Market Quadrant

⦿ Trend: Confirmed Downtrend

⦿ Momentum: Negative but improving

⦿ Breadth: Weak, but improving on lower timeframes

⦿ Bias: Bearish on both long & short timeframes

⦿ Swing Confidence: 100%

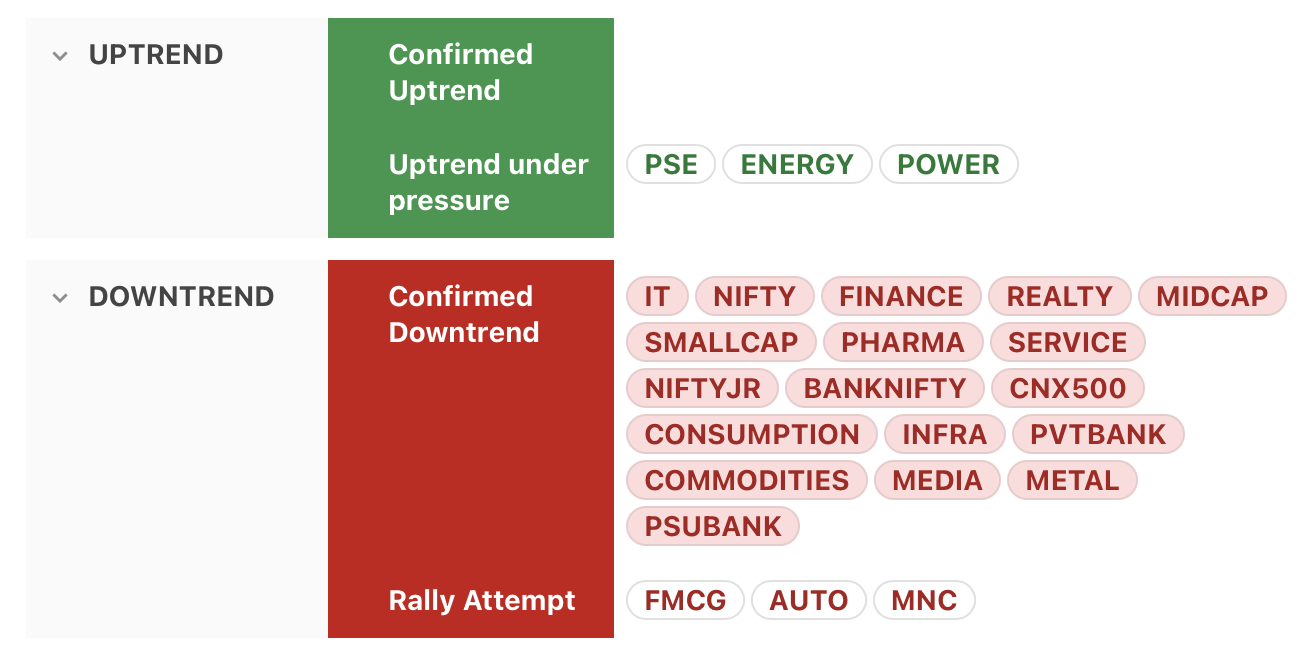

Trend

⦿ MNC index joins Auto & FMCG in undergoing a rally attempt

⦿ Almost all indices are in confirmed downtrend

⦿ PSE, Power & Energy in uptrend under pressure

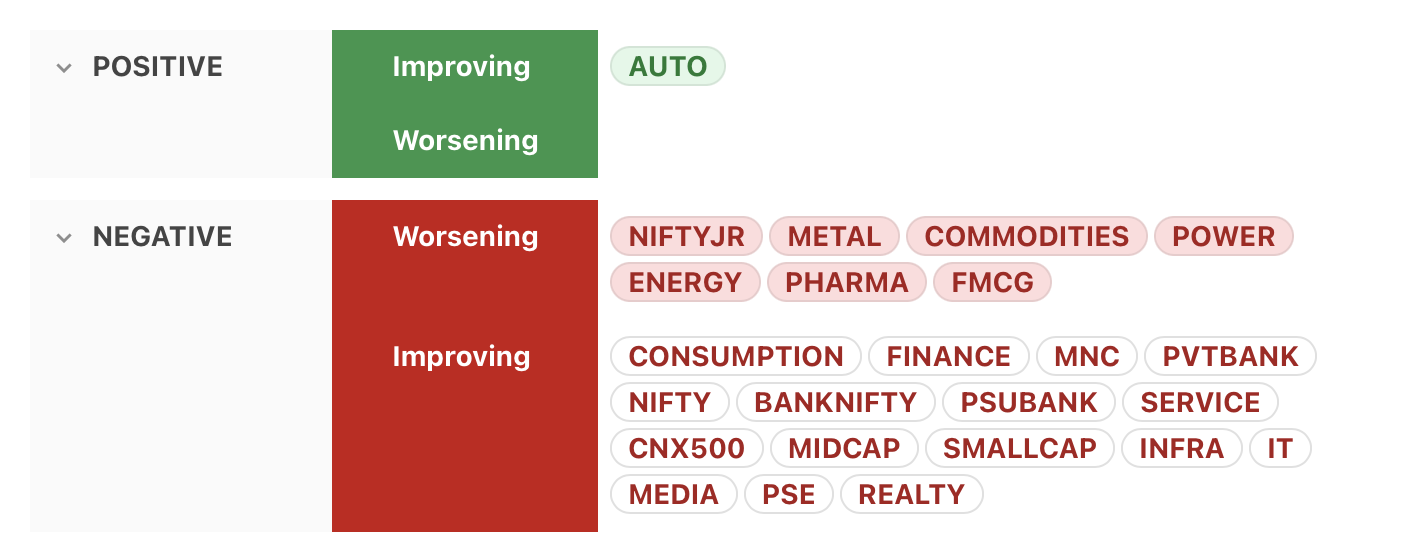

Momentum

⦿ Auto is the only index with positive momentum

⦿ Major indices (Nifty, CNX500, Midcap & Smallcap) now have negative but improving momentum.

