Market Quadrant:

⦿ Trend: Rally Attempt

⦿ Momentum: Negative but improving

⦿ Breadth: Weak & worsening a bit on all timeframes

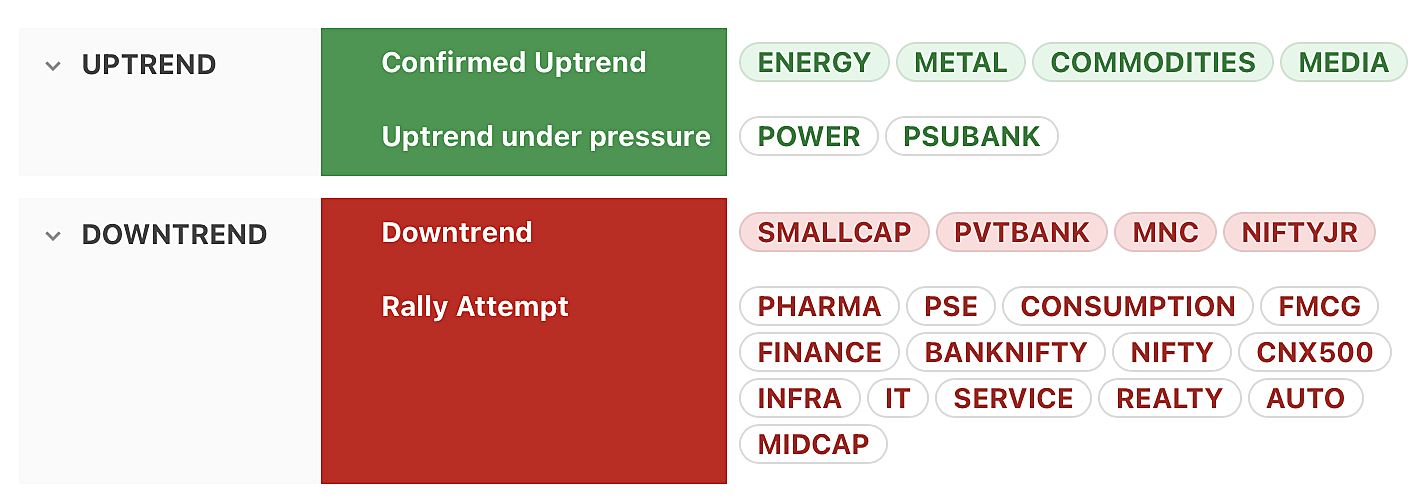

Trend:

⦿ Most major indices (including Nifty, CNX500, Banknifty) are now in rally attempt

⦿ Media, Commodities, Energy & Metal are the only indices with confirmed uptrend status

