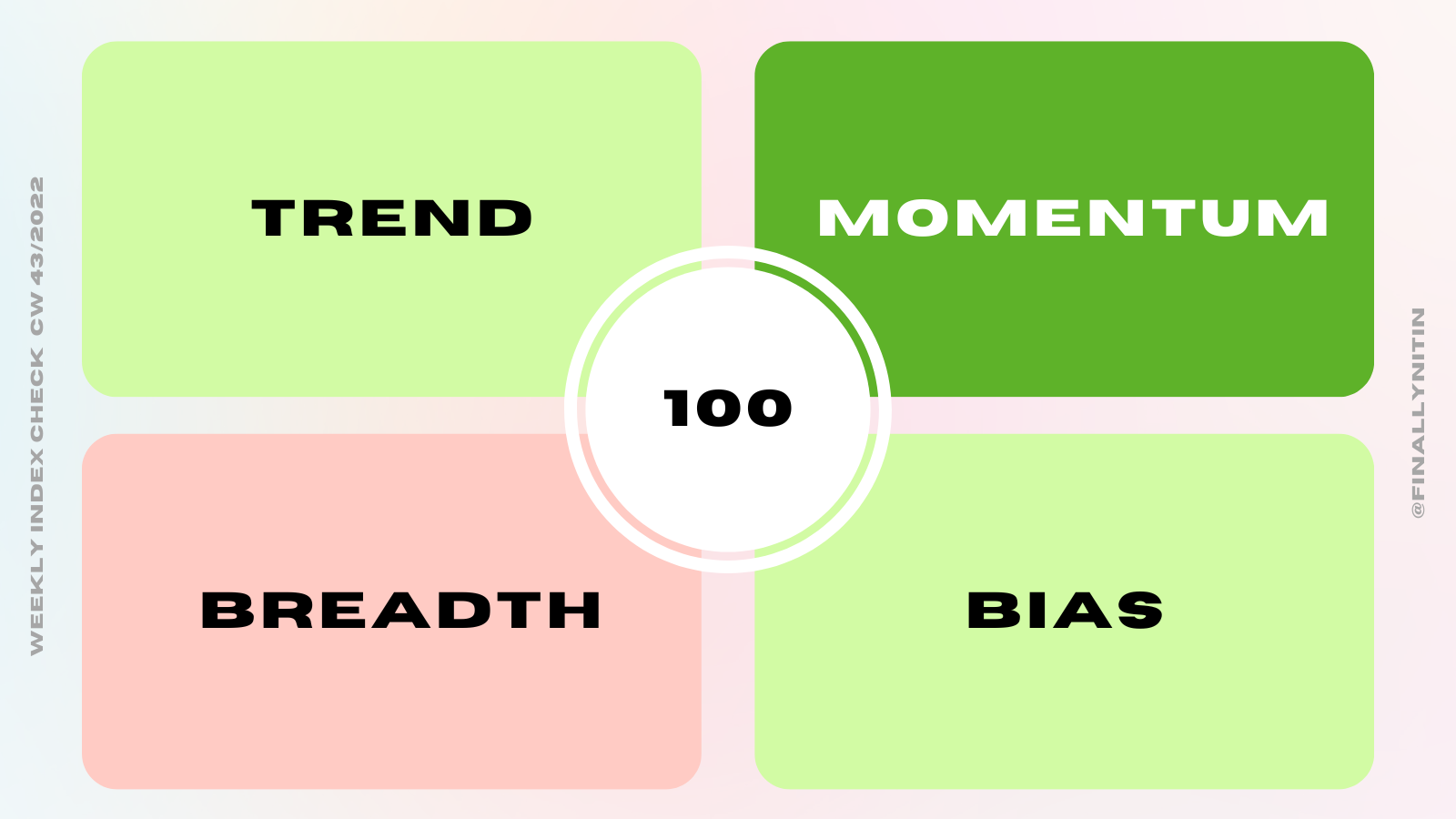

Market Quadrant

⦿ Trend: Uptrend under pressure

⦿ Momentum: Positive & improving

⦿ Breadth: Bearish but improving

⦿ Bias: Bullish

⦿ Swing Confidence: 100

⦿ Momentum: Positive & improving

⦿ Breadth: Bearish but improving

⦿ Bias: Bullish

⦿ Swing Confidence: 100

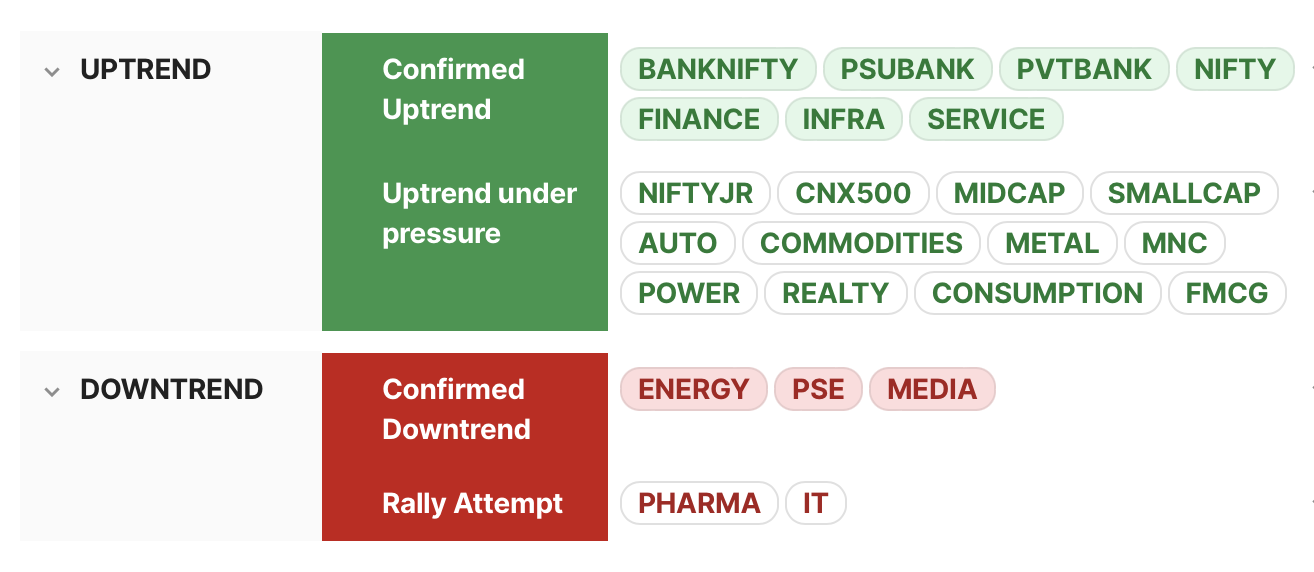

Trend

⦿ Most indices are still in an uptrend under pressure, but gradually moving towards a confirmed uptrend.

⦿ Both Nifty & Banknifty are now in a confirmed uptrend.

⦿ Media, Energy & PSE are in a confirmed downtrend.

⦿ IT & Pharma are in a rally attempt.

⦿ Both Nifty & Banknifty are now in a confirmed uptrend.

⦿ Media, Energy & PSE are in a confirmed downtrend.

⦿ IT & Pharma are in a rally attempt.

