Market Quadrant

⦿ Trend: Confirmed Uptrend

⦿ Momentum: Positive & improving

⦿ Breadth: Improving

⦿ Bias: Bullish

⦿ Swing Confidence: 100

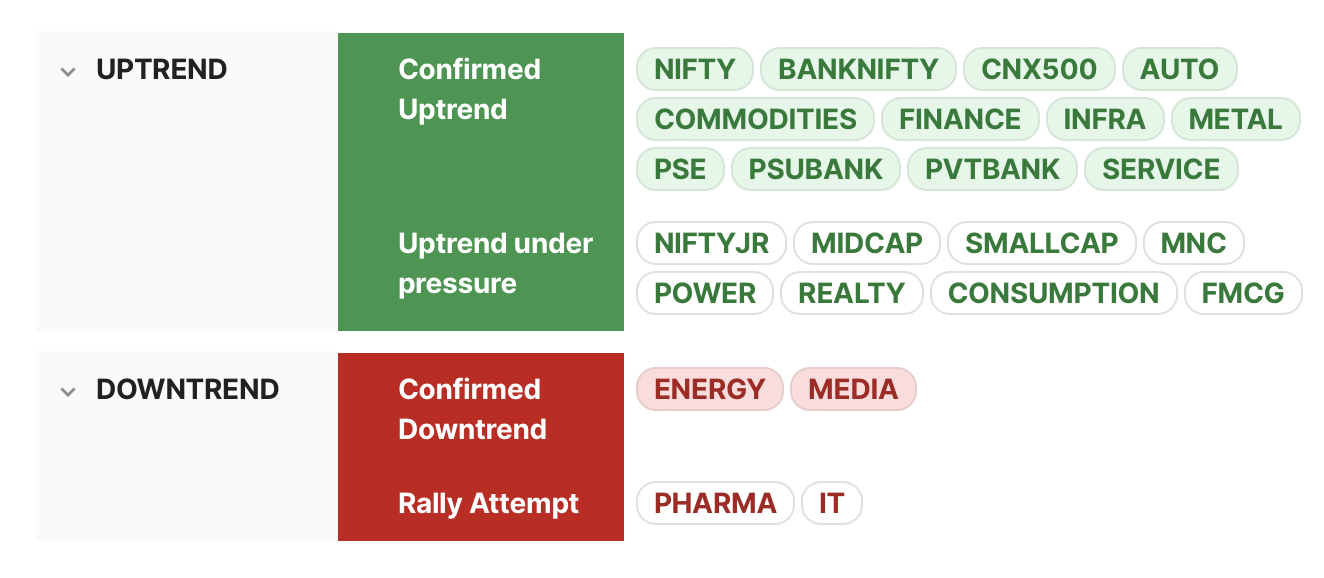

Trend

⦿ Most indices are now in a confirmed uptrend.

⦿ CNX500, Auto & Metal indices enter a confirmed uptrend.

⦿ Media & Energy are in a confirmed downtrend.

⦿ IT & Pharma are in a rally attempt.

⦿ CNX500, Auto & Metal indices enter a confirmed uptrend.

⦿ Media & Energy are in a confirmed downtrend.

⦿ IT & Pharma are in a rally attempt.