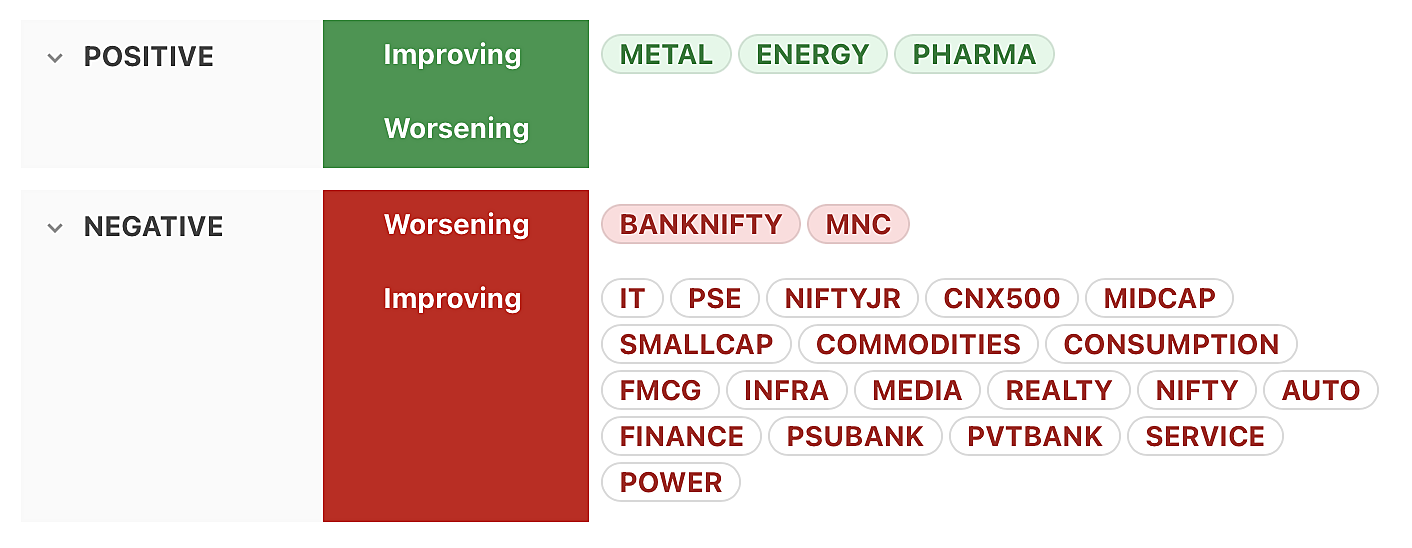

Momentum:

⦿ Metal, Energy & Pharma only indices with positive momentum

⦿ Majority of indices (including Nifty, CNX500, Midcap & Smallcap) have negative but improving momentum