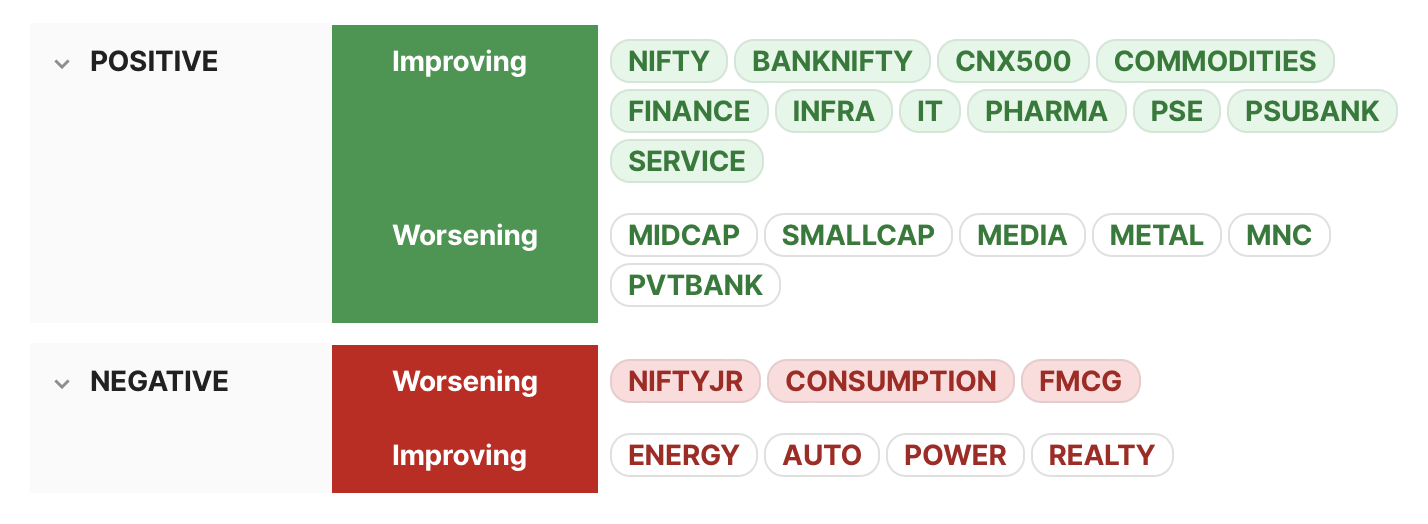

Momentum

⦿ Nifty, Banknifty & CNX500 have positive & improving momentum

⦿ Midcap & Smallcap still have positive but worsening momentum

⦿ NiftyJR & FMCG have negative & worsening momentum.

⦿ Long-term momentum will still take time to turn positive.

⦿ Midcap & Smallcap still have positive but worsening momentum

⦿ NiftyJR & FMCG have negative & worsening momentum.

⦿ Long-term momentum will still take time to turn positive.