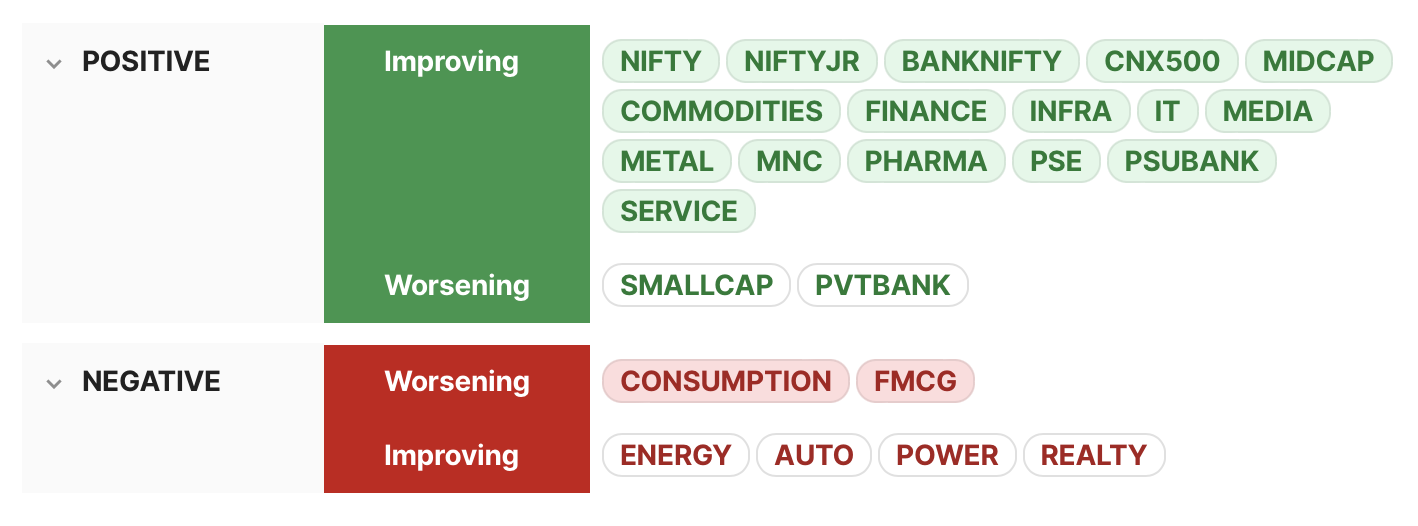

Momentum

⦿ Most major indices (including Nifty, Midcap, Banknifty & CNX500) have positive & improving momentum

⦿ Smallcap & PvtBank still have positive but worsening momentum.

⦿ Consumption & FMCG have negative & worsening momentum.

⦿ Long-term momentum will still take time to turn positive.

⦿ Smallcap & PvtBank still have positive but worsening momentum.

⦿ Consumption & FMCG have negative & worsening momentum.

⦿ Long-term momentum will still take time to turn positive.