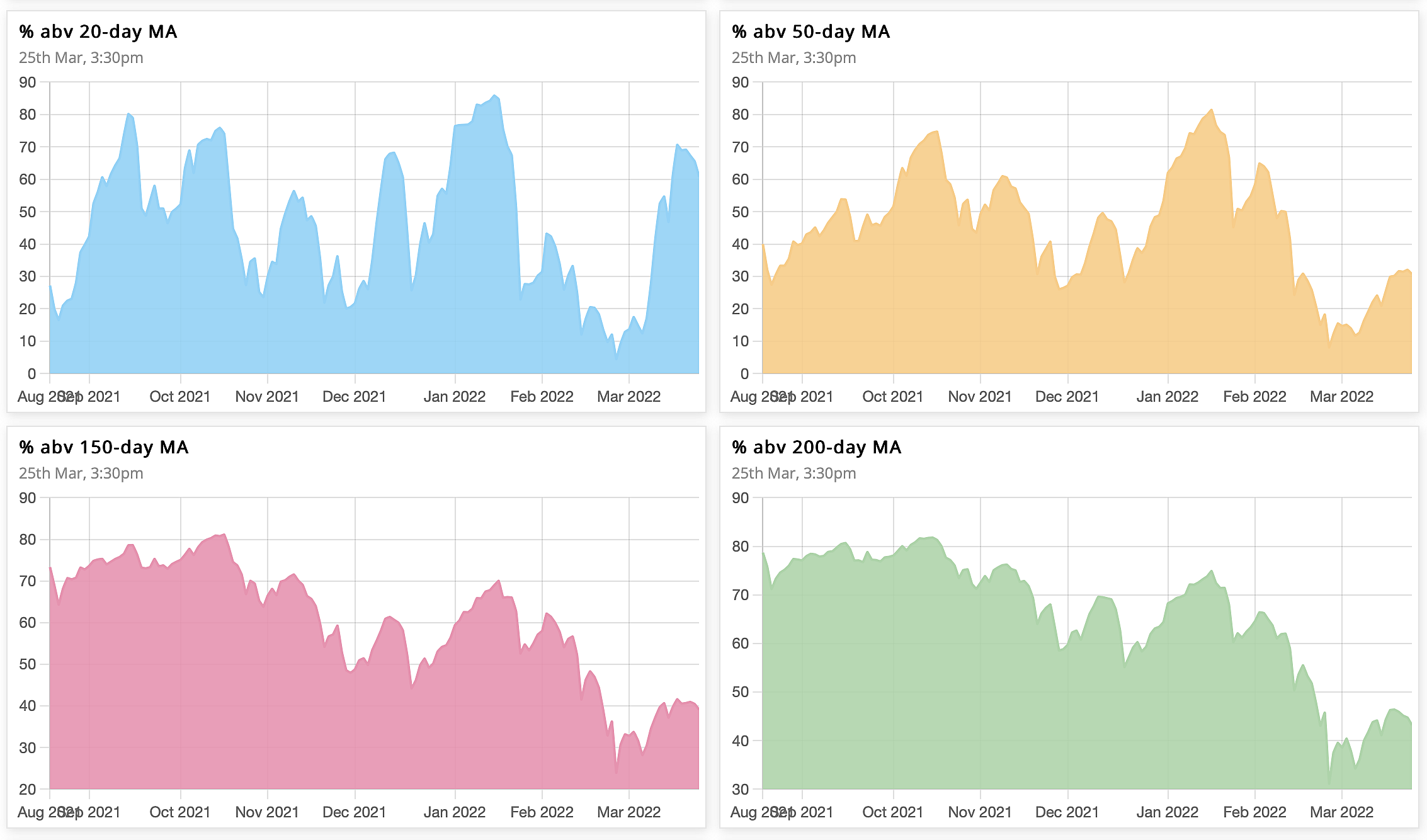

Market Breadth:

Market breadth weakening a bit on all timeframes. Higher timeframes stay bearish.

⦿ 70% → 60% above 20 MA (fresh buy)

⦿ 30% → 30% above 50 MA (neutral)

⦿ 41% → 39% above 150 MA (bearish bias)

⦿ 45% → 43% above 200 MA (bearish bias)