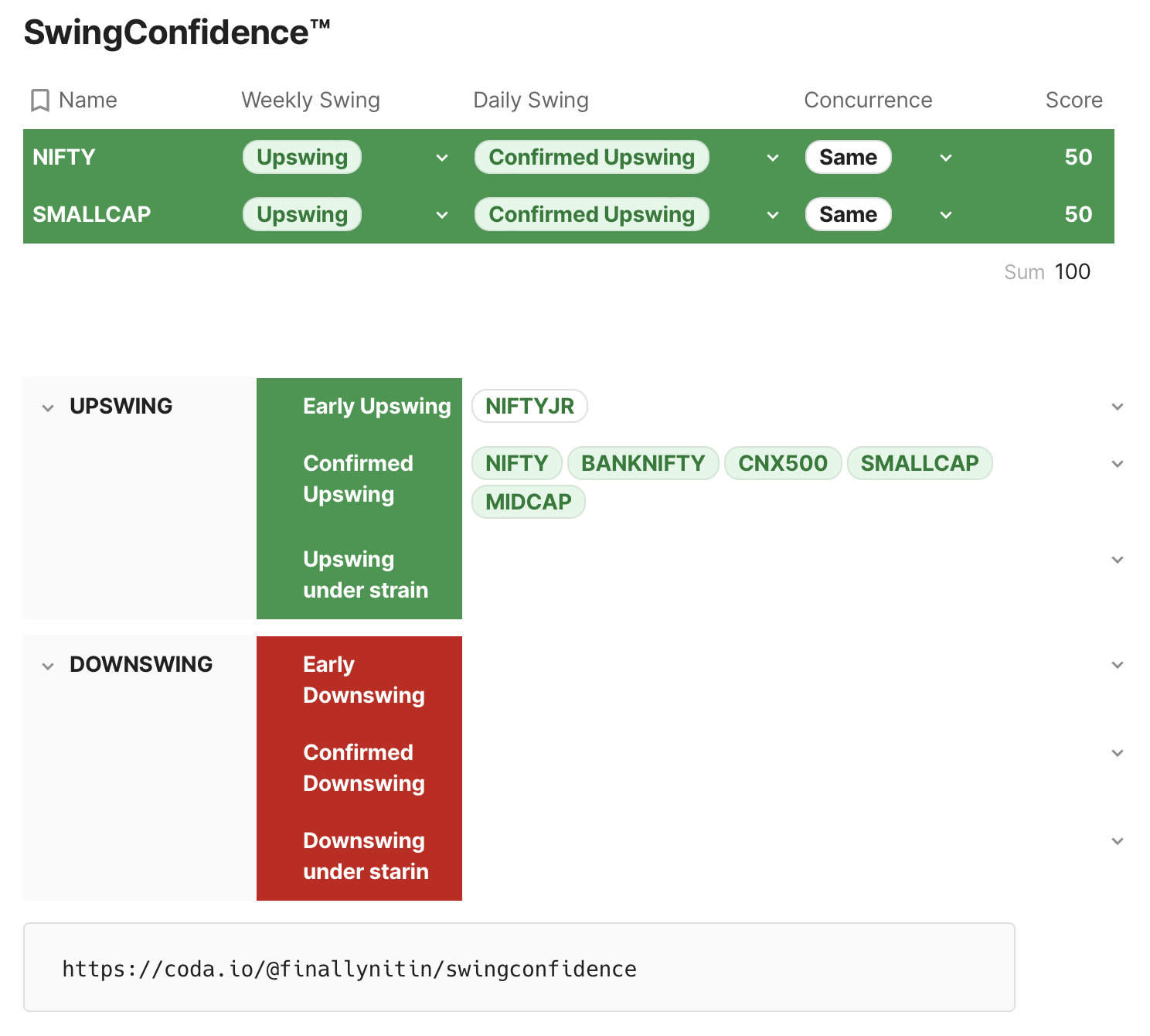

Swing

⦿ Both Nifty & Smallcap index stay in Confirmed Upswing. Both indices are in a weekly upswing.

⦿ Swing Confidence stays at 100. Long-only swing traders would be all-in now.