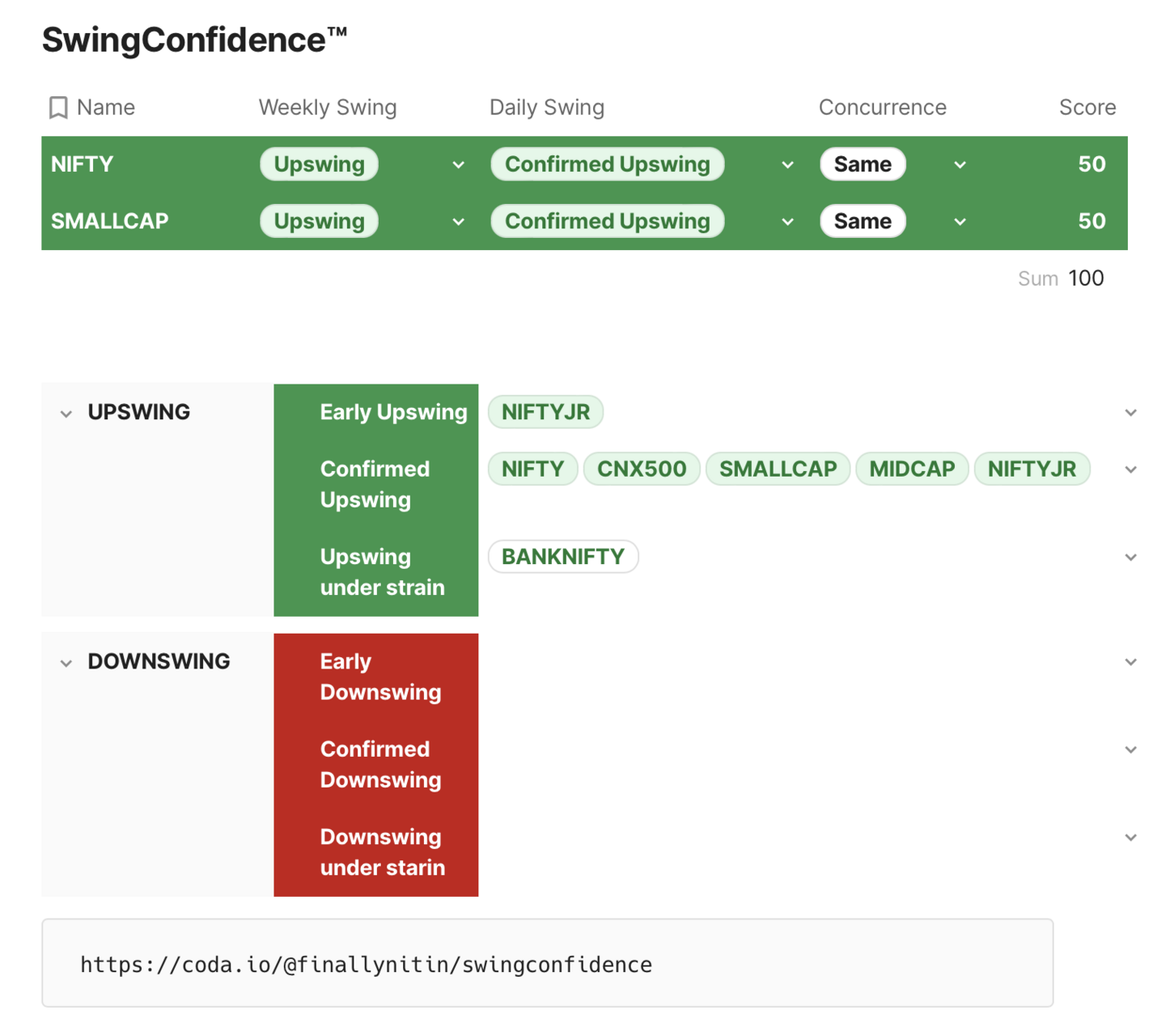

Swing

⦿ Both Nifty & Smallcap index stay in Confirmed Upswing. Both indices are in a weekly upswing.

⦿ SwingConfidence stays at 100. Long-only swing traders would be all-in now.

⦿ Most indices are also in a confirmed upswing.

⦿ SwingConfidence stays at 100. Long-only swing traders would be all-in now.

⦿ Most indices are also in a confirmed upswing.

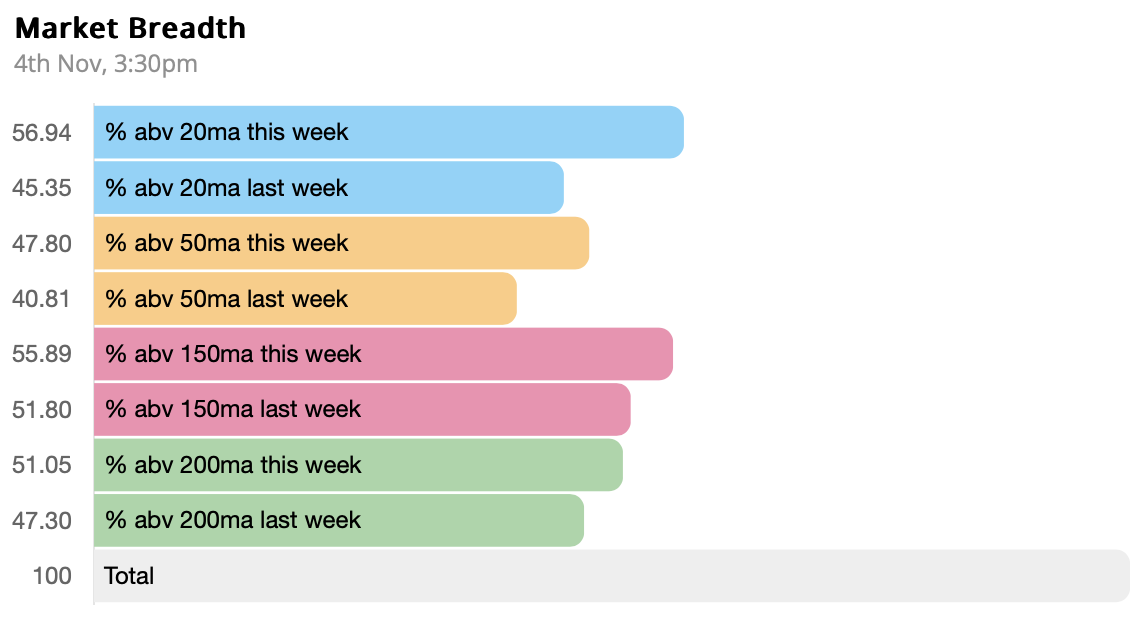

Breadth

⦿ Market breadth improving on all timeframes.

