Market Quadrant

⦿ Trend: Confirmed Downtrend

⦿ Momentum: Negative but not worsening

⦿ Breadth: Weak & worsening

⦿ Bias: Bearish on both long & short timeframes

⦿ Swing Confidence: 0% (no fresh trades)

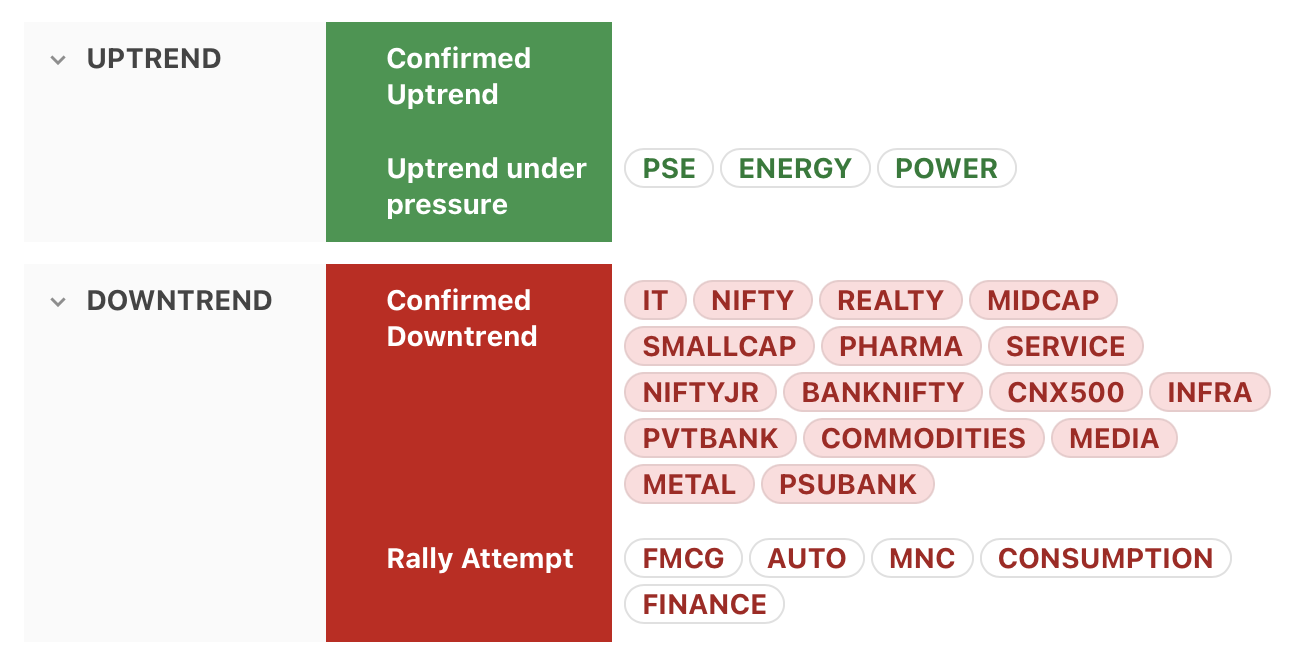

Trend

⦿ Pretty much unchanged from last week

⦿ All major indices are in confirmed downtrend

⦿ PSE, Power & Energy in uptrend under pressure

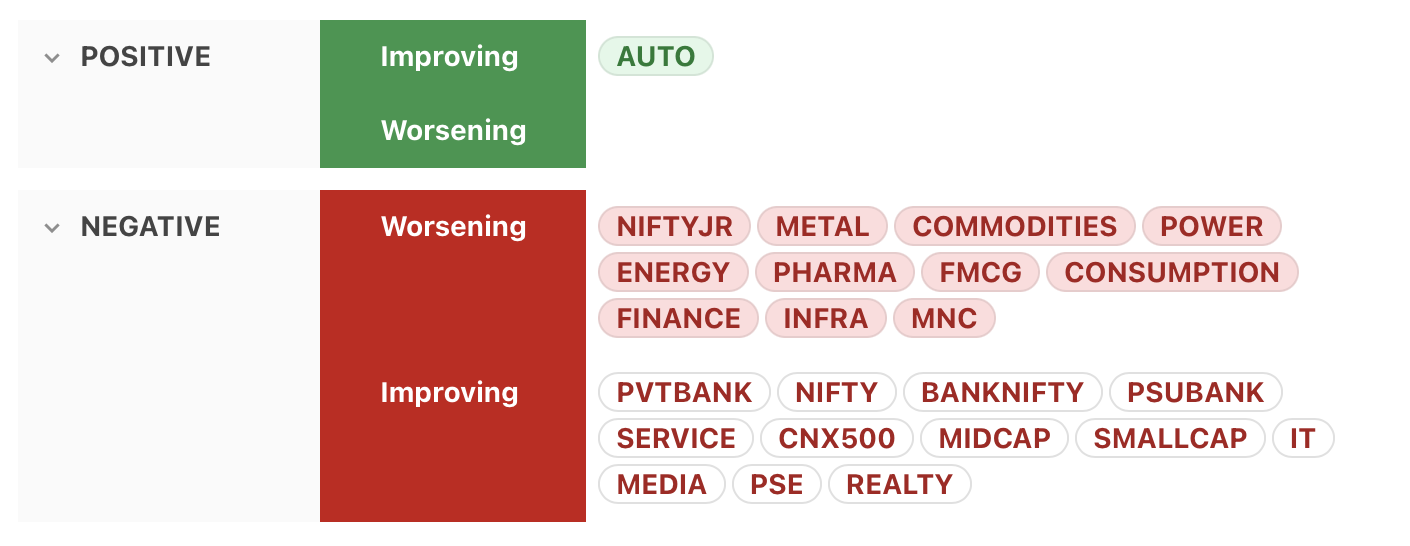

Momentum

⦿ Auto is the only index with positive momentum

⦿ Major indices (Nifty, CNX500, Midcap & Smallcap) still have negative but improving momentum.