⦿ Most indices are also in a confirmed upswing.

⦿ Swing Confidence stays at 100. Long-only swing traders would be all-in now.

⦿ Most indices are also in a confirmed upswing.

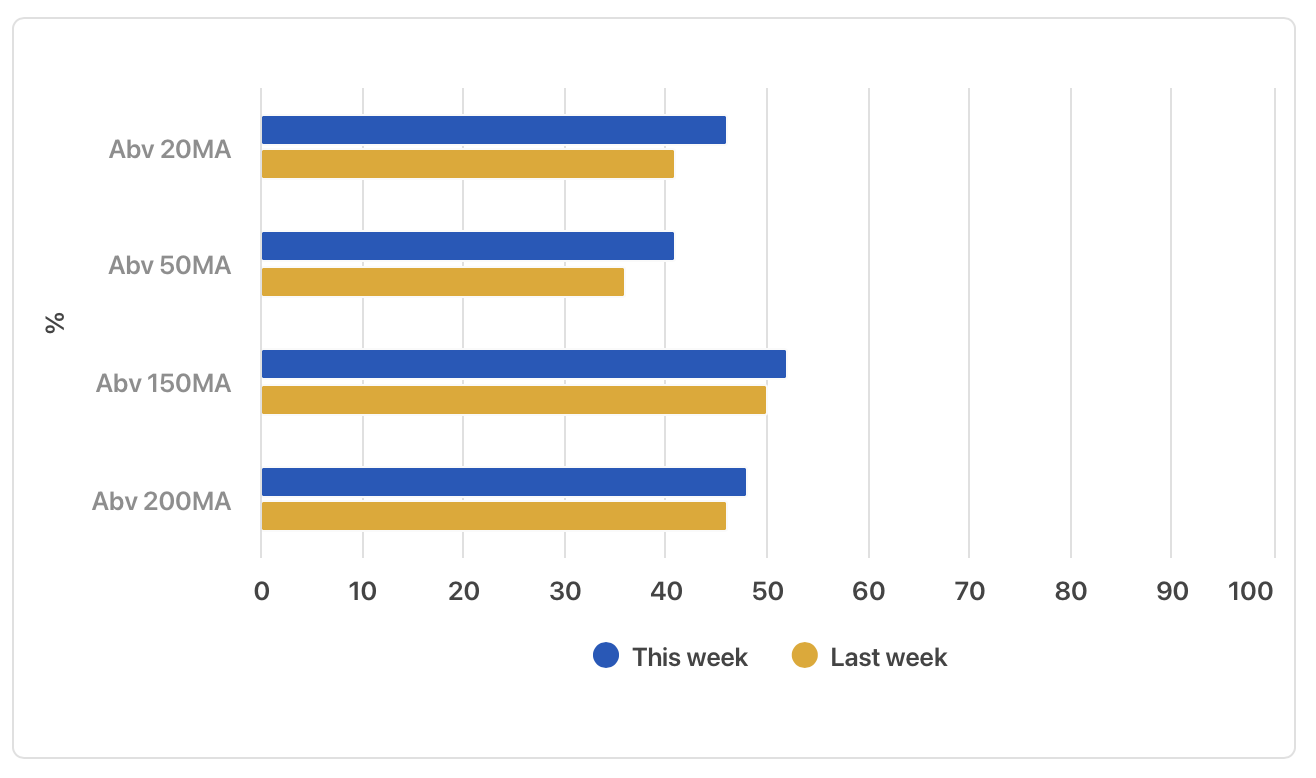

Breadth

⦿ Market breadth somewhat improving.

