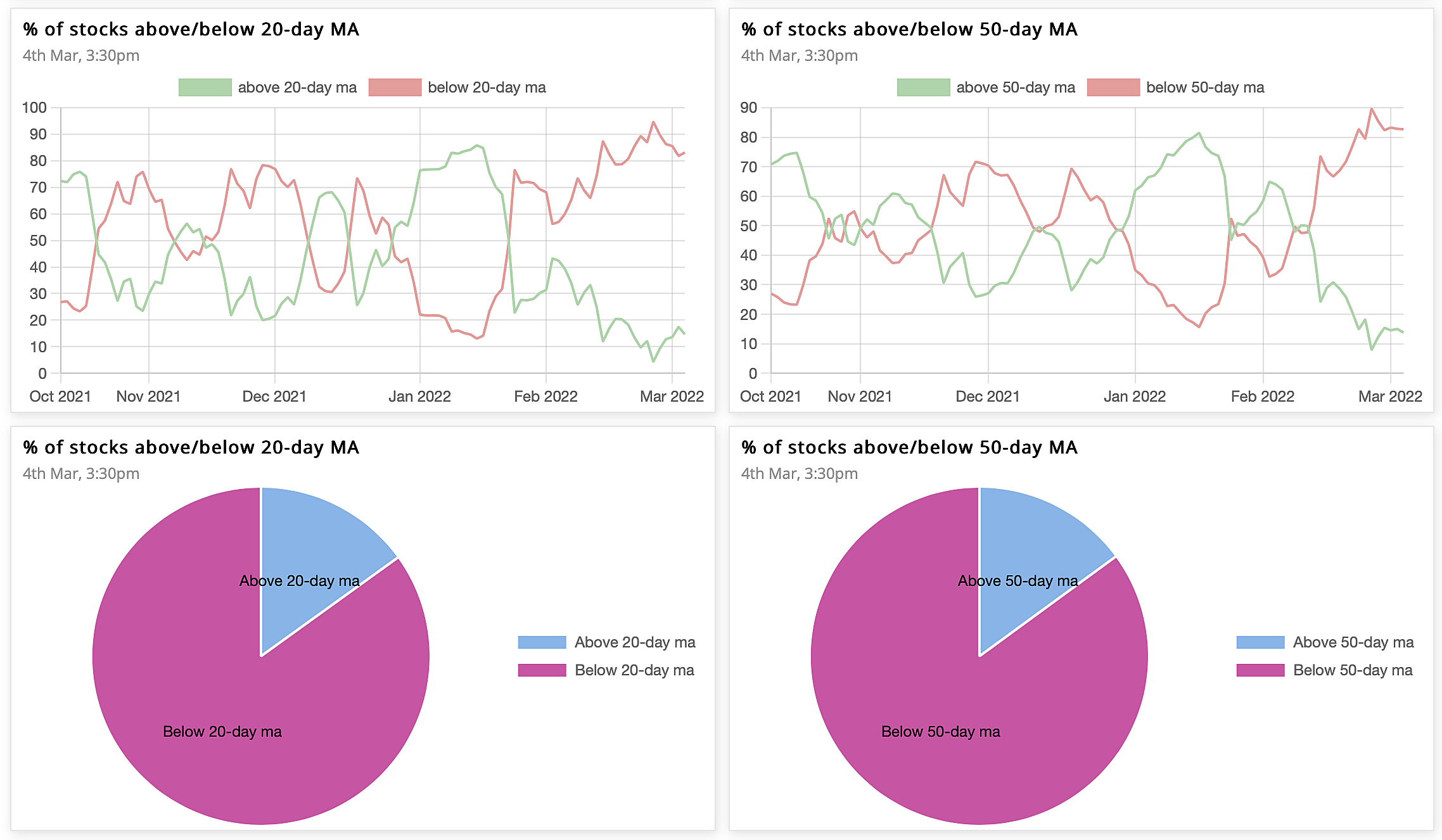

Higher timeframes stay bearish, lower timeframes stay oversold.

⦿ 9% → 14% above 20 SMA (oversold)

⦿ 12% → 13% above 50 SMA (oversold)

⦿ 30% → 31% above 150 SMA (bearish bias)

% of stocks above/below 20& 50MA

The Ratio between stocks above & below 50MA is now 0.17, while that for 20MA is 0.17.

The 10-day cumulative ratio for stocks above 50MA is 0.15.

A value >2 is good for swing trades on the long side.

The 10-day cumulative ratio for stocks above 50MA is 0.15.

A value >2 is good for swing trades on the long side.