⦿ Some more indices join the list of negative & worsening momentum

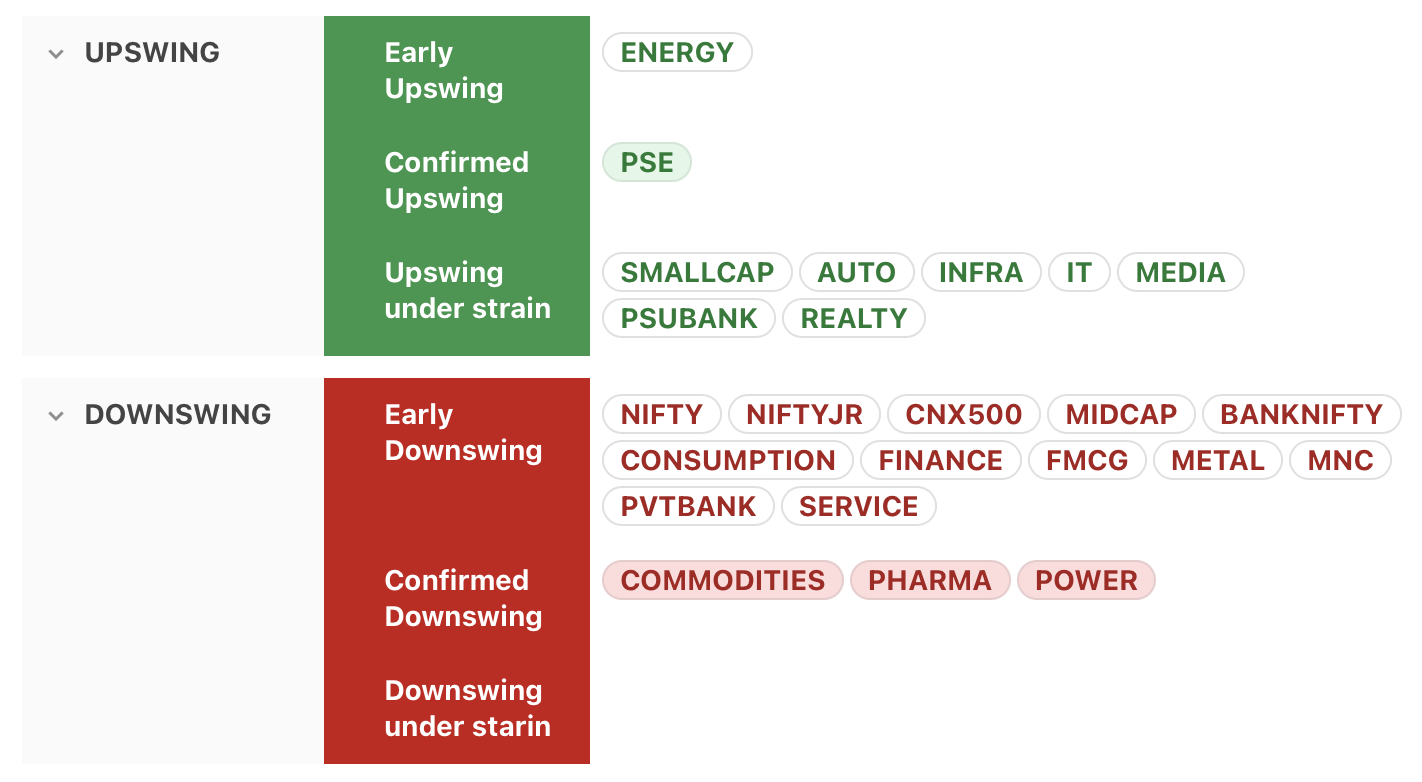

Swing

⦿ Nifty is now in Early downswing

⦿ Smallcap is in Upswing under strain

⦿ Swing Confidence now is 0. No fresh trades. Existing positions to be tightly monitored.