⦿ NiftyJR still has negative & worsening momentum

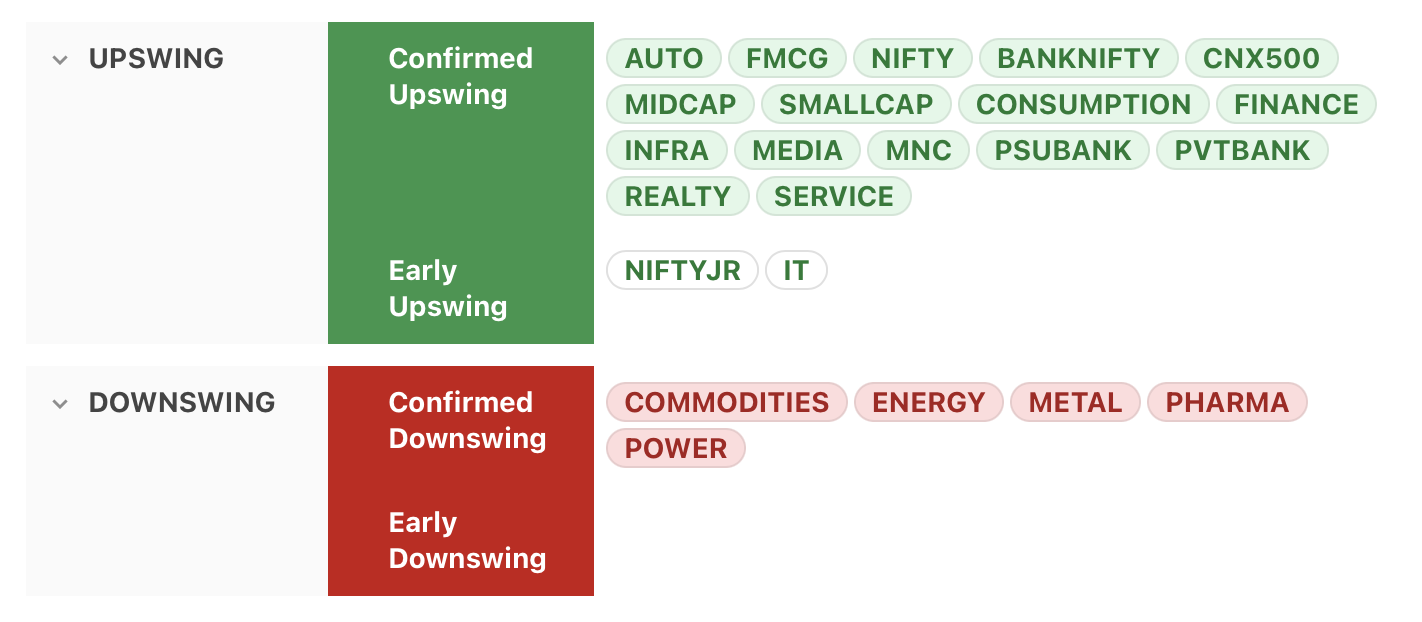

Swing

⦿ Both Nifty & Smallcap indices are in confirmed upswing, so SwingConfidence is 100%.