⦿ Intermediate timeframes very close to a fresh buy signal.

⦿ Higher timeframes are now bullish.

⦿ Intermediate timeframes very close to a fresh buy signal.

⦿ Higher timeframes are now bullish.

Bias

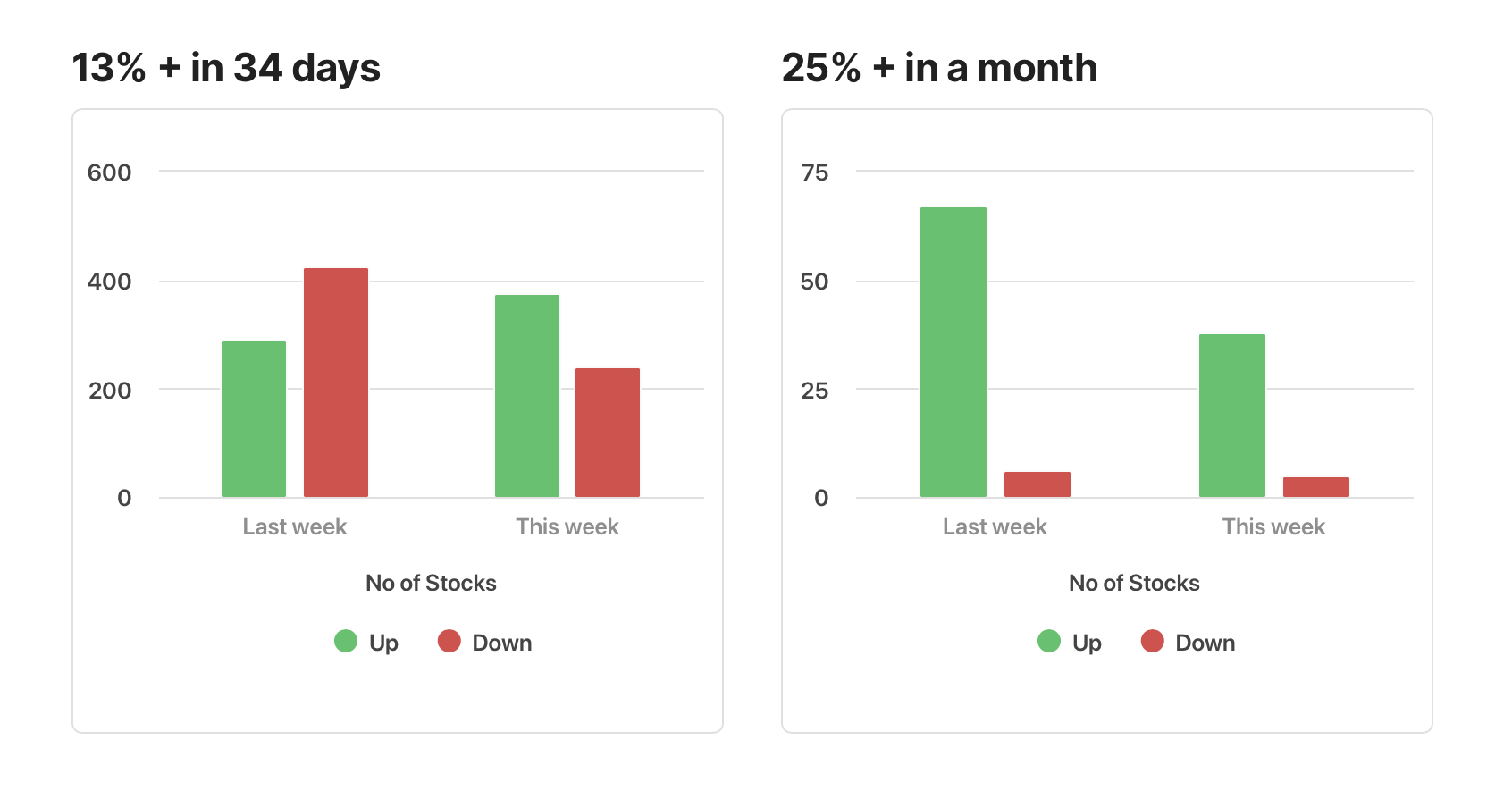

⦿ On a modified Stockbee market monitor, the short-term indicator of 13% up in 34 days now turns positive after 3 red weeks.