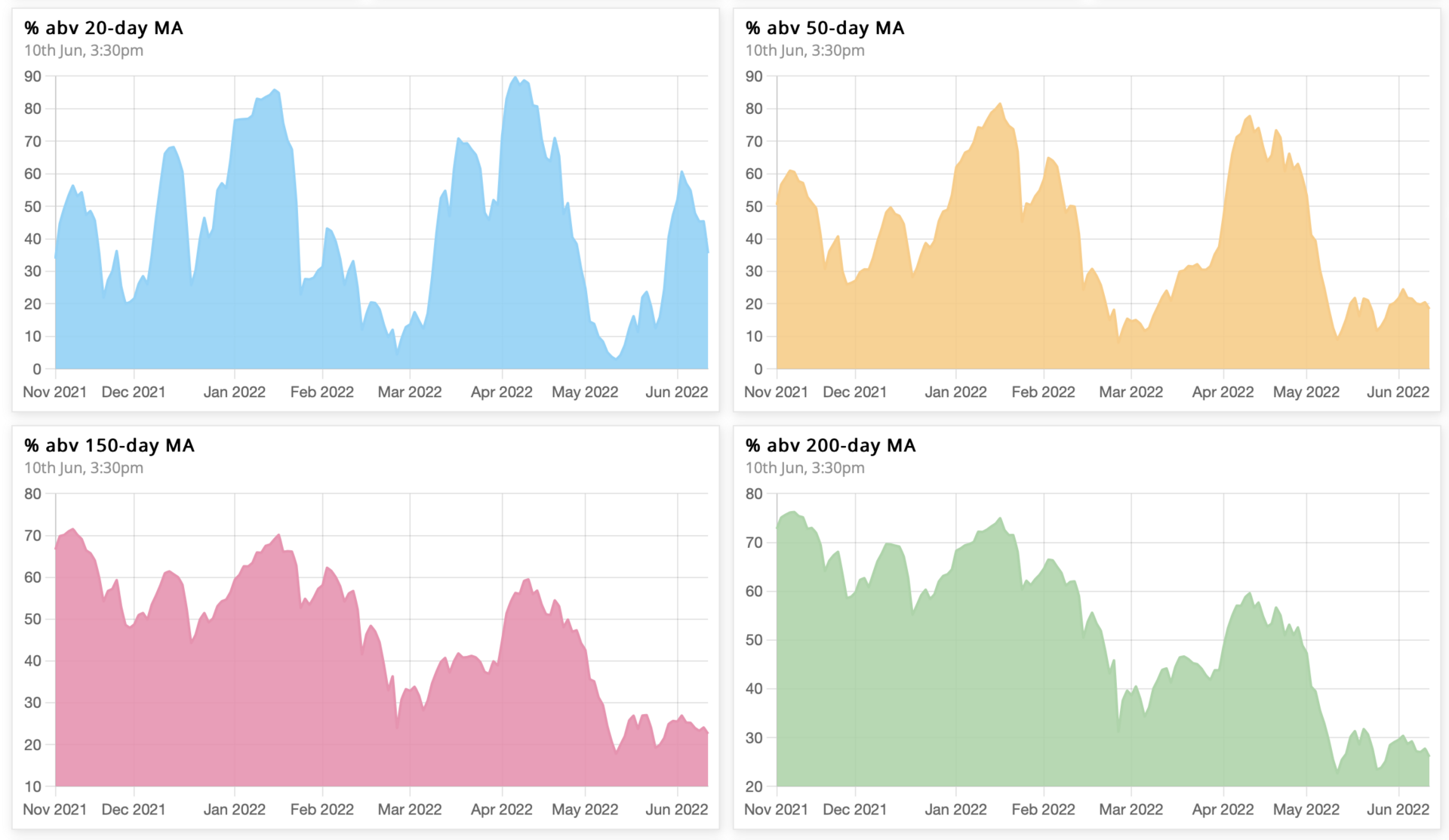

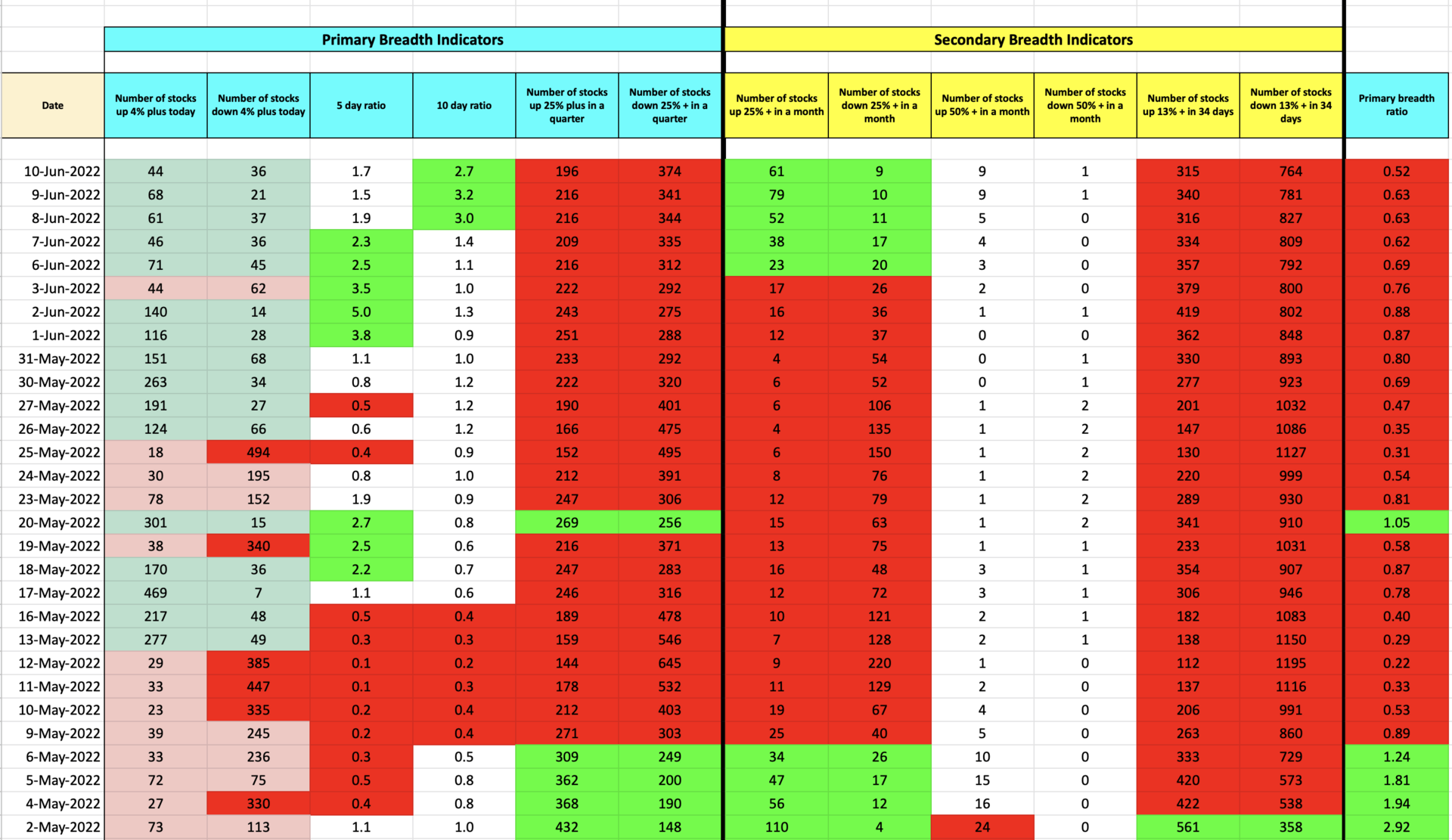

Market Breadth

Market breadth slightly worsening from last week's levels. Higher timeframes still have bearish bias, while lower timeframes are yet to give a fresh buy signal.

⦿ 57% → 35% above 20MA (no fresh buy)

⦿ 21% → 18% above 50MA (near oversold)

⦿ 24% → 22% above 150MA (bearish)

⦿ 30% → 26% above 200MA (bearish)

