A bit of perspective about the two instruments is necessary for readers to understand this post.

What are DVR's?

- DVR shares are shares with Differential Voting Rights. The holders of Tata Motors’ DVR shares can cast one vote for every 10 shares held. The holders of the 'normal' Tata Motors Equity shares are entitled to one vote per share. Almost everyone reading this email invests in stocks as an investment option; we are least concerned with the voting rights attached thereto.

- The Tata Motor DVR – shares with Differential Voting Rights (DVR), have been listed on Indian bourses since 2009, when Tata Motors took over Jaguar.

- These shares were issued at Rs. 60 when Tata Motors was quoting at 68. The discount at the time of listing was roughly 12 percent, today the discount is around 60 percent.

- Holders of DVR shares are entitled to an extra 5% dividend as compared to the normal shares. However, Tata Motors hasn't distributed dividends for the last couple of years.

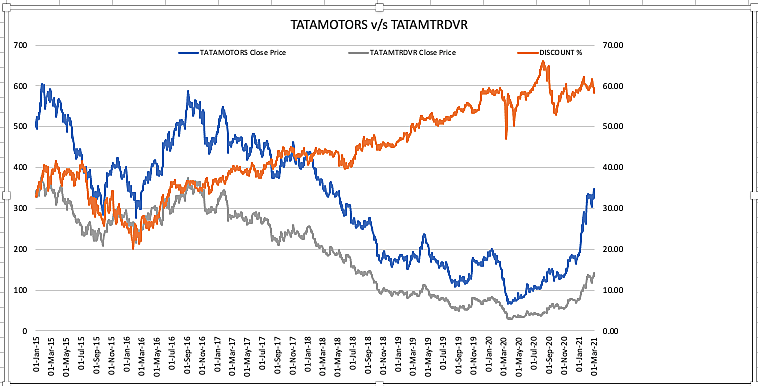

- There is a perfect correlation between traded prices of the DVR and ordinary shares. which means that they tend to move in the same direction, but the discount keeps fluctuating. So, if the ordinary shares move higher by 5 percent, the DVR will also move higher, but the percentage gain varies. Historically, the DVR has always quoted at a discount to the ordinary shares.

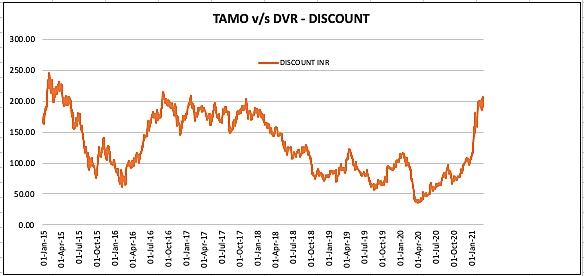

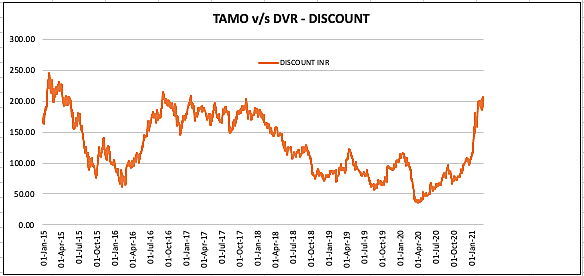

- The image below shows how the discount in percentage terms - so the price of the DVR is subtracted from that of the Ordinary share and that value is divided by the price of the ordinary share. This discount expressed in Indian Rupees (INR) is shown below.

For the sake of simplicity, henceforth I have referred to the Ordinary Shares as TAMO and the DVR's as DVR?

The question is - can we Arbitrage and make money by Selling the Ordinary Shares and Buying the DVR? The short answer is: YES. And this post explains how this can be done. (For those of you who don't understand the term 'Arbitrage', click on this link: What is an Arbitrage Trade)

The NSE has a separate segment called the SLBM segment, which is the abbreviation for Stock Lending and Borrowing Mechanism. So, the steps that one has to follow are as follows:

- The base case is that we don't own either TAMO or the DVR as on date. The closing prices of TAMO and the DVR were Rs. 325.15 and Rs. 135.40 on Friday, 5th March, 2021.

- For putting on an Arbitrage trade, we need to sell the instrument that has a higher price and buy the one that is traded at a discount. So, we have to sell TAMO and buy the DVR. But, we don't own any TAMO, so how can we sell something that we don't own?

- One has to borrow the shares in the SLBM segment and sell them in the Cash segment. At the same time, one has to buy the DVR's in the cash segment.