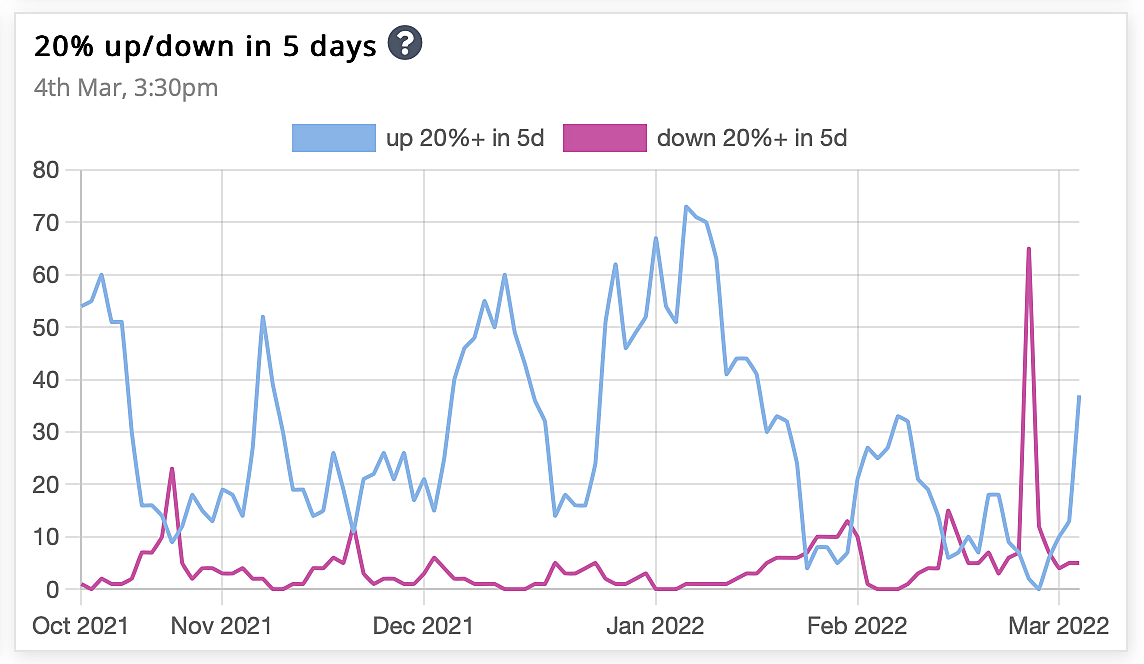

20% up/down in 5 days

The number of stocks up 20% in past 5 days is back to being greater than those down 20% in 5 days. Such brief bullish upthrusts are trading oppurtunites in the very short-term.

