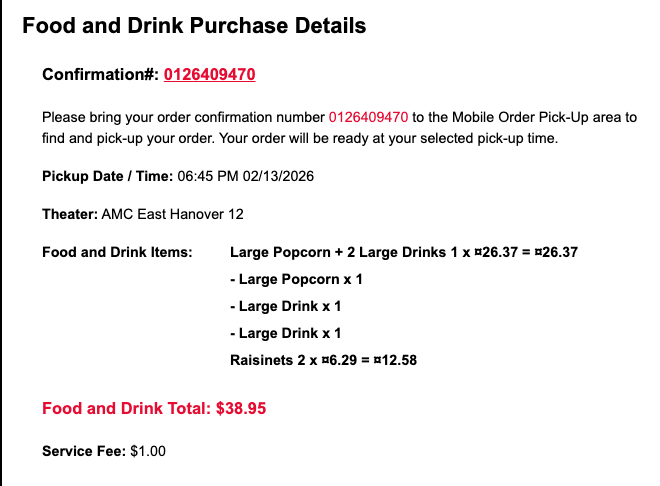

Raisinets, the popular chocolate-covered raisins, were first introduced in 1927 by the Blumenthal Chocolate Company in Philadelphia. As of 2026, that means they've been around for nearly a century. The brand gained early popularity as a movie theater snack and has changed hands over the years, from Nestlé to Ferrara (a Ferrero subsidiary) in 2018, but the core product remains largely the same. Wow, OK, right on the box they tell you that the box is only 2/3rds filled. The put the 'fill level' right on the box. Interesting. $6.29 for a 2/3rd filled box. Got it.

The movie starts in 25 minutes.

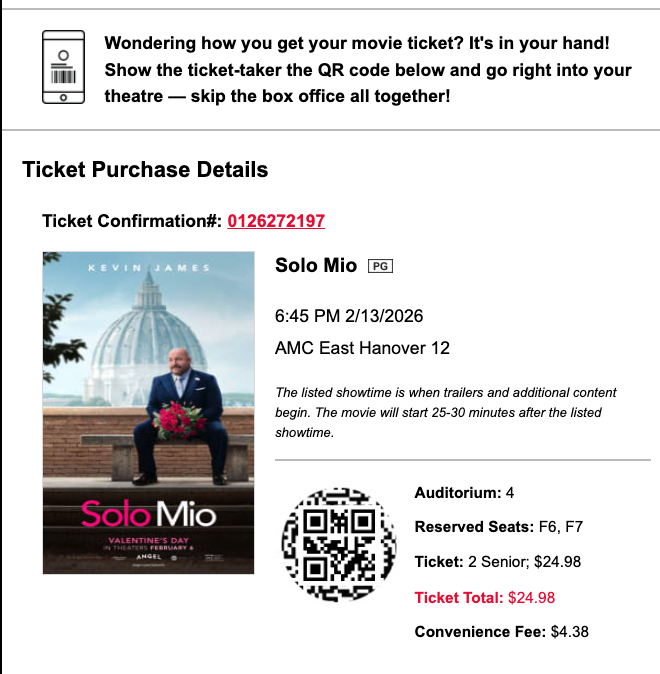

A convenience fee is an extra charge added to a transaction by a merchant or service provider to cover the cost of offering a more convenient payment option. It's typically applied when customers choose methods like credit card payments, online bookings, or phone transactions, especially if a fee-free alternative (such as paying in cash or by check) is available. For example, you might see this fee when buying concert tickets online or paying a utility bill over the phone, often ranging from 2-4% of the total amount or a flat rate like $3-5. These fees are legal in most places but must be disclosed upfront, and they're distinct from surcharges (which are specifically for credit card processing costs). Wow, huh. They charged me a $4.38 convenience fee on a $24.98 purchase. That's 17.5%. Interesting.

The movie starts in 20 minutes.

A service fee (also called a service charge) is an extra fee a business adds on top of the base price of a product or service to cover the costs of providing associated services, operations, staffing, platform use, processing, or administration. It is not the same as the core price of the item itself and is usually disclosed upfront.

Restaurants: Mandatory 10–20% added to the bill (most commonly 15–18%). It covers server wages, kitchen staff, benefits, or operations. It is not a tip/gratuity — tipping may still be expected on top (check the menu or receipt wording). Common for large parties, fine dining, or increasingly at regular tables.

Event ticketing (Ticketmaster, SeatGeek, etc.): $5–$20+ per ticket or 10–25%+ of face value. Covers platform costs, customer service, credit-card processing, venue fees, etc.

Delivery apps (Uber Eats, DoorDash, Grubhub): Separate “service fee” (often 5–15% of subtotal) that goes to the platform, distinct from the delivery fee and driver pay.

Hotels/Resorts: “Resort fee” or “destination fee” ($20–$50+/night) for Wi-Fi, pool, gym, etc.

Banking/Financial: Monthly account maintenance fees ($5–$15), wire transfer fees, foreign ATM fees, or low-balance fees.

Government/Education/Utilities: Tuition payments, parking tickets, utility bills — sometimes a regulated “service fee.”

Service Fee vs. Convenience Fee (key distinction)

Service fee — Broader term for covering general service/platform/operational costs. Can apply to all payment methods and is used across nearly any industry (restaurants, ticketing, banking, apps).