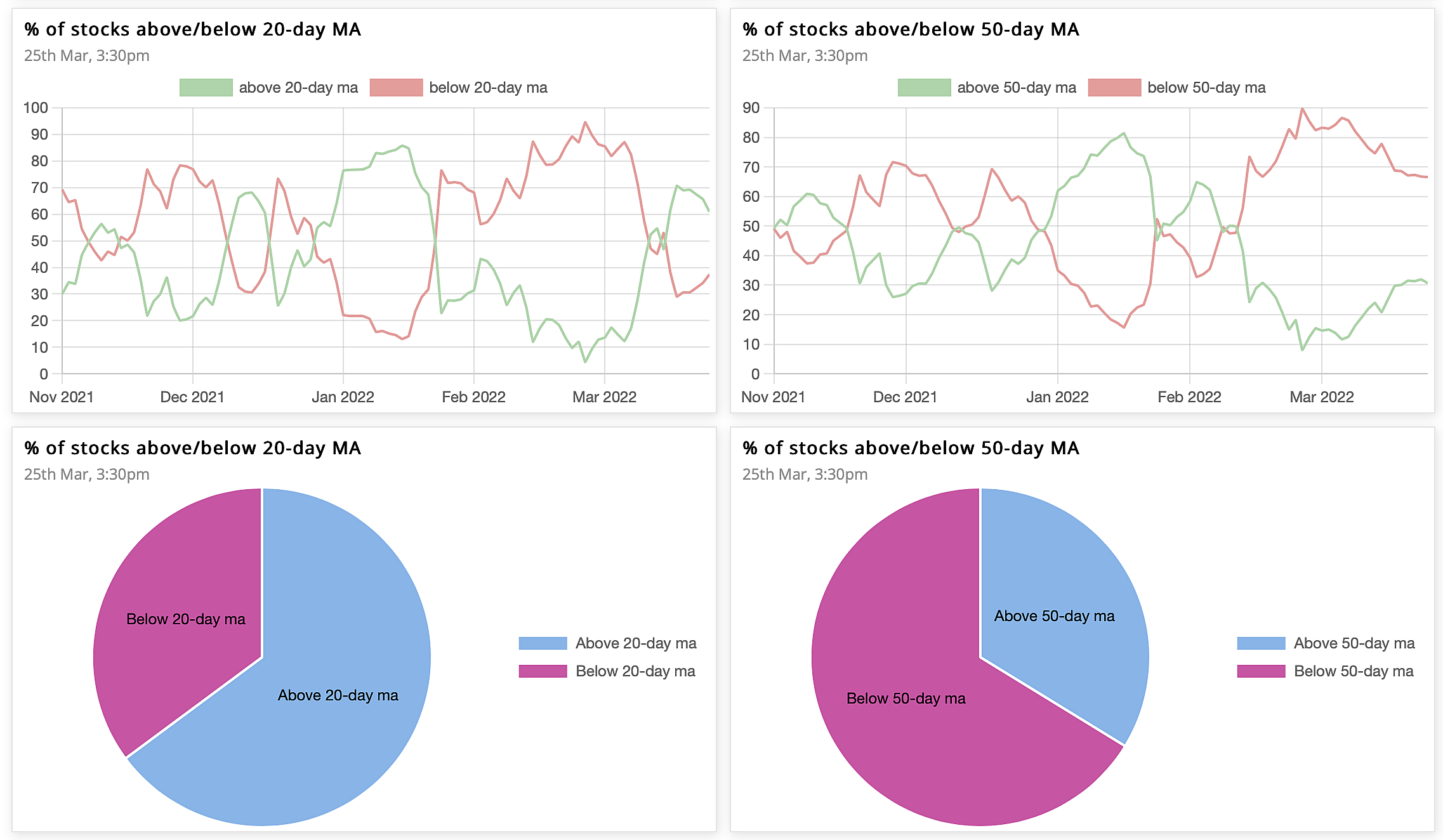

% of stocks above/below 20& 50MA

The Ratio between stocks above & below 50MA is 0.5, while that for 20MA is 1.8.

The 10-day cumulative ratio for stocks above 50MA is 0.3.

A value >2 is good for swing trades on the long side.

The 10-day cumulative ratio for stocks above 50MA is 0.3.

A value >2 is good for swing trades on the long side.