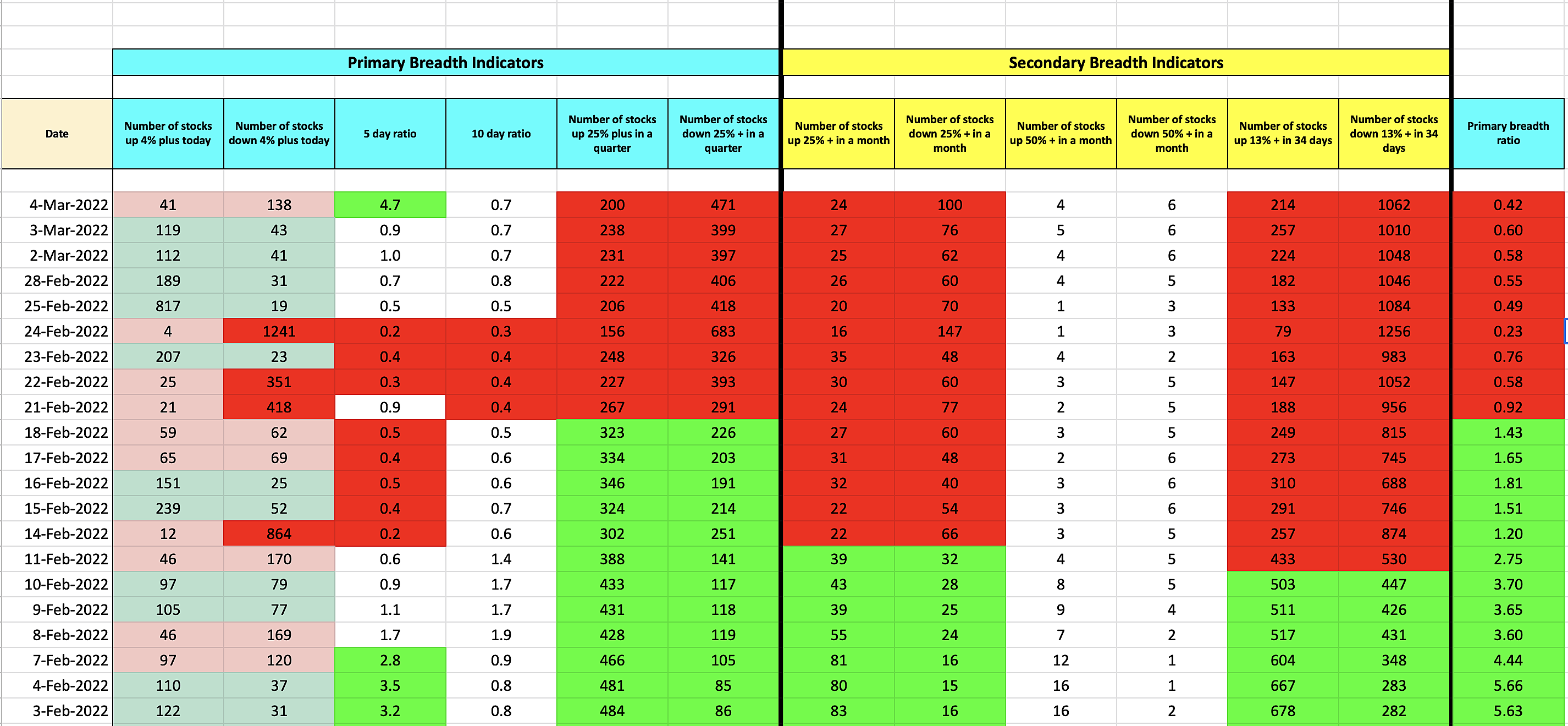

Stockbee Market Monitor

On a modified Stockbee market monitor, number of stocks 25% plus quarter stays less than 25% down quarter for second consecutive week.

Both 13% up in 34 days, & up 25% up in a month have stayed red, which shows bearish phase in the shorter-term as well.

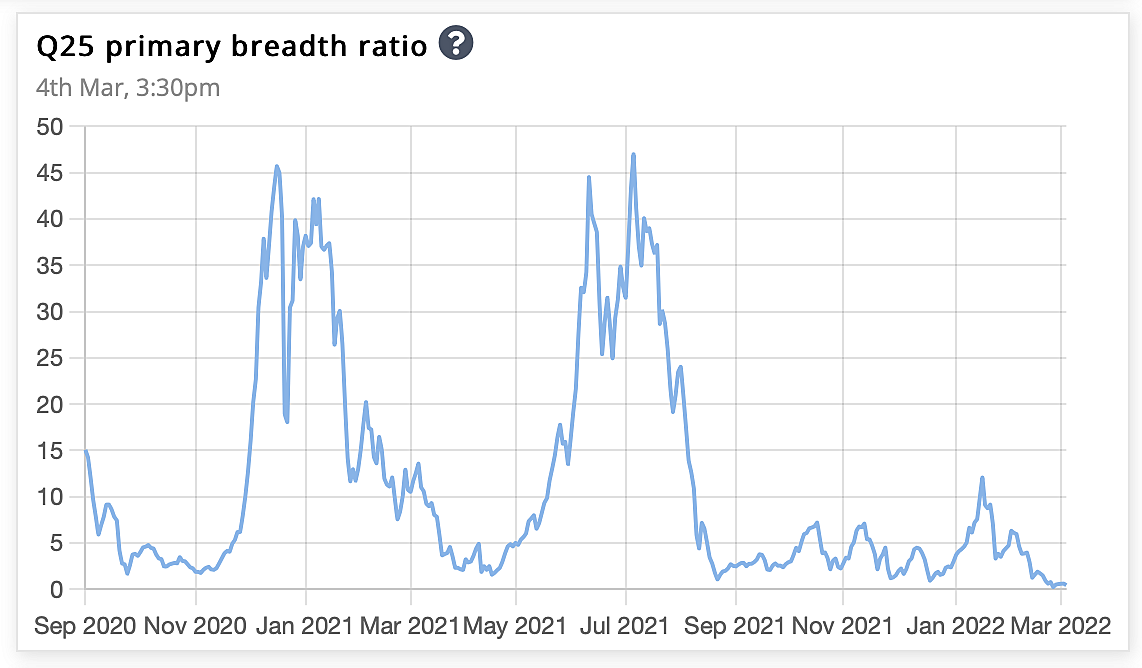

Primary Breadth Ratio

Overall, the market is bearish, as the number of stocks up 25% plus in a quarter is less than that down 25% plus in a quarter.

The ratio between the two is the primary breadth ratio, which is now less than 1.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.