Bias

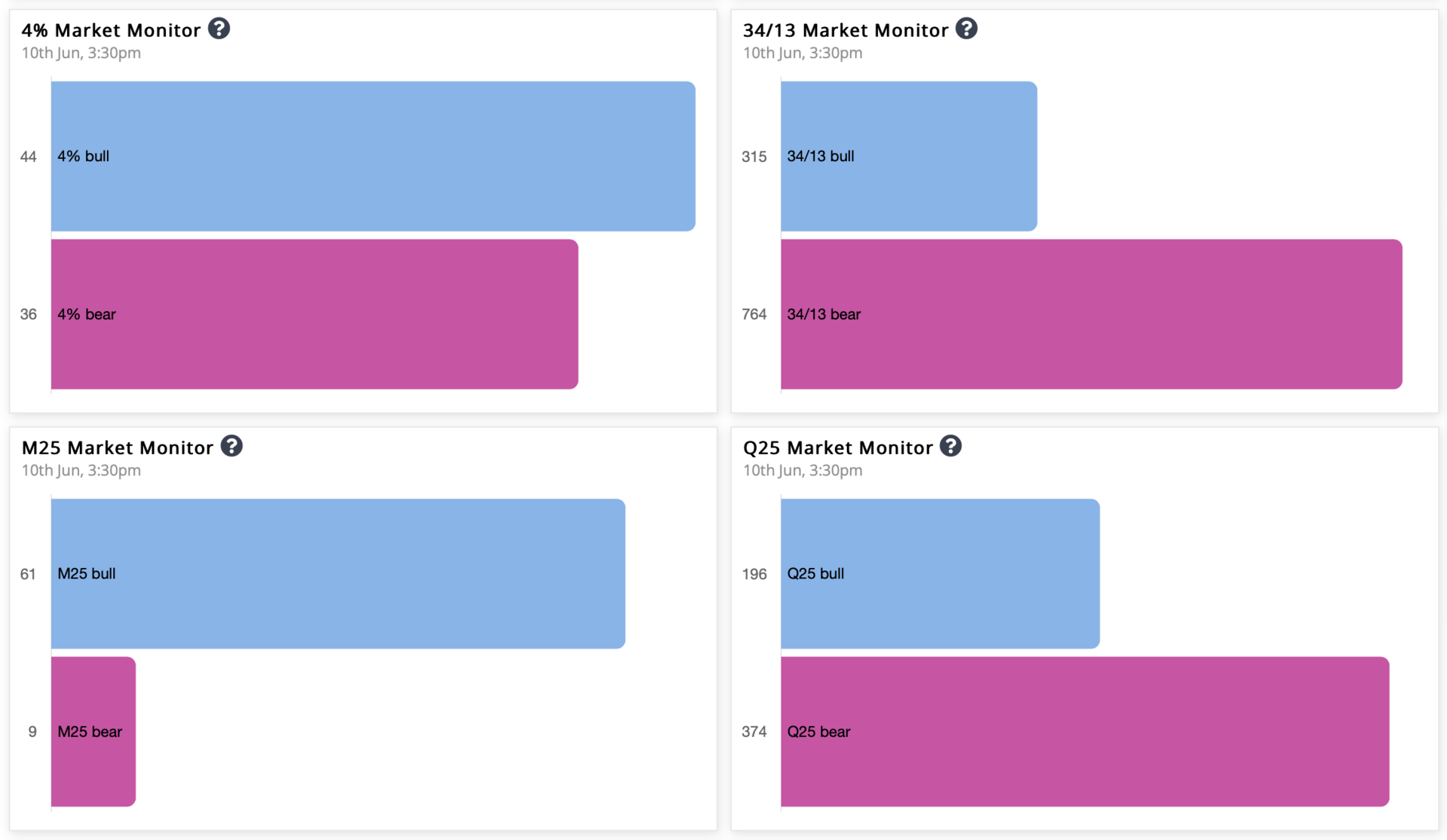

On a modified Stockbee market monitor, the short-term indicator of 13% up in 34 days stays negative for past 5 weeks, & the long-term metric of stocks 25% plus quarter is now negative for past 3 weeks. The intermediate 25% plus in a month is now positive after past 3 weeks.