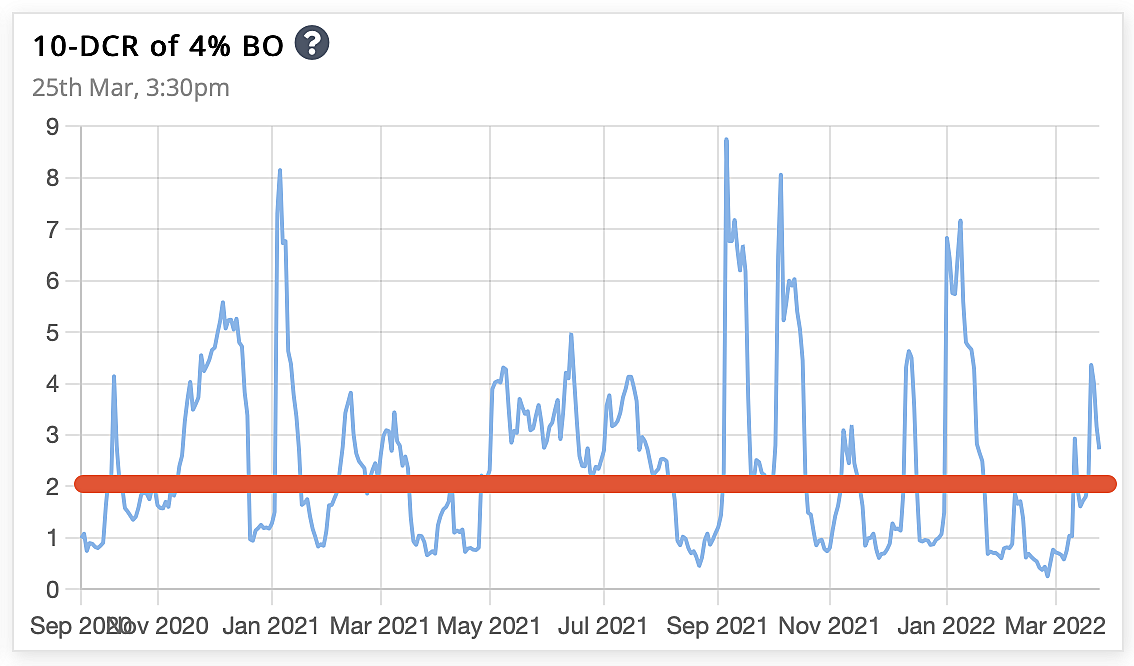

4% up/down in 1 day

The 10-day cumulative ratio between stocks up & down 4% in a day stays in the green (>2), signalling that short-term trading oppurtunites are there.

When market is in a bearish phase, a fresh bull move starts when 10-DCR first time stays above 2.