⦿ Intermediate timeframes still await fresh buy signal.

⦿ Higher timeframes partially bullish.

⦿ Intermediate timeframes still await fresh buy signal.

⦿ Higher timeframes partially bullish.

Bias

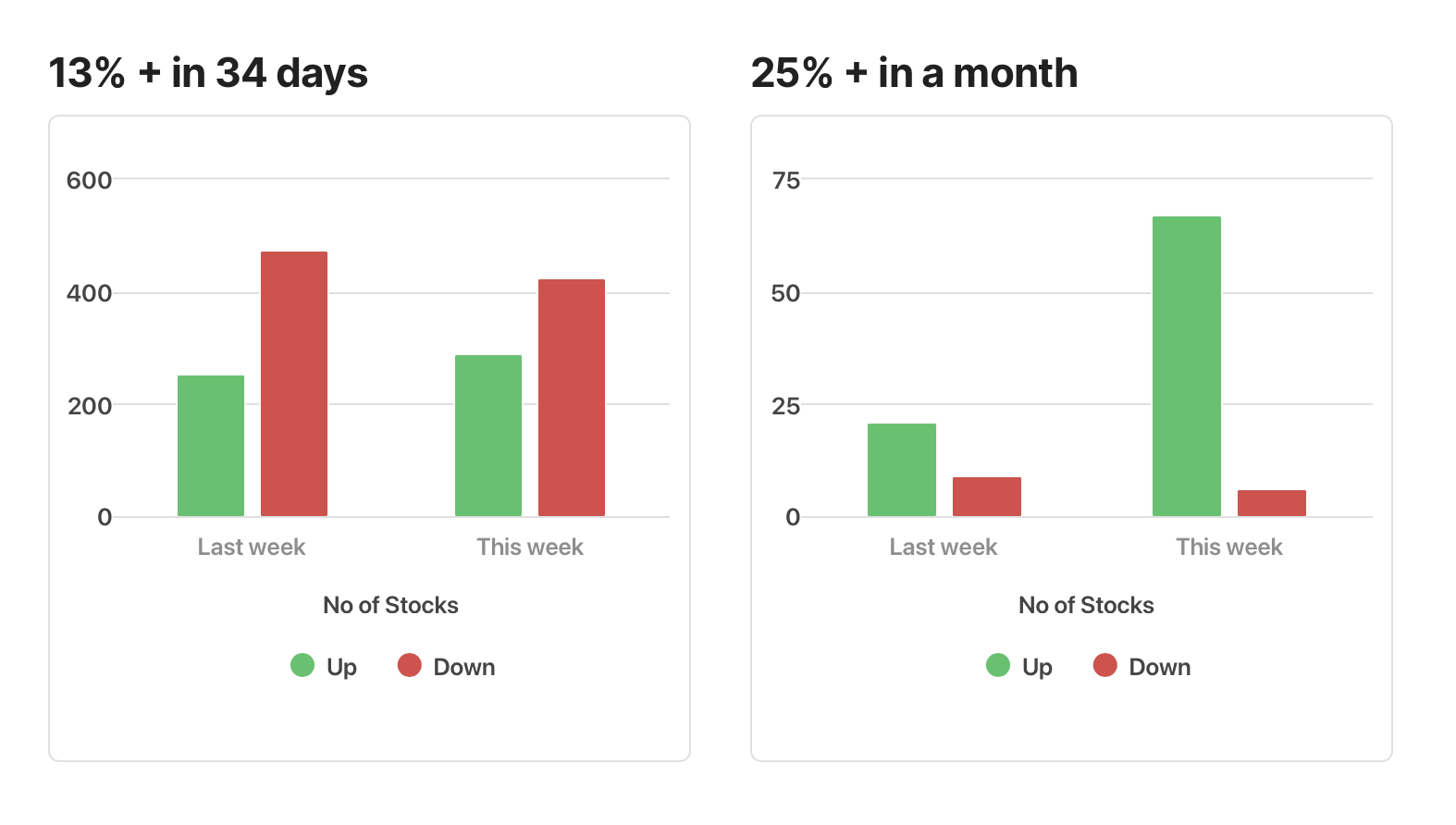

⦿ On a modified Stockbee market monitor, the short-term indicator of 13% up in 34 days is negative for 3rd consecutive week.