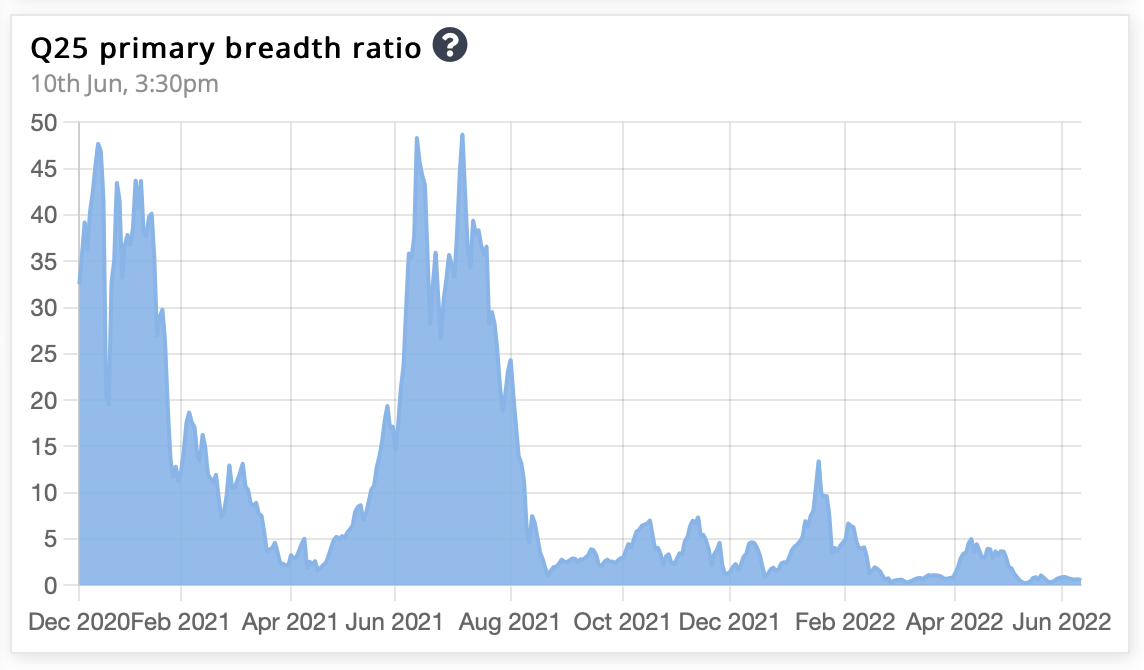

Primary Breadth Ratio

Overall, the market is bearish for past 3 weeks, as the number of stocks up 25% plus in a quarter stays lesser than that down 25% plus in a quarter. The ratio between the two is the primary breadth ratio, which is now 0.52.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.

.png)