⦿ The intermediate 25% plus in a month stays positive for 17th consecutive week.

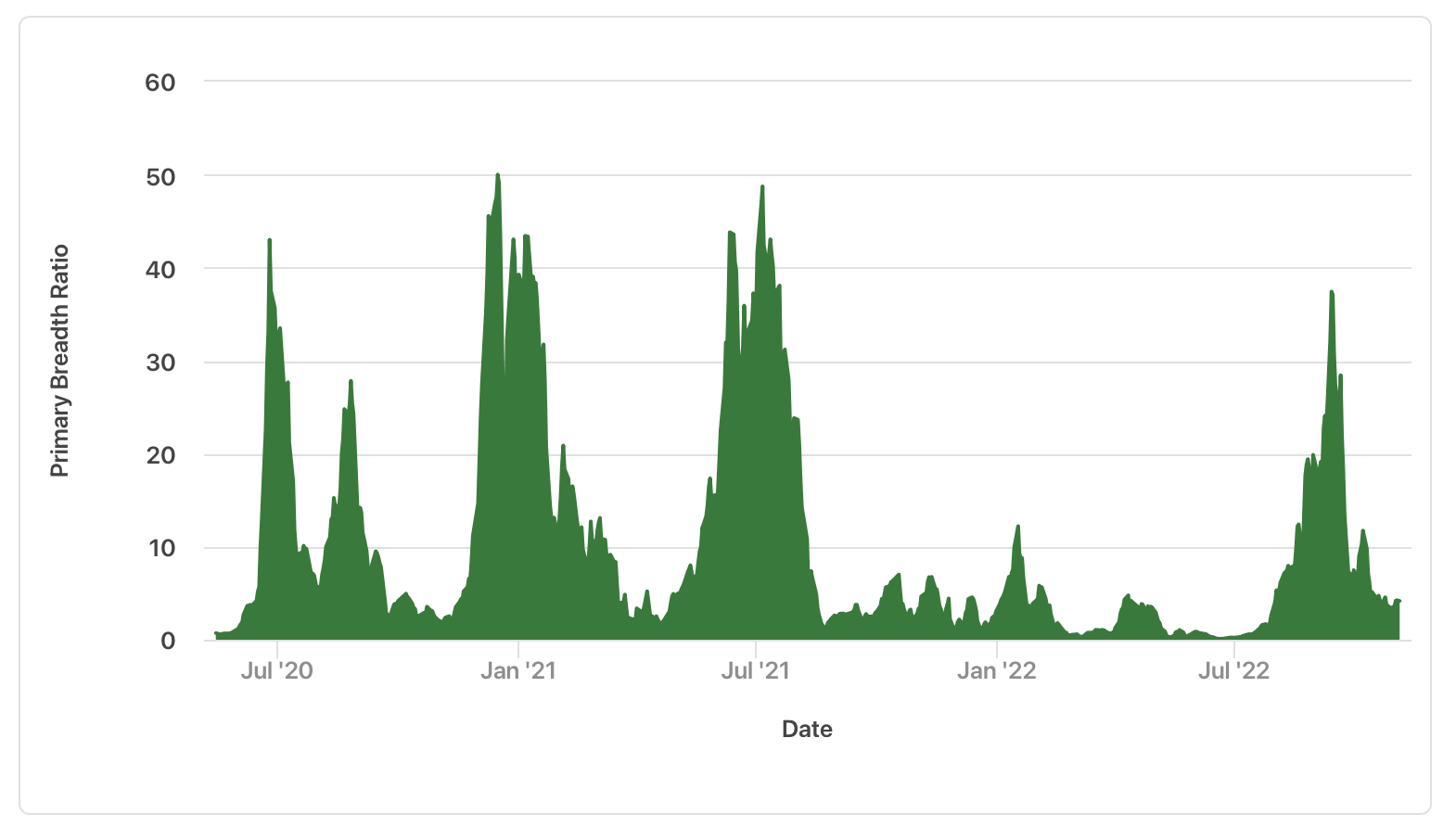

Overall, the market is bullish for 16th consecutive week, as the number of stocks up 25% plus in a quarter stays greater than that down 25% plus in a quarter. The ratio between the two is the primary breadth ratio, which is now 4.1.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.

.png)