Convenience fee — Narrower: specifically for using a non-standard or more convenient payment channel (e.g., paying by credit card online/phone when the normal method is cash/check in person). Usually a flat dollar amount.

In strict payment-network rules (Visa/Mastercard/Amex), only government, education, and certain utility merchants are allowed to charge a regulated “Service Fee” that can be a percentage and applied to all channels — regular merchants use “Convenience Fee” for payment-channel charges. Service fees are legal if clearly disclosed upfront (strengthened by the FTC’s junk-fee rules). Always read the fine print before purchasing, especially for tickets, restaurants, and delivery orders.

Huh. Interesting. They charged a $1 service fee to charge me $38.95 in popcorn, fountain soda and candy. The true cost of fountain soda refers to what it actually costs a business like a restaurant, fast-food chain, or convenience store to produce and serve a single drink—far below the typical $2–$4 retail price charged to customers. This low cost is why fountain drinks are among the highest-margin items on most menus, with markups often exceeding 600–1,100%. Large (20–32 oz.): 4–8 cents for syrup/liquid + 7–10 cents for cup/etc. = Total: 11–18 cents.

Popcorn: Large/Bucket (16–20+ cups): $0.50–$1.05 total (kernels $0.30–$0.50 + oil $0.15 + bucket $0.40 + misc. $0.10–$0.20). For example, a large bucket might break down to $0.12 (ingredients) + $0.40 (packaging) = $0.52 total, but some estimates include overhead pushing it to $1. High-volume chains like AMC or Regal get lower bulk rates (e.g., kernels under $0.10/lb), dropping their costs further.

Convenience fee — Narrower: specifically for using a non-standard or more convenient payment channel (e.g., paying by credit card online/phone when the normal method is cash/check in person). Usually a flat dollar amount.

In strict payment-network rules (Visa/Mastercard/Amex), only government, education, and certain utility merchants are allowed to charge a regulated “Service Fee” that can be a percentage and applied to all channels — regular merchants use “Convenience Fee” for payment-channel charges. Service fees are legal if clearly disclosed upfront (strengthened by the FTC’s junk-fee rules). Always read the fine print before purchasing, especially for tickets, restaurants, and delivery orders.

Huh. Interesting. They charged a $1 service fee to charge me $38.95 in popcorn, fountain soda and candy. The true cost of fountain soda refers to what it actually costs a business like a restaurant, fast-food chain, or convenience store to produce and serve a single drink—far below the typical $2–$4 retail price charged to customers. This low cost is why fountain drinks are among the highest-margin items on most menus, with markups often exceeding 600–1,100%. Large (20–32 oz.): 4–8 cents for syrup/liquid + 7–10 cents for cup/etc. = Total: 11–18 cents.

Popcorn: Large/Bucket (16–20+ cups): $0.50–$1.05 total (kernels $0.30–$0.50 + oil $0.15 + bucket $0.40 + misc. $0.10–$0.20). For example, a large bucket might break down to $0.12 (ingredients) + $0.40 (packaging) = $0.52 total, but some estimates include overhead pushing it to $1. High-volume chains like AMC or Regal get lower bulk rates (e.g., kernels under $0.10/lb), dropping their costs further.

The movie starts in 15 minutes.

So, the listed showtime is when trailers and additional content begin. The movie will start 25-30 minutes after the listed showtime. They have my wife and I captive to watch 25 to 30 minutes of commercials. Got it. Ha, thank goodness I have my smartphone to keep me busy....... remember: no talking in the movie theater!

Someone gave us a $75 gift card for AMC around a year ago. It just sat there in my inbox. 'Solo Mio' was the first movie night in a long time. We're a Netflix kinda couple. What if we never used that $75 card?

Breakage refers to the portion of a gift card value that goes unredeemed by the customer, allowing the issuing company to eventually recognize it as revenue. This can happen when cards are lost, forgotten, expired (where allowed by law), or only partially used, leaving a small unused balance. For example, if a $50 gift card is purchased but only $40 is spent, the remaining $10 could become breakage if it's never redeemed. Companies account for breakage as a liability initially but may derecognize it over time based on redemption patterns and regulations like escheatment laws, which in some U.S. states require unused balances to be turned over to the state as unclaimed property.

Slippage, in the context of prepaid services like gift cards or similar products, is a related but distinct concept that describes the profit gained from discrepancies in how value is billed versus actually consumed—often due to rounding, minimum increments, or unused portions in unit-based billing. While more commonly discussed in industries like telecommunications (e.g., rounding up call minutes), it can apply to gift cards in scenarios where small, uneconomical remnants of value lead to non-redemption, effectively creating "pure profit" for the issuer similar to breakage.

The movies have strict rules: no talking. And turn off your smartphones when the movie starts! Ha, they might want to tell you to turn off your smartphones during that 25 to 30 minutes while you are sitting there, with too much time on your hands.

Too much time to do Google Searches and to think about service charges and breakage and slippage and convenience fees and packaging and shrinkage and..... why Netflix is kicking AMC's ass.

TomCapone.com goes to my LinkedIn

TommyCapone.com goes to my Bluesky

ThomasCapone.com goes to my Sunday Blog

Cell: 201-466-8442 { texting preferred }