- In financial terms, this is how it works:

- The borrowing cost as on date is roughly Re. 1 per share. So, if one has to borrow 1000 shares of TAMO, it will cost us Rs. 1000

- We sell these shares in the cash segment on the NSE and that would fetch us Rs. 3,25,150 say Rs. 325,000.

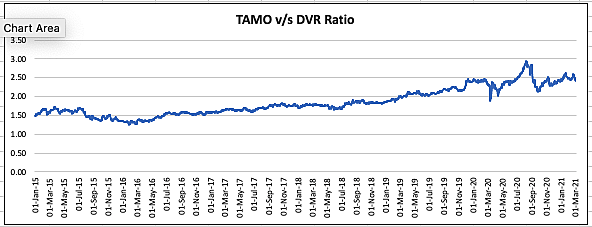

- From these proceeds, we buy 2400 shares of the DVR. How have I arrived at the quantity of 2400? That is simple, just divide the closing prices, so 325/135 = 2.40. This multiplied by the 1000 shares of TAMO, that we have borrowed, gives us 2400 as the quantity of DVR shares that we need to buy to ‘hedge’ our short sale. This is the TAMO v/s DVR ‘Ratio’ at yesterday’s closing prices. This is the most important metric and one that has to be watched. Because, this ‘Ratio’ will determine the ‘pay off’.

- There is a margin obligation for this trade, and that is roughly 125 percent of the borrowing value. So, the margin that the broker will collect from us is Rs. 406,250.

- We have effectively, locked in or pocketed, Rs. 190 per share. The bet is that this discount will narrow, as more and more investors start using the arbitrage mechanism.

- Obviously, we are betting that the discount narrows. How can be so sure that the discount will narrow? In the stock market, one can't be sure of anything, but the probability that the discount will narrow is higher than the opposite. The reasons are:

- The image below shows the historical 'performance' of the DISCOUNT between the two instruments for the period from 01 January, 2015 till date.

- It is clear that as the price of TAMO rises, the discount tends to narrow.

- The DVR shareholders are eligible for an extra 5 percent dividend over and above what the TAMO shares are entitled to. The company hasn't distributed dividends since 2016. But with the turnaround that is currently underway, it is only a matter of time that they return to the dividend list. Moreover, the management has a target of becoming debt free in the near future and hence one can safely assume that they will distribute dividends as well. Read this: Tata Motors vows to be debt-free within three years.

- If you look at the graph shown below again, it is clear that the discount widened almost immediately after dividends were suspended in May 2016.

- Moreover, the DVR was part of the Nifty 50 for the period from April 2016 till January 2018, and after it was dropped from the benchmark, there was a fall in the demand for the same. Nifty back to 50-stock index, as Tata Motors DVR exits - The Hindu BusinessLine

- In any case, on a historical basis, the discount is now at its peak. In other words, it is a safe bet as an arbitrage trade.

How much can one make in this trade, considering the risk and the cost of execution? I expect the discount to half from here, at the very least. Hence,

- We are pocketing Rs. 195 per share and we should exit this trade when the discount is around Rs. 100. The tricky part is the time period over which it will happen.

- If I were to assume a time period of one year, then the cost works out as follows:

- We have invested Rs. 406,250 and the interest on this for one year @ 9 percent per annum would come to Rs. 36,563.

- We would end up making Rs. 95 per share on 1000 shares, which is Rs. 95000. The cost of borrowing would be Rs. 1 per month and that works out to Rs. 12,000. So, we net Rs. 46,437 (95000 less 36,563 - which is our interest cost, and then deduct the cost of borrowing the TAMO shares @ Re. 1 per month for 12 months, which comes to Rs. 12000).

- The return in percentage terms would be 46,437/418,250 *100 which is 11.10 percent.

- In my opinion, this is a very good returns considering the risk. Moreover, if the discount continues to drop, the returns will be higher.

- What if the discount widens? Then we have to keep buying the DVR to maintain the ratio. So, one has to monitor the ratio of the TAMO to the DVR and trade accordingly, if the discount were to widen. The probability of this ratio climbing higher is low. Why do I say that? The ratio between the two instruments has been shown below. The line is almost flat, so one can easily conclude that the probability that the ratio will fall is greater than the opposite.

To view this post in your browser or to share it click Tata Motors DVR and Tata Motors - Arbitrage Opportunity.

To subscribe click Subscribe.

(Disclosure: I have already executed this trade)