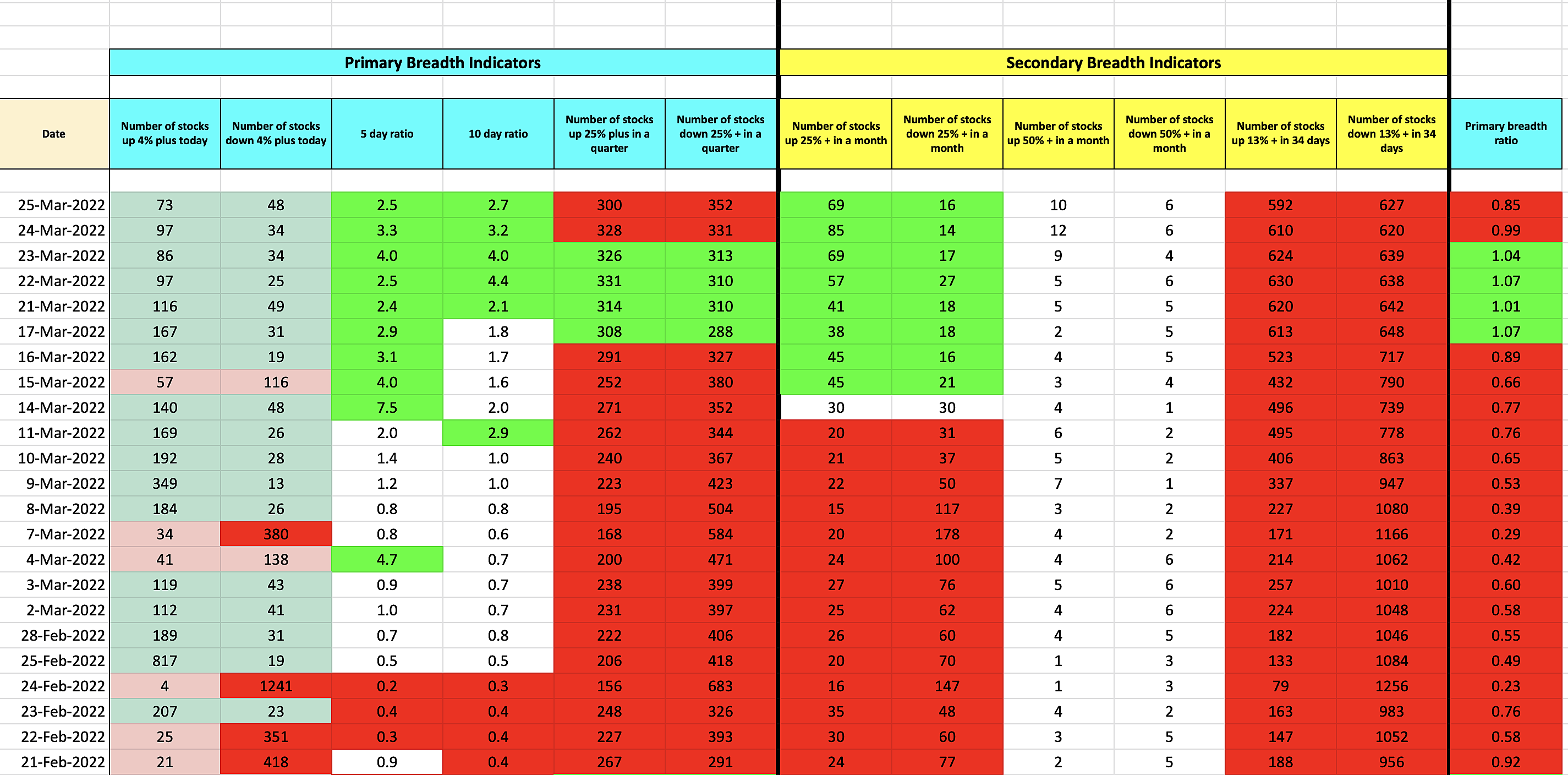

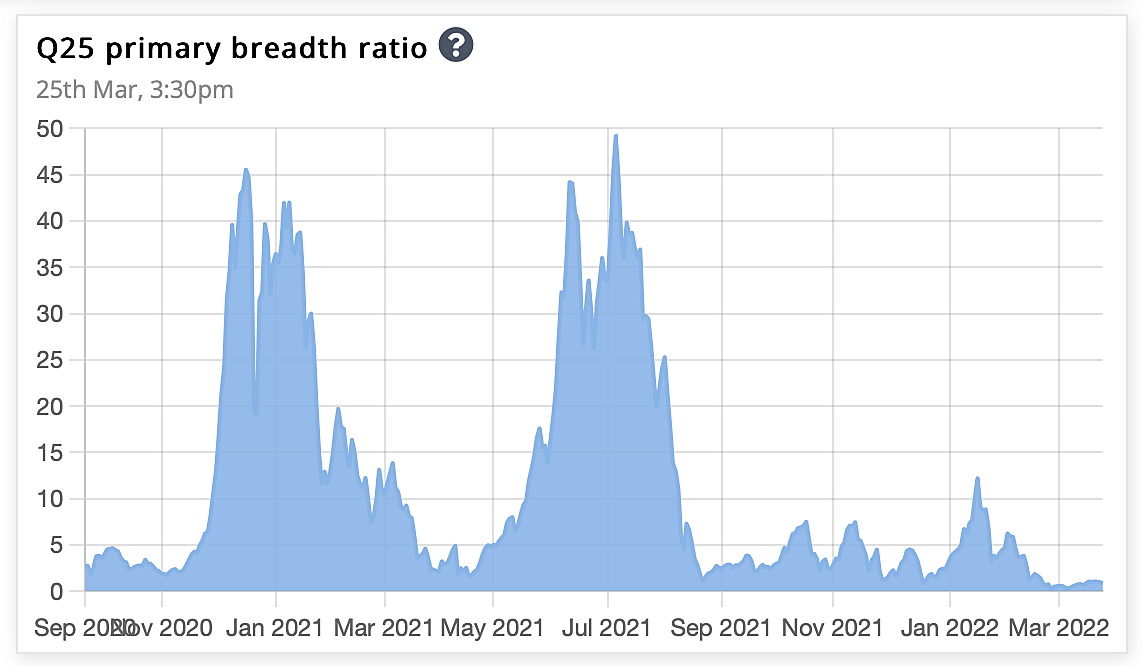

Stockbee Market Monitor

On a modified Stockbee market monitor, the short-term bearish phase (13% up in 34 days) continues for fifth consecutive week. Also, the long-term metric of stocks 25% plus quarter is now back in the red.

Overall, the market is bearish, as the number of stocks up 25% plus in a quarter is now lesser than that down 25% plus in a quarter. The ratio between the two is the primary breadth ratio, which is now less than 1.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.

.png)