⦿ NiftyJR is lagging behind, & is in early upswing

⦿ Commodities, Energy, Metals & Power are still in confirmed downswing

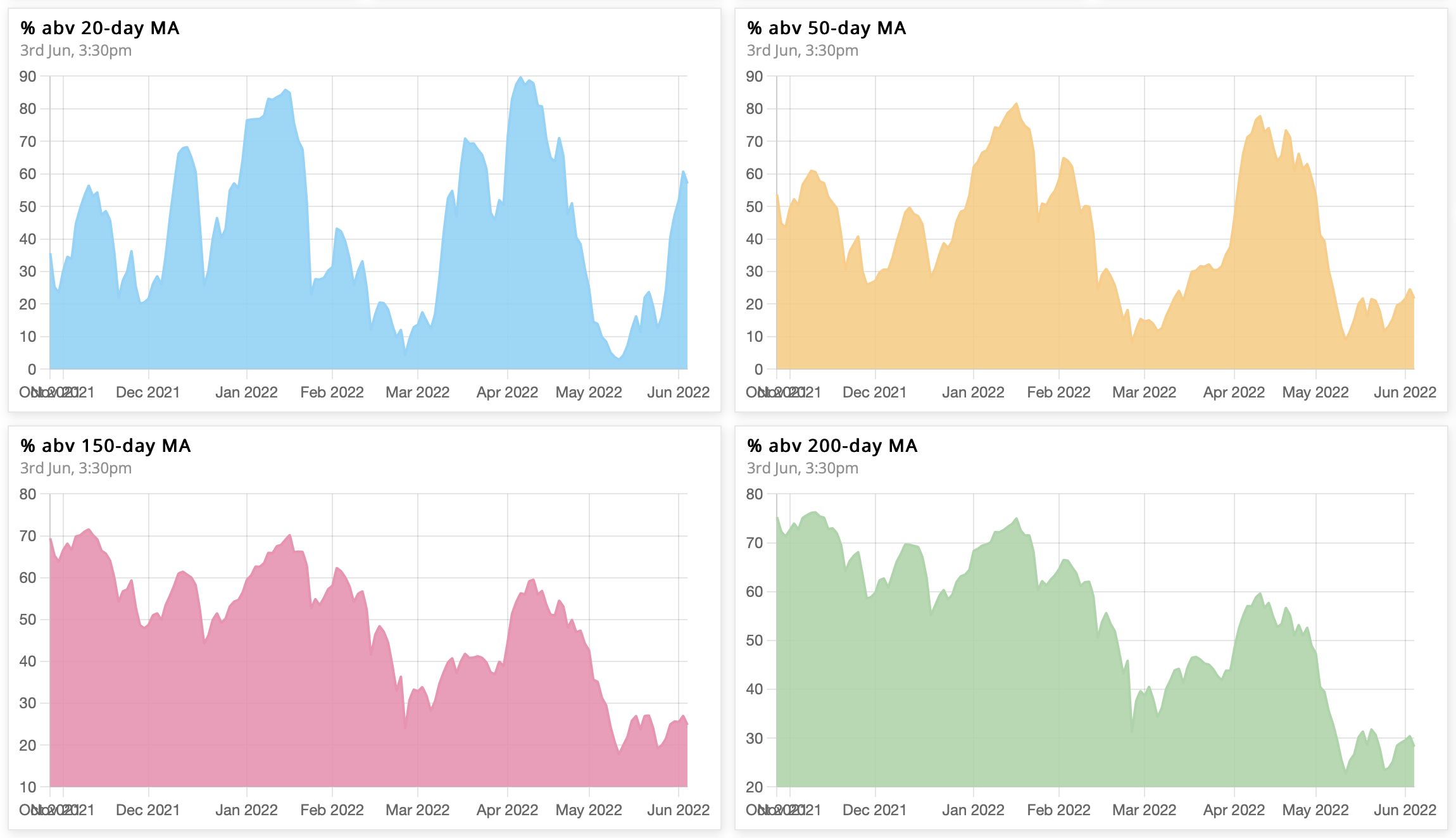

Breadth

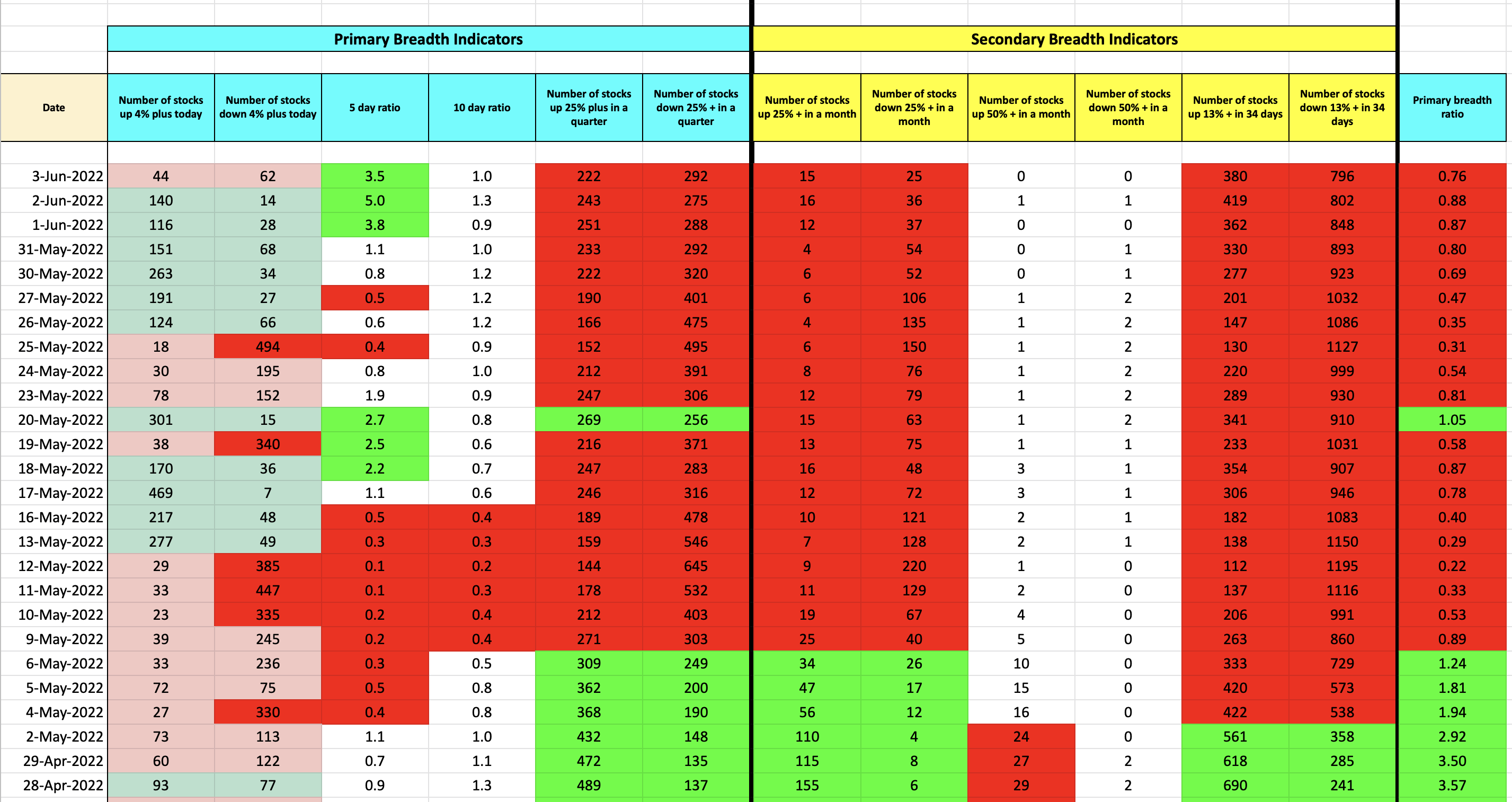

Market breadth slightly improving from last week's levels. Higher timeframes still have bearish bias, while lower timeframes are giving fresh buy signal.