⦿ The intermediate 25% plus in a month stays positive for 16th consecutive week.

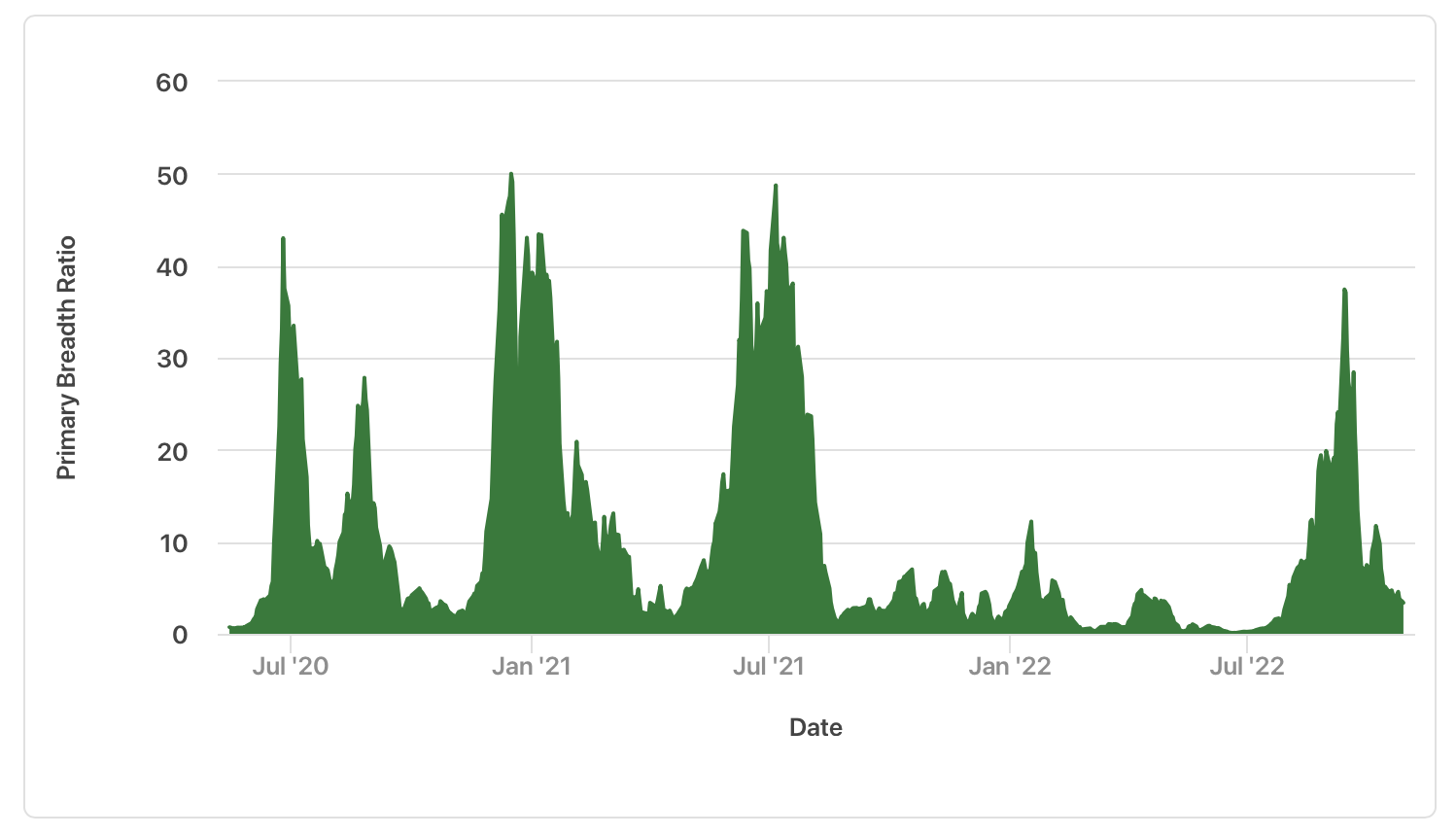

Overall, the market is bullish for 15th consecutive week, as the number of stocks up 25% plus in a quarter stays greater than that down 25% plus in a quarter. The ratio between the two is the primary breadth ratio, which is now 3.4.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.