⦿ 24% → 57% above 20MA (fresh buy)

⦿ 15% → 21% above 50MA (near oversold)

⦿ 21% → 24% above 150MA (bearish)

⦿ 24% → 30% above 200MA (bearish)

Bias

On a modified Stockbee market monitor, the short-term indicator of 13% up in 34 days stays negative for past 4 weeks, & the intermediate 25% plus in a month is negative for past 3 weeks, & the long-term metric of stocks 25% plus quarter is now negative for past 2 weeks.

Finally...

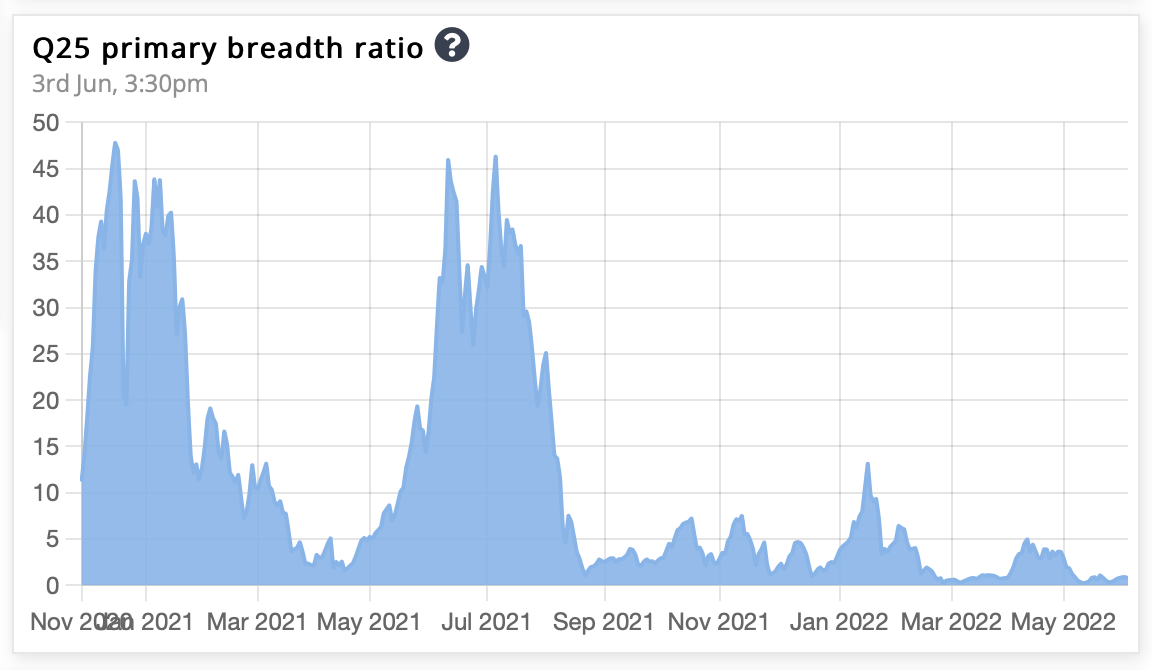

Overall, the market is bearish for past 2 weeks, as the number of stocks up 25% plus in a quarter is now lesser than that down 25% plus in a quarter. The ratio between the two is the primary breadth ratio, which is now 0.76.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.

.png)